What amount should be reported as premium expense for the current year?

Q: How much gross profit should be reported for 2021?

A: Percentage-of-Completion Method-: The Percentage of Completion Method comes under the revenue…

Q: What is The Net unrealized Gain (Loss) each year? Is the Net unrealized Gain (Loss) taxable?

A: Formula: Unrealized gain ( Loss ) = Fair value of securities - amortized cost. Deduction of…

Q: Insurance of last year in adjustment where to adjust that insurance?

A: Adjusting Entry – Adjusting Entries are the entries that make the accrual principle work for the…

Q: What is equivalent annual annuity (EAA) method?

A: Equivalent annual annuity (EAA): Equivalent annual annuity measures the annual payments a scheme…

Q: What is the total amount of unamortized premium discount after its fourth interest payment? or

A: Effective interest rate is the interest rate which is actually interest rate which is applied on the…

Q: The interest that is charged on the principal and the interest from previous years is called

A: Interest on Interest is a term not used in simple interest. In simple interest, interest is only…

Q: What is the amount of the required annual deposit?

A: Here we have been give the following information Funds required at the end of January…

Q: What is the difference between the present value of an annuity and the futurevalue of an annuity?

A: Annuity refers to a series of payments made at regular interval of time.

Q: How much expense should recognized in 2021?

A: The transportation expenses are the expenses are occurred during the delivery of the goods. This…

Q: Explain how the present value of an ordinary annuityinterest table is converted to the present value…

A:

Q: Assuming the investment is appropriately recognized as financial assets at amortized cost: How much…

A: A bond is a kind of debt financial instrument that is being issued by corporations and the…

Q: What is the estimated liability for premium claims outstanding at December 31, (2002? Requirements:…

A: calculation for premium expenses and estimated liability are as follows

Q: compute the amount of the installments

A: The loan is the amount of money borrowed from a lender at a fixed rate of interest. the amount can…

Q: What is General Annuity? (payment interval and interest period, time of payment, duration)

A: An annuity is a contract between you and an insurance company in which you make a lump-sum payment…

Q: What is Jensen's AGI for the current year?

A: CORRECT OPTION : D

Q: What is the amount of income tax payable for 2019?

A: Income tax is a form of direct tax which is to be paid by the individual on income earned during the…

Q: What is the Depreciation Allowance under Inflation?

A: Inside these laws of unique cost depreciation, the absolute estimation of the duty exclusions in…

Q: what should be withheld from a bonus in the year it is paid?

A: Explanation and correct answer is given below,

Q: Annuity and annuity due vary in that one is paid in advance.

A: This quotation explains abut Annuity and annuity due vary in that one is paid in advance.

Q: Which of the following cannot be calculated? Select one: a. the interest rate on perpetuity given…

A: Perpetuity is referred to as an annuity, which does not have an end or the stream of the cash…

Q: How much is the business tax payable for the August?

A: What is Income Tax Payable?Income tax payable is a term given to a business organization’s tax…

Q: How much is the income tax expense/(benefit) for the third quarter? (NOTE: If your answer is an…

A: Formula: Income tax expense amount = Net income x Tax rate

Q: How much should be reported as Administrative expense for 2020?

A:

Q: Required: How much, if any, of the costs can be capitalized for fiscal 2021?

A: Development of any article or thing or any project basically took place In two steps Research and…

Q: urt approach allocates more propen urt and the IRS approaches allocate proach allocates interest…

A: The right answer is B The tax court and the IRS approaches allocate the same amount of expenses ,…

Q: How much is the warranty expense in 2021?

A: Simon Corporation Selling a new line of products that’s carry a two year warranty against defects…

Q: What is the liability for the outstanding premiums at year-end? *

A: The amount that an organization owes is referred to as a liability of the organization. All the…

Q: Describe the Depreciation Allowance under Inflation?

A: Depreciation: Depreciation is an accounting method to calculate the value of a tangible asset during…

Q: Net income

A: Definition: NET INCOME: It the amount earned during the year after making deductions such as…

Q: Differentiate annuity dues and deferred annuities.

A: An annuity can be divided into two types: Annuity due: Unlike a regular annuity, annuity due…

Q: What is the period of deferment of a deferred annuity?

A: Solution- Deferred Annuity- A deferred regular payment is a contract with an…

Q: How is the interest earned on the principal amount calculated at the end of each interest period?

A: The interest calculation will be different based on the mode of interest. The amount of interest can…

Q: PART III If a capital expenditure is mistakenly treated as sa reveune expenditrue, how will the…

A: Whenever a company made expenditure it is categorized as revenue expenditure or capital expenditure,…

Q: Why did you put 2019 and 2020, when all expenses incurred in 2021 or 2022?

A: Taxable income refers to the base upon which an income tax system imposes tax. In other words, the…

Q: How is the present value of an annuity determined?

A: Present value: Present value is the value of future cash flow today. Present value is the…

Q: What is the interest rate the borrower will pay after the first rate adjustment?

A: Data given: Start rate = 3.50% Maximum cap for the first year=3% MTA index at the end of the first…

Q: compute for the after tax cost of debt.

A: 12 Calculate cost of equity using CAPM model as shown below: Cost of equity Risk free…

Q: What is the Gross Profit Rate in 2019?

A: Gross profit rate = Gross profit/Revenue

Q: How much is the income tax payable assuming the taxable year is 2020?

A: Taxable income will be calculated by adding gross profit from sales, capital gain, dividends from…

Q: Define current portion of long-term debt

A: Long-term debts are liabilities that is to be repayable in more than one year. Such liabilities are…

Q: Explain how the future value of an ordinary annuityinterest table is converted to the future value…

A:

Q: what is the annual insurance loss ratio formula?

A: The insurance loss ratio is calculated to know the profits that an insurance company can earn over a…

Q: What amount of loss should DEF accrue at December 31, 2021?

A: Contingent liability refers to those liability of a company which is occurred due to the result of…

Q: How much is the net income in 2021?

A: Net income refers to the income amount or value which is earned through the business or entity…

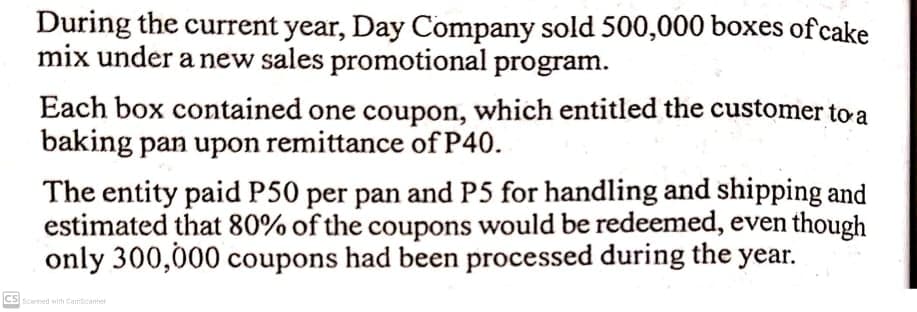

What amount should be reported as premium expense for the current year?

Step by step

Solved in 2 steps

- A Company sold 80,000 sold reversible shirts under a new sales promotional program during the year. Each shirt carried one coupon which entitled the customer to a P50 cash rebate. The entity estimated that 70% of the coupons will be redeemed even though only 35,000 coupons had been processed during the current year. what amount should be reported as rebate liability for unredeemed coupons at year-end? a. 1,225,000 b. 1,750,000 c. 0 d. 1,050,000A Company sold 80,000 sold reversible shirts under a new sales promotional program during the year. Each shirt carried one coupon which entitled the customer to a P50 cash rebate. The entity estimated that 70% of the coupons will be redeemed even though only 35,000 coupons had been processed during the current year. What amount of rebate expense should be reported for the current year? a. 2,800,000 b. 2,250,000 c. 1,750,000 d. 4,000,000luna Company sold 700,000 boxes of “puto” mix under a new sales promotional program. Each box contains one coupon, which if submitted with P40, entitles the customer to a kitchen knife. The company pays P60 per knife and P5 for handling and shipping. It estimates that 70% of the coupons will be redeemed, even though only 250,000 coupons had been processed during 2020. How much should luna report as liability for unredeemed coupons at December 31, 2020?

- During 1998, Day Company sold 500,000 boxes of cake mix under a new sales promotional program. Each box contains one coupon, which entitle the customer to a baking pan upon remittance of P4.00. Day pays P5.00 per pan and P0.50 for handling and shipping. Day estimates that 80% of the coupons will be redeemed, even though only 300,000 coupons had been processed during 1998. What amount should Day report as a liability for unredeemed coupons at December 31, 1998? 100,000 150,000 300,000 500,000In December 2021, Belarmino Company began including one coupon in each package of candy that is sells and offering a toy in exchange of P5 and five coupons. The toys cost P8 each. Eventually, 60% of the coupons will be redeemed. During December, Belarmino Company sold 110,000 packages of candy and no coupons were redeemed. Belarmino Company should report an estimated liability for coupons of Group of answer choices 105,600 198,000 39,600 528,000Please show your solution in good accounting form In 2021, SUGA Company sold 485,000 boxes of cereals under a new sales promotional program. Each box contains one coupon, which entitles the customer to a premium that costs the company ₱75. Five coupons plus a remittance of ₱20 must be presented by the customer to receive a premium. SUGA estimated that 85% of the coupons will be redeemed. Actual premiums redeemed were 5,000 units. Additional information disclosed that ₱10 per premium is incurred for storage and distribution. a. Compute for the liability for the unredeemed coupons. b. Compute for the premium expense for the year.

- Last year, the sales of OSP Inc. Amounted to R5 million and its most recent statement of financial position revealed trade receivables of R822 000. All sales were on 30 days’ credit to customers. In order to encourage customers to pay in time, the management accountant of OSR Inc has proposed introducing an early settlement discount of 1% for payment within 30 days, while increasing its normal credit period to 45 days. It is expected that, on average, 60% of customers will take the discount and pay within 30 days. 30% of the customers will pay after 45 days, and the rest of the customers will not change their current paying behaviour, OSP Inc. Is charge interest of 12% per annum on its overdraft facility Required: Determine the net benefit (cost) of the proposed changes in trade receivables policy A. Net cost of approximately R7 000 B. Net benefit of approximately R 13000 C. Net cost of approximately R 13 000 D. Net benefit of approximately R 7 000During 2021, SUGA Company sold 485,000 boxes of cereals under a new sales promotional program. Each box contains one coupon, which entitles the customer to a premium that cost the company ₱75. Five coupons plus a remittance of ₱20 must be presented by the customer to receive a premium. SUGA estimated that 85% of the coupons will be redeemed. Actual premiums redeemed were 5,000 units. Additional information disclosed that ₱10 per premium is incurred for storage and distribution. Compute for the liability for the unredeemed coupons.During 2021, SUGA Company sold 485,000 boxes of cereals under a new sales promotional program. Each box contains one coupon, which entitles the customer to a premium that cost the company ₱75. Five coupons plus a remittance of ₱20 must be presented by the customer to receive a premium. SUGA estimated that 85% of the coupons will be redeemed. Actual premiums redeemed were 5,000 units. Additional information disclosed that ₱10 per premium is incurred for storage and distribution. Compute for the premium expense for the year.

- During 2021, SUGA Company sold 485,000 boxes of cereals under a new sales promotional program. Each box contains one coupon, which entitles the customer to a premium that cost the company ₱75. Five coupons plus a remittance of ₱20 must be presented by the customer to receive a premium. SUGA estimated that 85% of the coupons will be redeemed. Actual premiums redeemed were 5,000 units. Additional information disclosed that ₱10 per premium is incurred for storage and distribution. REQUIRED: 1. Compute for the liability for the unredeemed coupons. 2. Compute for the premium expense for the year.Sweet Dates Company offers a premium to its customers—a glass bowl (cost to Sweet Dates is $0.90) upon return of 40 coupons. Two coupons are placed in each box of dates sold. The company estimates, on the basis of past experience, that only 70% of the coupons will ever be redeemed. During 2019, 10 million boxes of dates are sold at $0.30 each. Eight million coupons are redeemed during 2019. Sweet Dates purchased 360,000 glass bowls for the plan on January 1, 2019. Required: 1. Prepare the journal entries related to the sale of dates and the premium plan in 2019. 2. Show how the preceding items would be reported on the December 31, 2019, balance sheet.In 2021 , Holyoak offers a coupon for $ 15 off qualifying purchases of its new line of products Holyoak sold 11,000 of these products during the year By year - end of 2021 , 8,100 coupons had be $ 15 reduction of purchase price provided to customers Holyoak's historical experience with such coupons indicates that 80 % of customers use the coupon Holyoak recognizes coupon expense are issued What is the expense that Holyoak should report for its promotional coupons in its 2021 income statement ? Choice 132,000 121,500 165,000 132.500