Prediction markets allow traders to bet on future events. One prediction market that is particularly active this season involves betting on the winner of the U.S. presidential election. Thus, for example, if one trader buys one share of "Obama to win" from another trader, then if Obama wins the election the seller pays 1 dollar to the buyer, and if Obama does not win the seller pays nothing; either way, the seller keeps the money paid by the buyer for the purchase of the share. (a) Leila is an expected utility maximizer with von Neumann-Morgenstern utility u(x) In(x + 1) and initial wealth 4. Leila believes that Obama will win with probability 1/2.

Prediction markets allow traders to bet on future events. One prediction market that is particularly active this season involves betting on the winner of the U.S. presidential election. Thus, for example, if one trader buys one share of "Obama to win" from another trader, then if Obama wins the election the seller pays 1 dollar to the buyer, and if Obama does not win the seller pays nothing; either way, the seller keeps the money paid by the buyer for the purchase of the share. (a) Leila is an expected utility maximizer with von Neumann-Morgenstern utility u(x) In(x + 1) and initial wealth 4. Leila believes that Obama will win with probability 1/2.

Chapter8: Game Theory

Section: Chapter Questions

Problem 8.8P

Related questions

Question

Please teach not just solve

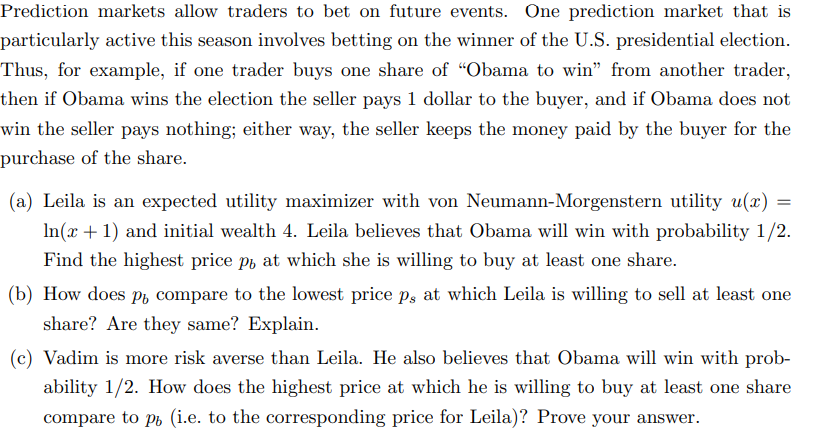

Transcribed Image Text:Prediction markets allow traders to bet on future events. One prediction market that is

particularly active this season involves betting on the winner of the U.S. presidential election.

Thus, for example, if one trader buys one share of “Obama to win" from another trader,

then if Obama wins the election the seller pays 1 dollar to the buyer, and if Obama does not

win the seller pays nothing; either way, the seller keeps the money paid by the buyer for the

purchase of the share.

(a) Leila is an expected utility maximizer with von Neumann-Morgenstern utility u(x)

In(x + 1) and initial wealth 4. Leila believes that Obama will win with probability 1/2.

Find the highest price po at which she is willing to buy at least one share.

(b) How does pu compare to the lowest price ps at which Leila is willing to sell at least one

share? Are they same? Explain.

(c) Vadim is more risk averse than Leila. He also believes that Obama will win with prob-

ability 1/2. How does the highest price at which he is willing to buy at least one share

compare to pu (i.e. to the corresponding price for Leila)? Prove your answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you