preceding 1st January. The accounts were made upto 31st December, 2015 as usual and the Trading ar n wOJ Profit and Loss Account gave the following result : To Opening Stock To Purchases To Gross Profit c/d $ 1,40,000| By Sales 9,10,000 By Closing Stock 3,00,000 12,00,00 1,50,00 13,50,000 13,50,0 18,000 By Gross Profit b/d 20,000 51,000 48,000 12,000 15,000 3,00,0 To Rent, Rates and Insurance To Directors' Fees To Salaries To Office Expenses To Travel" rs' Commission To Discounts

preceding 1st January. The accounts were made upto 31st December, 2015 as usual and the Trading ar n wOJ Profit and Loss Account gave the following result : To Opening Stock To Purchases To Gross Profit c/d $ 1,40,000| By Sales 9,10,000 By Closing Stock 3,00,000 12,00,00 1,50,00 13,50,000 13,50,0 18,000 By Gross Profit b/d 20,000 51,000 48,000 12,000 15,000 3,00,0 To Rent, Rates and Insurance To Directors' Fees To Salaries To Office Expenses To Travel" rs' Commission To Discounts

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 17P: Comprehensive: Income Statement and Supporting Schedules The following s a partial list of the...

Related questions

Question

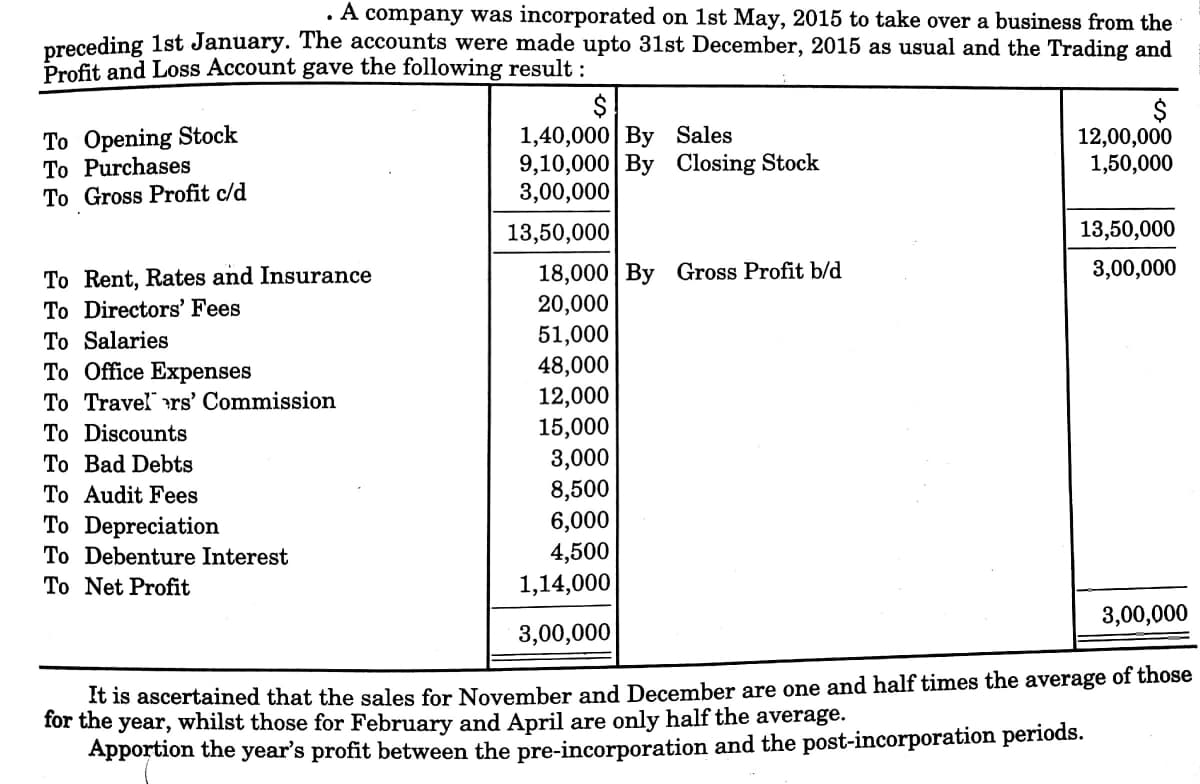

Transcribed Image Text:. A company was incorporated on 1st May, 2015 to take over a business from the

preceding 1st January. The accounts were made upto 31st December, 2015 as usual and the Trading and

Profit and Loss Account gave the following result :

To Opening Stock

To Purchases

To Gross Profit c/d

2$

1,40,000| By Sales

9,10,000| By Closing Stock

3,00,000

12,00,000

1,50,000

13,50,000

13,50,000

18,000 | By Gross Profit b/d

20,000

3,00,000

To Rent, Rates and Insurance

To Directors' Fees

51,000

48,000

12,000

15,000

3,000

8,500

6,000

4,500

To Salaries

To Office Expenses

To Travel rs' Commission

To Discounts

To Bad Debts

To Audit Fees

To Depreciation

To Debenture Interest

To Net Profit

1,14,000

3,00,000

3,00,000

It is ascertained that the sales for November and December are one and half times the average of those

for the year, whilst those for February and April are only half the average.

Apportion the year's profit between the pre-incorporation and the post-incorporation periods.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning