Required: 1. Prepare a bank reconciliation at August 31. 2. Prepare the necessary adjusting journal entries required to make the cash account in the general ledger agree with the adjusted cash balance on the July bank reconciliation.

Required: 1. Prepare a bank reconciliation at August 31. 2. Prepare the necessary adjusting journal entries required to make the cash account in the general ledger agree with the adjusted cash balance on the July bank reconciliation.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 1PA

Related questions

Question

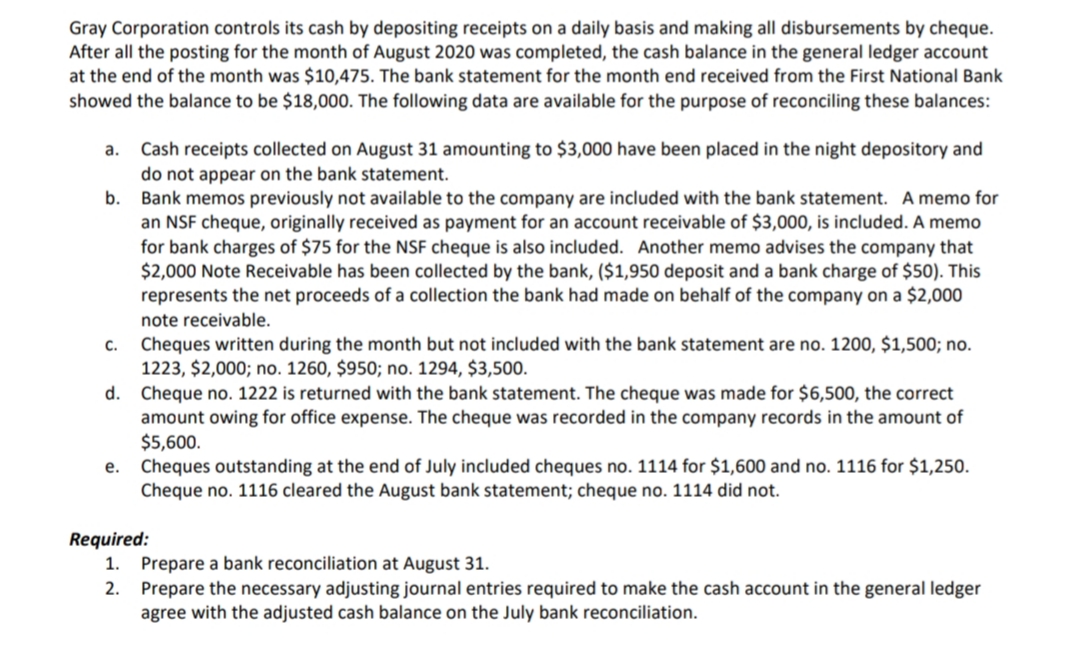

Transcribed Image Text:Gray Corporation controls its cash by depositing receipts on a daily basis and making all disbursements by cheque.

After all the posting for the month of August 2020 was completed, the cash balance in the general ledger account

at the end of the month was $10,475. The bank statement for the month end received from the First National Bank

showed the balance to be $18,000. The following data are available for the purpose of reconciling these balances:

a. Cash receipts collected on August 31 amounting to $3,000 have been placed in the night depository and

do not appear on the bank statement.

b. Bank memos previously not available to the company are included with the bank statement. A memo for

an NSF cheque, originally received as payment for an account receivable of $3,000, is included. A memo

for bank charges of $75 for the NSF cheque is also included. Another memo advises the company that

$2,000 Note Receivable has been collected by the bank, ($1,950 deposit and a bank charge of $50). This

represents the net proceeds of a collection the bank had made on behalf of the company on a $2,000

note receivable.

c. Cheques written during the month but not included with the bank statement are no. 1200, $1,500; no.

1223, $2,000; no. 1260, $950; no. 1294, $3,500.

d. Cheque no. 1222 is returned with the bank statement. The cheque was made for $6,500, the correct

amount owing for office expense. The cheque was recorded in the company records in the amount of

$5,600.

e. Cheques outstanding at the end of July included cheques no. 1114 for $1,600 and no. 1116 for $1,250.

Cheque no. 1116 cleared the August bank statement; cheque no. 1114 did not.

Required:

1. Prepare a bank reconciliation at August 31.

2. Prepare the necessary adjusting journal entries required to make the cash account in the general ledger

agree with the adjusted cash balance on the July bank reconciliation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT