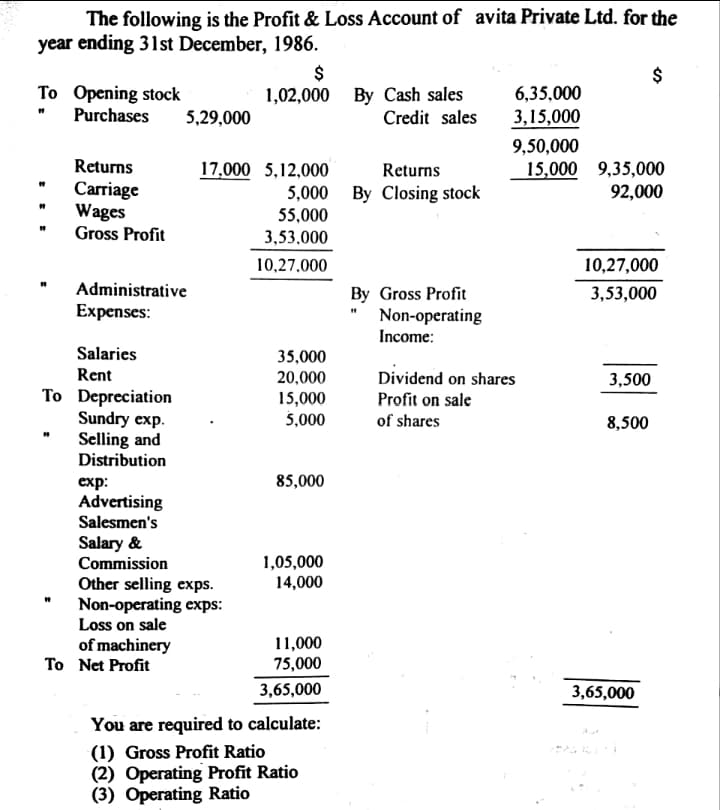

The following is the Profit & Loss Account of avita Private Ltd. for the year ending 31st December, 1986. $ 1,02,000 By Cash sales $ To Opening stock " Purchases 6,35,000 3,15,000 5,29,000 Credit sales 9,50,000 15,000 9,35,000 92,000 Returns 17,000 5,12,000 Returns Сarriage Wages 5,000 By Closing stock 55,000 Gross Profit 3,53,000 10,27,000 10,27,000 Administrative Expenses: 3,53,000 By Gross Profit Non-operating Income: Salaries 35,000 20,000 15,000 Rent Dividend on shares 3,500 To Depreciation Sundry exp. Selling and Distribution Profit on sale 5,000 of shares 8,500 85,000 exp: Advertising Salesmen's Salary & Commission 1,05,000 14,000 Other selling exps. Non-operating exps: Loss on sale of machinery To Net Profit 11,000 75,000 3,65,000 3,65,000 You are required to calculate: (1) Gross Profit Ratio (2) Operating Profit Ratio (3) Operating Ratio

The following is the Profit & Loss Account of avita Private Ltd. for the year ending 31st December, 1986. $ 1,02,000 By Cash sales $ To Opening stock " Purchases 6,35,000 3,15,000 5,29,000 Credit sales 9,50,000 15,000 9,35,000 92,000 Returns 17,000 5,12,000 Returns Сarriage Wages 5,000 By Closing stock 55,000 Gross Profit 3,53,000 10,27,000 10,27,000 Administrative Expenses: 3,53,000 By Gross Profit Non-operating Income: Salaries 35,000 20,000 15,000 Rent Dividend on shares 3,500 To Depreciation Sundry exp. Selling and Distribution Profit on sale 5,000 of shares 8,500 85,000 exp: Advertising Salesmen's Salary & Commission 1,05,000 14,000 Other selling exps. Non-operating exps: Loss on sale of machinery To Net Profit 11,000 75,000 3,65,000 3,65,000 You are required to calculate: (1) Gross Profit Ratio (2) Operating Profit Ratio (3) Operating Ratio

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.8E: Income Statement Ratio The income statement of Holly Enterprises shows operating revenues of...

Related questions

Question

Transcribed Image Text:The following is the Profit & Loss Account of avita Private Ltd. for the

year ending 31st December, 1986.

$

$

To Opening stock

6,35,000

3,15,000

1,02,000 By Cash sales

Purchases

5,29,000

Credit sales

9,50,000

15,000 9,35,000

92,000

Returns

17,000 5,12,000

Returns

Сarriage

Wages

Gross Profit

5,000 By Closing stock

55,000

3,53.000

10,27,000

10,27,000

Administrative

Expenses:

3,53,000

By Gross Profit

Non-operating

Income:

Salaries

35,000

20,000

15,000

5,000

Rent

Dividend on shares

3,500

To Depreciation

Sundry exp.

Selling and

Distribution

Profit on sale

of shares

8,500

85,000

exp:

Advertising

Salesmen's

Salary &

1,05,000

14,000

Commission

Other selling exps.

Non-operating exps:

Loss on sale

of machinery

To Net Profit

11,000

75,000

3,65,000

3,65,000

You are required to calculate:

(1) Gross Profit Ratio

(2) Operating Profit Ratio

(3) Operating Ratio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning