QUESTION 10 FICA Rate (Social Security + Medicare Withholding) 7.65% (6.2% + 1.45%) Employee 7.65% (6.2% • 1.45%) 15.3% (12.4% + 2.9%) Employer Sell-Employed earnings up to the taxable maximum. Their Medicare portion is 1.45% on all earnings. Based on the above schedule, if Kim is working at Starbucks earning $45,000 per year, what is her FICA tax? O 6,885 $2,790 O $3,442.50 O She does not pay FICA tax because her total salary is less than $50,000

QUESTION 10 FICA Rate (Social Security + Medicare Withholding) 7.65% (6.2% + 1.45%) Employee 7.65% (6.2% • 1.45%) 15.3% (12.4% + 2.9%) Employer Sell-Employed earnings up to the taxable maximum. Their Medicare portion is 1.45% on all earnings. Based on the above schedule, if Kim is working at Starbucks earning $45,000 per year, what is her FICA tax? O 6,885 $2,790 O $3,442.50 O She does not pay FICA tax because her total salary is less than $50,000

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 16MC: An employee earns $8,000 in the first pay period. The FICA Social Security Tax rate is 6.2%, and the...

Related questions

Question

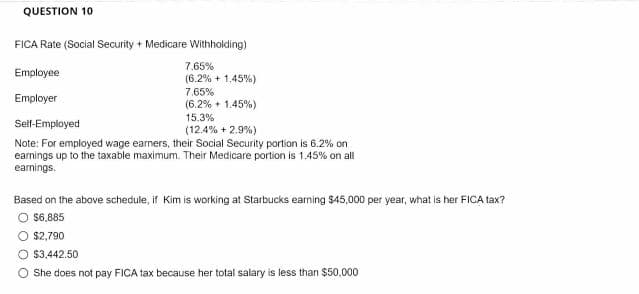

Transcribed Image Text:QUESTION 10

FICA Rate (Social Security + Medicare Withholding)

7.65%

Employee

(6.2% + 1.45%)

7.65%

(6.2% + 1.45%)

Employer

15.3%

Self-Employed

(12.4% + 2.9%)

Note: For employed wage earners, their Social Security portion is 6.2% on

earnings up to the taxable maximum. Their Medicare portion is 1.45% on all

earnings.

Based on the above schedule, if Kim is working at Starbucks earning $45,000 per year, what is her FICA tax?

O $6,885

O $2,790

$3,442.50

O She does not pay FICA tax because her total salary is less than $50,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage