preferred shares, both payable on 30 October 20X5, to shareholders of record on 10 October 20X5. (Record the dividend declaration and payment.) k. On 31 December, holders of fractional rights exercised those rights, resulting in the issuance of 1,850 shares. The Page 1024 remaining rights expired. 1. Earnings for 20X5 were $25 million. Required: repare journal entries to record the listed transactions. Round per-share amounts to two decimal places.

preferred shares, both payable on 30 October 20X5, to shareholders of record on 10 October 20X5. (Record the dividend declaration and payment.) k. On 31 December, holders of fractional rights exercised those rights, resulting in the issuance of 1,850 shares. The Page 1024 remaining rights expired. 1. Earnings for 20X5 were $25 million. Required: repare journal entries to record the listed transactions. Round per-share amounts to two decimal places.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter8: Liabilities And Stockholders' Equity

Section: Chapter Questions

Problem 8.24E

Related questions

Question

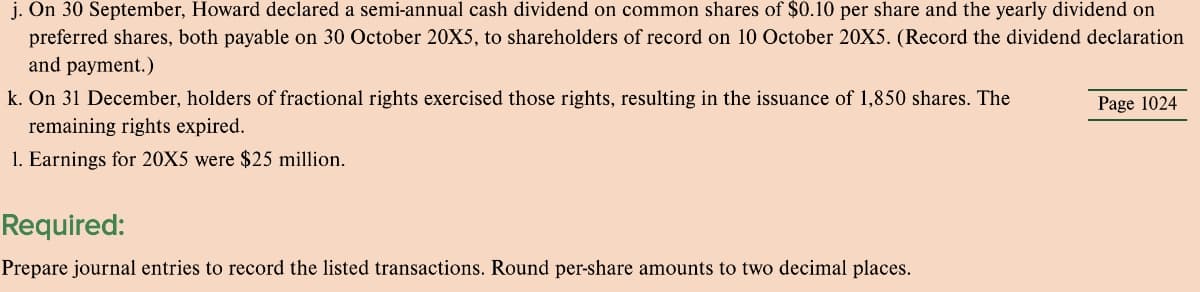

Transcribed Image Text:j. On 30 September, Howard declared a semi-annual cash dividend on common shares of $0.10 per share and the yearly dividend on

preferred shares, both payable on 30 October 20X5, to shareholders of record on 10 October 20X5. (Record the dividend declaration

and payment.)

k. On 31 December, holders of fractional rights exercised those rights, resulting in the issuance of 1,850 shares. The

Page 1024

remaining rights expired.

1. Earnings for 20X5 were $25 million.

Required:

Prepare journal entries to record the listed transactions. Round per-share amounts to two decimal places.

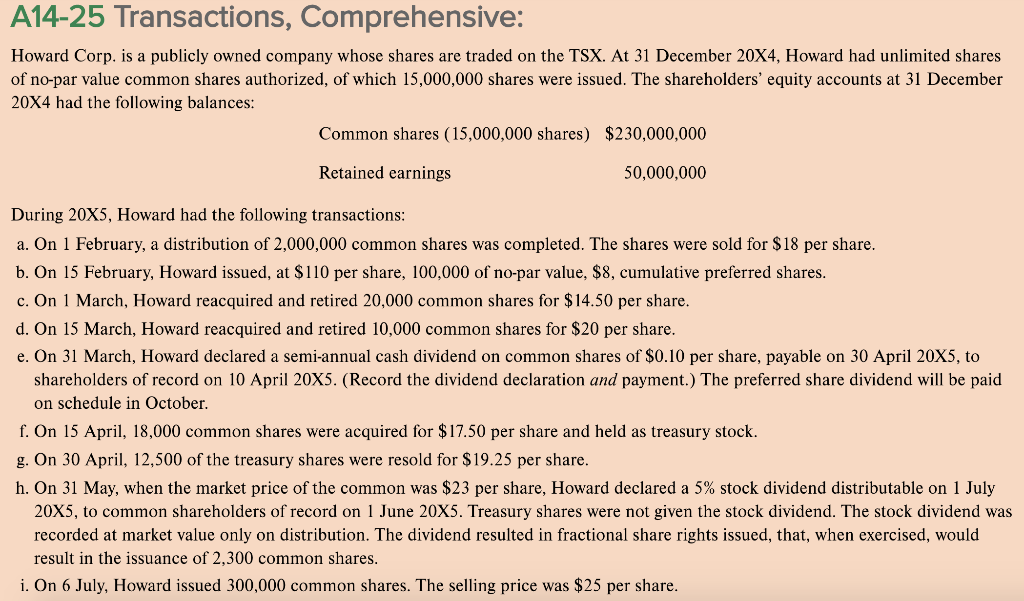

Transcribed Image Text:A14-25 Transactions, Comprehensive:

Howard Corp. is a publicly owned company whose shares are traded on the TSX. At 31 December 20X4, Howard had unlimited shares

of no-par value common shares authorized, of which 15,000,000 shares were issued. The shareholders' equity accounts at 31 December

20X4 had the following balances:

Common shares (15,000,000 shares) $230,000,000

Retained earnings

50,000,000

During 20X5, Howard had the following transactions:

a. On 1 February, a distribution of 2,000,000 common shares was completed. The shares were sold for $18 per share.

b. On 15 February, Howard issued, at $110 per share, 100,000 of no-par value, $8, cumulative preferred shares.

c. On 1 March, Howard reacquired and retired 20,000 common shares for $14.50 per share.

d. On 15 March, Howard reacquired and retired 10,000 common shares for $20 per share.

e. On 31 March, Howard declared a semi-annual cash dividend on common shares of $0.10 per share, payable on 30 April 20X5, to

shareholders of record on 10 April 20X5. (Record the dividend declaration and payment.) The preferred share dividend will be paid

on schedule in October.

f. On 15 April, 18,000 common shares were acquired for $17.50 per share and held as treasury stock.

g. On 30 April, 12,500 of the treasury shares were resold for $19.25 per share.

h. On 31 May, when the market price of the common was $23 per share, Howard declared a 5% stock dividend distributable on 1 July

20X5, to common shareholders of record on 1 June 20X5. Treasury shares were not given the stock dividend. The stock dividend was

recorded at market value only on distribution. The dividend resulted in fractional share rights issued, that, when exercised, would

result in the issuance of 2,300 common shares.

i. On 6 July, Howard issued 300,000 common shares. The selling price was $25 per share.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning