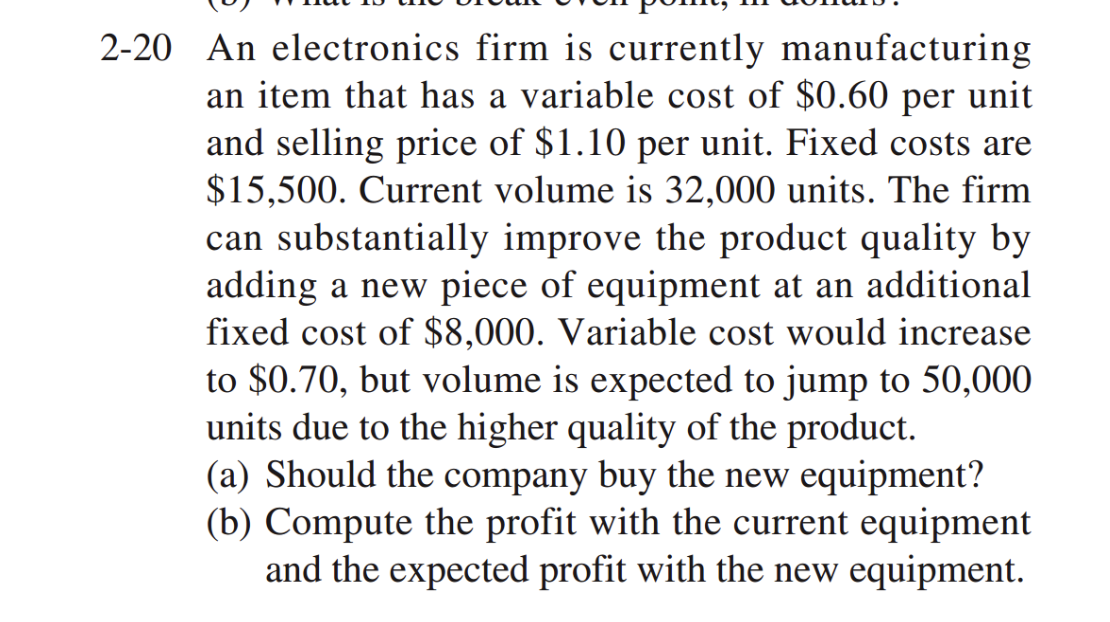

An electronics firm is currently manufacturing an item that has a variable cost of $0.60 per unit and selling price of $1.10 per unit. Fixed costs are $15,500. Current volume is 32,000 units. The firm can substantially improve the product quality by adding a new piece of equipment at an additional

An electronics firm is currently manufacturing an item that has a variable cost of $0.60 per unit and selling price of $1.10 per unit. Fixed costs are $15,500. Current volume is 32,000 units. The firm can substantially improve the product quality by adding a new piece of equipment at an additional

Chapter14: Capital Structure Management In Practice

Section14.A: Breakeven Analysis

Problem 5P

Related questions

Question

include excel sheet calculating profit as well

Transcribed Image Text:2-20 An electronics firm is currently manufacturing

an item that has a variable cost of $0.60 per unit

and selling price of $1.10 per unit. Fixed costs are

$15,500. Current volume is 32,000 units. The firm

can substantially improve the product quality by

adding a new piece of equipment at an additional

fixed cost of $8,000. Variable cost would increase

to $0.70, but volume is expected to jump to 50,000

units due to the higher quality of the product.

(a) Should the company buy the new equipment?

(b) Compute the profit with the current equipment

and the expected profit with the new equipment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning