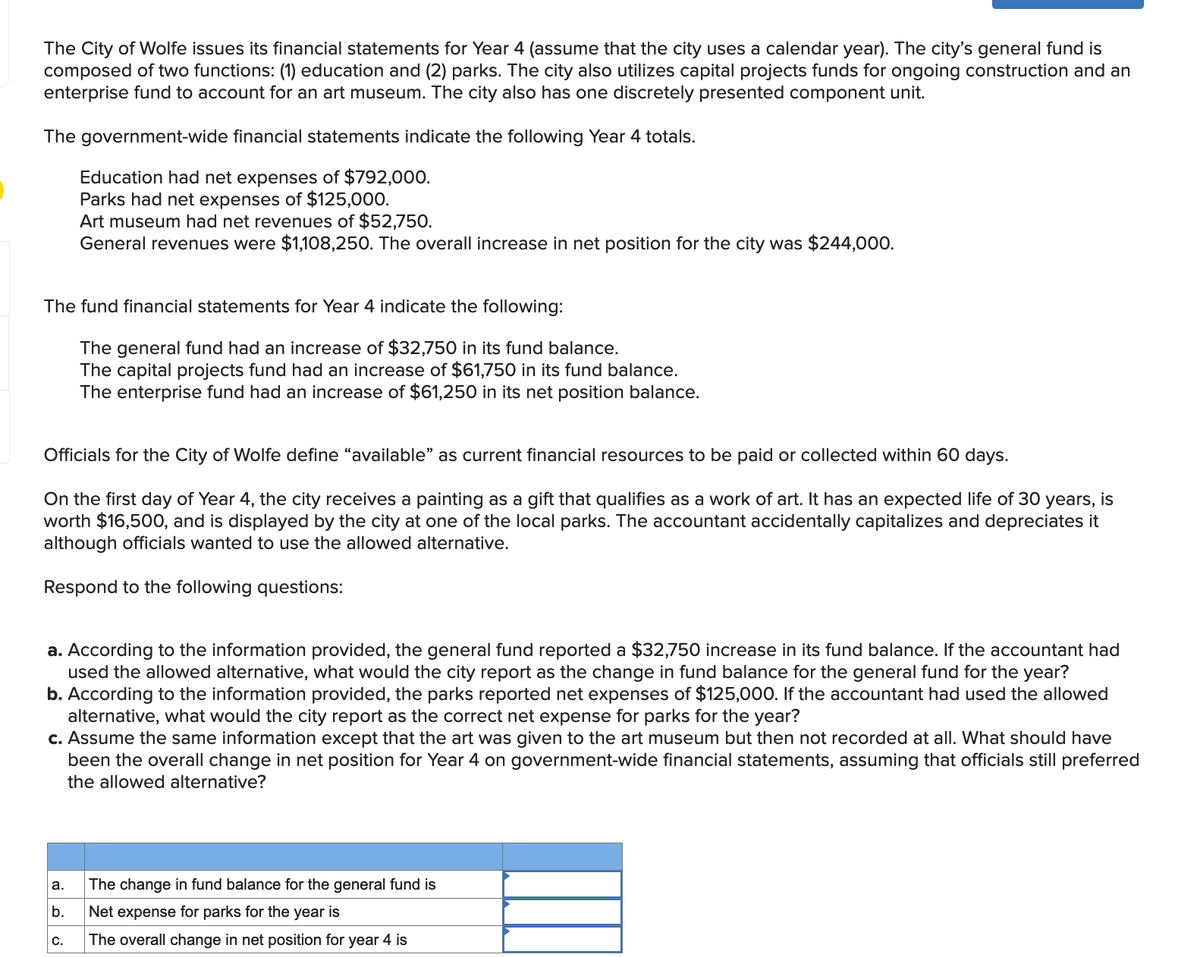

The City of Wolfe issues its financial statements for Year 4 (assume that the city uses a calendar year). The city's general fund is composed of two functions: (1) education and (2) parks. The city also utilizes capital projects funds for ongoing construction and an enterprise fund to account for an art museum. The city also has one discretely presented component unit. The government-wide financial statements indicate the following Year 4 totals. Education had net expenses of $792,000. Parks had net expenses of $125,000. Art museum had net revenues of $52,750. General revenues were $1,108,250. The overall increase in net position for the city was $244,000. The fund financial statements for Year 4 indicate the following: The general fund had an increase of $32,750 in its fund balance. The capital projects fund had an increase of $61,750 in its fund balance. The enterprise fund had an increase of $61,250 in its net position balance. Officials for the City of Wolfe define “available" as current financial resources to be paid or collected within 60 days. On the first day of Year 4, the city receives a painting as a gift that qualifies as a work of art. It has an expected life of 30 years, is worth $16,500, and is displayed by the city at one of the local parks. The accountant accidentally capitalizes and depreciates it although officials wanted to use the allowed alternative. Respond to the following questions: a. According to the information provided, the general fund reported a $32,750 increase in its fund balance. If the accountant had used the allowed alternative, what would the city report as the change in fund balance for the general fund for the year? b. According to the information provided, the parks reported net expenses of $125,000. If the accountant had used the allowed alternative, what would the city report as the correct net expense for parks for the year? c. Assume the same information except that the art was given to the art museum but then not recorded at all. What should have been the overall change in net position for Year 4 on government-wide financial statements, assuming that officials still preferred the allowed alternative?

The City of Wolfe issues its financial statements for Year 4 (assume that the city uses a calendar year). The city's general fund is composed of two functions: (1) education and (2) parks. The city also utilizes capital projects funds for ongoing construction and an enterprise fund to account for an art museum. The city also has one discretely presented component unit. The government-wide financial statements indicate the following Year 4 totals. Education had net expenses of $792,000. Parks had net expenses of $125,000. Art museum had net revenues of $52,750. General revenues were $1,108,250. The overall increase in net position for the city was $244,000. The fund financial statements for Year 4 indicate the following: The general fund had an increase of $32,750 in its fund balance. The capital projects fund had an increase of $61,750 in its fund balance. The enterprise fund had an increase of $61,250 in its net position balance. Officials for the City of Wolfe define “available" as current financial resources to be paid or collected within 60 days. On the first day of Year 4, the city receives a painting as a gift that qualifies as a work of art. It has an expected life of 30 years, is worth $16,500, and is displayed by the city at one of the local parks. The accountant accidentally capitalizes and depreciates it although officials wanted to use the allowed alternative. Respond to the following questions: a. According to the information provided, the general fund reported a $32,750 increase in its fund balance. If the accountant had used the allowed alternative, what would the city report as the change in fund balance for the general fund for the year? b. According to the information provided, the parks reported net expenses of $125,000. If the accountant had used the allowed alternative, what would the city report as the correct net expense for parks for the year? c. Assume the same information except that the art was given to the art museum but then not recorded at all. What should have been the overall change in net position for Year 4 on government-wide financial statements, assuming that officials still preferred the allowed alternative?

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:The City of Wolfe issues its financial statements for Year 4 (assume that the city uses a calendar year). The city's general fund is

composed of two functions: (1) education and (2) parks. The city also utilizes capital projects funds for ongoing construction and an

enterprise fund to account for an art museum. The city also has one discretely presented component unit.

The government-wide financial statements indicate the following Year 4 totals.

Education had net expenses of $792,000.

Parks had net expenses of $125,000.

Art museum had net revenues of $52,750.

General revenues were $1,108,250. The overall increase in net position for the city was $244,000.

The fund financial statements for Year 4 indicate the following:

The general fund had an increase of $32,750 in its fund balance.

The capital projects fund had an increase of $61,750 in its fund balance.

The enterprise fund had an increase of $61,250 in its net position balance.

Officials for the City of Wolfe define "available" as current financial resources to be paid or collected within 60 days.

On the first day of Year 4, the city receives a painting as a gift that qualifies as a work of art. It has an expected life of 30 years, is

worth $16,500, and is displayed by the city at one of the local parks. The accountant accidentally capitalizes and depreciates it

although officials wanted to use the allowed alternative.

Respond to the following questions:

a. According to the information provided, the general fund reported a $32,750 increase in its fund balance. If the accountant had

used the allowed alternative, what would the city report as the change in fund balance for the general fund for the year?

b. According to the information provided, the parks reported net expenses of $125,000. If the accountant had used the allowed

alternative, what would the city report as the correct net expense for parks for the year?

c. Assume the same information except that the art was given to the art museum but then not recorded at all. What should have

been the overall change in net position for Year 4 on government-wide financial statements, assuming that officials still preferred

the allowed alternative?

a.

The change in fund balance for the general fund is

b.

Net expense for parks for the year is

С.

The overall change in net position for year 4 is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education