Prepare a bank reconciliation at July 31.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter5: Cash Control Systems

Section: Chapter Questions

Problem 2AP

Related questions

Question

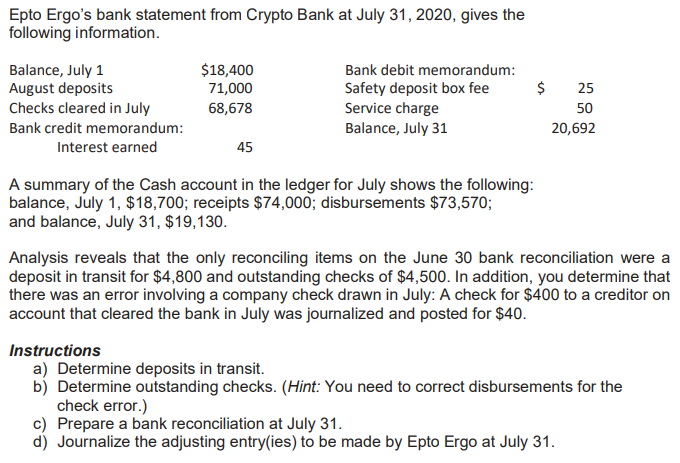

Transcribed Image Text:Epto Ergo's bank statement from Crypto Bank at July 31, 2020, gives the

following information.

$18,400

Balance, July 1

August deposits

Checks cleared in July

Bank debit memorandum:

$

Safety deposit box fee

Service charge

Balance, July 31

71,000

25

68,678

50

Bank credit memorandum:

20,692

Interest earned

45

A summary of the Cash account in the ledger for July shows the following:

balance, July 1, $18,700; receipts $74,000; disbursements $73,570;

and balance, July 31, $19,130.

Analysis reveals that the only reconciling items on the June 30 bank reconciliation were a

deposit in transit for $4,800 and outstanding checks of $4,500. In addition, you determine that

there was an error involving a company check drawn in July: A check for $400 to a creditor on

account that cleared the bank in July was journalized and posted for $4.

Instructions

a) Determine deposits in transit.

b) Determine outstanding checks. (Hint: You need to correct disbursements for the

check error.)

c) Prepare a bank reconciliation at July 31.

d) Journalize the adjusting entry(ies) to be made by Epto Ergo at July 31.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,