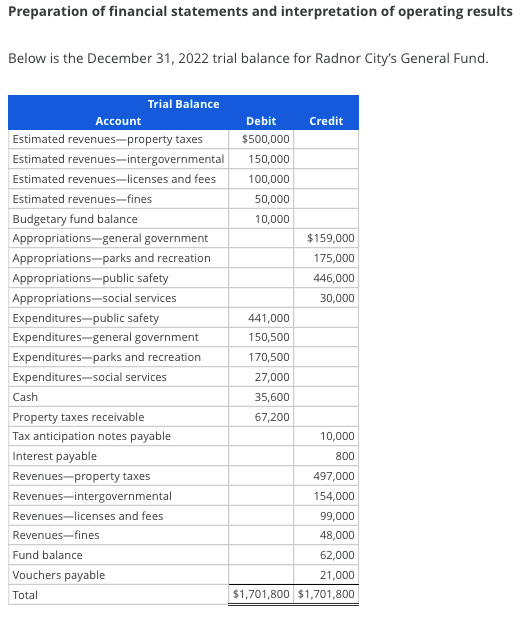

Preparation of financial statements and interpretation of operating results Below is the December 31, 2022 trial balance for Radnor City's General Fund. Trial Balance Account Debit Credit Estimated revenues-property taxes $500,000 Estimated revenues-intergovernmental 150,000 Estimated revenues-licenses and fees 100,000 Estimated revenues-fines 50,000 Budgetary fund balance Appropriations-general government 10,000 $159,000 Appropriations-parks and recreation 175,000 Appropriations-public safety 446,000 Appropriations-social services 30,000 Expenditures-public safety 441,000 Expenditures-general government 150,500 Expenditures-parks and recreation 170,500 Expenditures-social services 27,000 Cash 35,600 Property taxes receivable 67,200 Tax anticipation notes payable 10,000 Interest payable 800 Revenues-property taxes 497,000 Revenues-intergovernmental 154,000 Revenues-licenses and fees 99,000 Revenues-fines 48,000 Fund balance 62,000 Vouchers payable 21,000 Total $1,701,800 $1,701,800

Preparation of financial statements and interpretation of operating results Below is the December 31, 2022 trial balance for Radnor City's General Fund. Trial Balance Account Debit Credit Estimated revenues-property taxes $500,000 Estimated revenues-intergovernmental 150,000 Estimated revenues-licenses and fees 100,000 Estimated revenues-fines 50,000 Budgetary fund balance Appropriations-general government 10,000 $159,000 Appropriations-parks and recreation 175,000 Appropriations-public safety 446,000 Appropriations-social services 30,000 Expenditures-public safety 441,000 Expenditures-general government 150,500 Expenditures-parks and recreation 170,500 Expenditures-social services 27,000 Cash 35,600 Property taxes receivable 67,200 Tax anticipation notes payable 10,000 Interest payable 800 Revenues-property taxes 497,000 Revenues-intergovernmental 154,000 Revenues-licenses and fees 99,000 Revenues-fines 48,000 Fund balance 62,000 Vouchers payable 21,000 Total $1,701,800 $1,701,800

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

100%

Transcribed Image Text:Preparation of financial statements and interpretation of operating results

Below is the December 31, 2022 trial balance for Radnor City's General Fund.

Trial Balance

Account

Debit

Credit

Estimated revenues-property taxes

$500,000

Estimated revenues-intergovernmental

150,000

Estimated revenues-licenses and fees

100,000

Estimated revenues-fines

50,000

Budgetary fund balance

Appropriations-general government

10,000

$159,000

Appropriations-parks and recreation

175,000

Appropriations-public safety

446,000

Appropriations-social services

30,000

Expenditures-public safety

441,000

Expenditures-general government

150,500

Expenditures-parks and recreation

170,500

Expenditures-social services

27,000

Cash

35,600

Property taxes receivable

67,200

Tax anticipation notes payable

10,000

Interest payable

800

Revenues-property taxes

497,000

Revenues-intergovernmental

154,000

Revenues-licenses and fees

99,000

Revenues-fines

48,000

Fund balance

62,000

Vouchers payable

21,000

Total

$1,701,800 $1,701,800

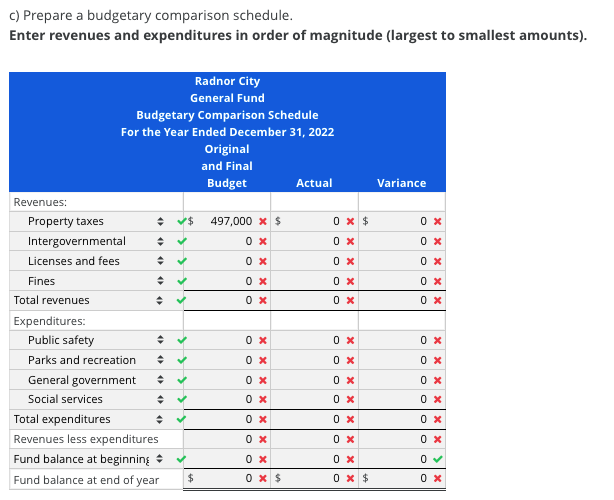

Transcribed Image Text:C) Prepare a budgetary comparison schedule.

Enter revenues and expenditures in order of magnitude (largest to smallest amounts).

Radnor City

General Fund

Budgetary Comparison Schedule

For the Year Ended December 31, 2022

Original

and Final

Budget

Actual

Variance

Revenues:

Property taxes

497,000 x $

0 x $

Intergovernmental

Licenses and fees

Fines

Total revenues

0 x

0 x

Expenditures:

Public safety

0 x

0 x

Parks and recreation

0 x

General government

0 x

0 x

Social services

Total expenditures

0 x

Revenues less expenditures

Fund balance at beginning +

0 x

Fund balance at end of year

$4

0 x $

0 x $

0 x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education