Premium Expense Estimated Liability for Premiums (To record premium expense)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 13RE: CoolShoes sells its elite tennis shoes to sports retailers throughout the country. When introducing...

Related questions

Question

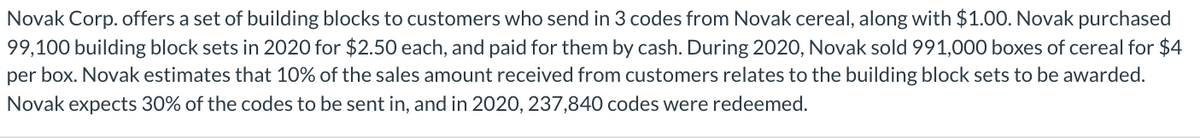

Transcribed Image Text:Novak Corp. offers a set of building blocks to customers who send in 3 codes from Novak cereal, along with $1.00. Novak purchased

99,100 building block sets in 2020 for $2.50 each, and paid for them by cash. During 2020, Novak sold 991,000 boxes of cereal for $4

per box. Novak estimates that 10% of the sales amount received from customers relates to the building block sets to be awarded.

Novak expects 30% of the codes to be sent in, and in 2020, 237,840 codes were redeemed.

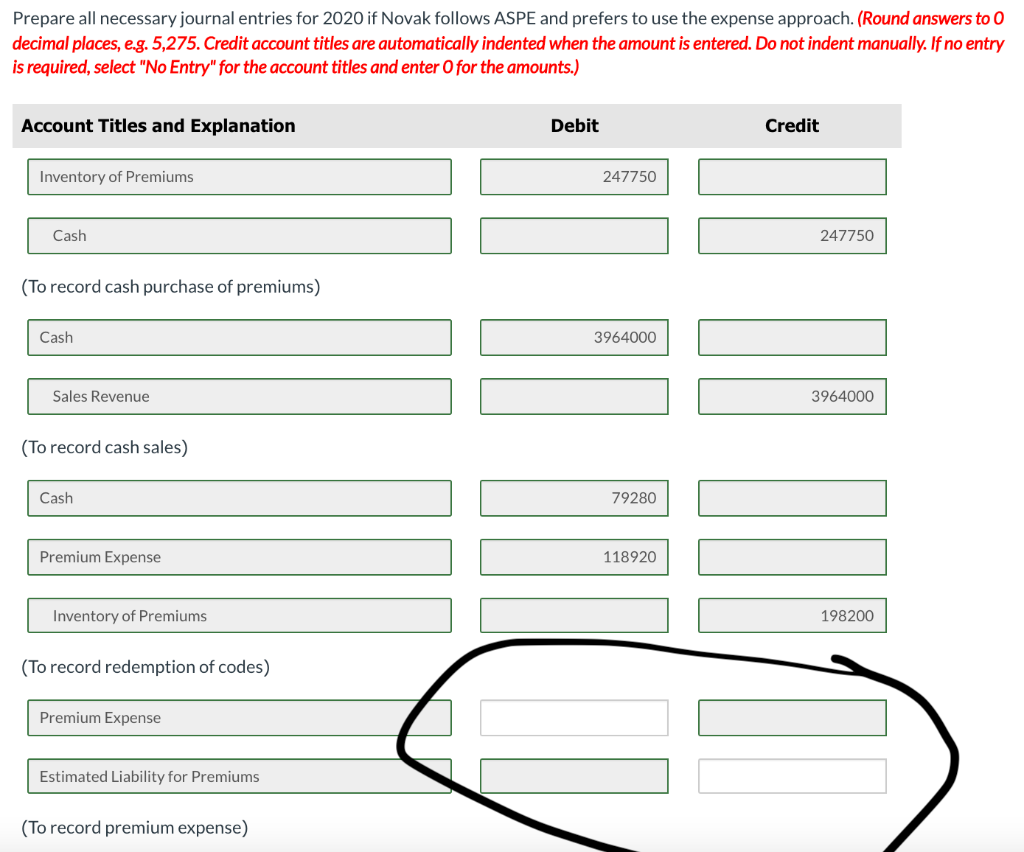

Transcribed Image Text:Prepare all necessary journal entries for 2020 if Novak follows ASPE and prefers to use the expense approach. (Round answers to 0

decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry

is required, select "No Entry" for the account titles and enter O for the amounts.)

Account Titles and Explanation

Debit

Credit

Inventory of Premiums

247750

Cash

247750

(To record cash purchase of premiums)

Cash

3964000

Sales Revenue

3964000

(To record cash sales)

Cash

79280

Premium Expense

118920

Inventory of Premiums

198200

(To record redemption of codes)

Premium Expense

Estimated Liability for Premiums

(To record premium expense)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning