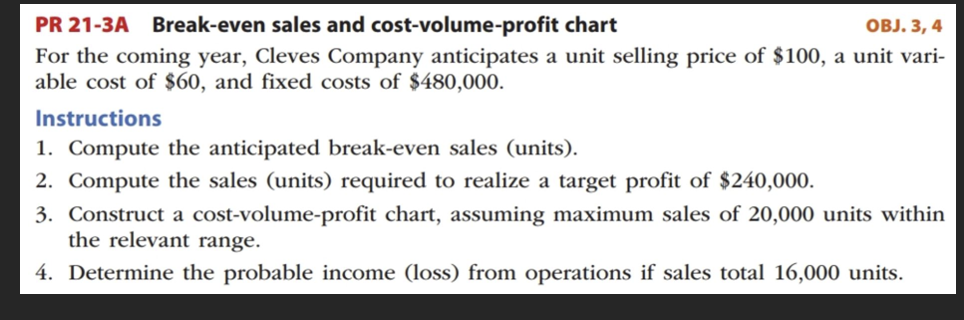

PR 21-3A Break-even sales and cost-volume-profit chart OBJ. 3, 4 For the coming year, Cleves Company anticipates a unit selling price of $100, a unit vari- able cost of $60, and fixed costs of $480,000. Instructions 1. Compute the anticipated break-even sales (units). 2. Compute the sales (units) required to realize a target profit of $240,000. 3. Construct a cost-volume-profit chart, assuming maximum sales of 20,000 units within the relevant range. 4. Determine the probable income (loss) from operations if sales total 16,000 units.

PR 21-3A Break-even sales and cost-volume-profit chart OBJ. 3, 4 For the coming year, Cleves Company anticipates a unit selling price of $100, a unit vari- able cost of $60, and fixed costs of $480,000. Instructions 1. Compute the anticipated break-even sales (units). 2. Compute the sales (units) required to realize a target profit of $240,000. 3. Construct a cost-volume-profit chart, assuming maximum sales of 20,000 units within the relevant range. 4. Determine the probable income (loss) from operations if sales total 16,000 units.

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter19: Cost Behavior And Cost-Volume-Profit Analysis

Section: Chapter Questions

Problem 19.17EX

Related questions

Question

Please read instructions on Image 1, and please answer questions on page 2.

thanks for your time!

Transcribed Image Text:PR 21-3A Break-even sales and cost-volume-profit chart

OBJ. 3, 4

For the coming year, Cleves Company anticipates a unit selling price of $100, a unit vari-

able cost of $60, and fixed costs of $480,000.

Instructions

1. Compute the anticipated break-even sales (units).

2. Compute the sales (units) required to realize a target profit of $240,000.

3. Construct a cost-volume-profit chart, assuming maximum sales of 20,000 units within

the relevant range.

4. Determine the probable income (loss) from operations if sales total 16,000 units.

Transcribed Image Text:Question 1

Break even Sales (Units)

Question 2

Sales (Units)

Skip Question 3

Question 4

Income from operations

Expert Solution

Step 1 Introduction

Contribution Margin :— It is the difference between sales and variable cost.

Break Even Point (BEP) :— It is the point of production where total cost is equal to total revenue. At this point, total contribution margin is equal to total fixed cost.

It is calculated by dividing total fixed cost by contribution margin per unit.

BEP = Fixed Cost/Contribution Margin per unit

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,