Prepare a basic income statement forecast for the subsequent fiscal year, using a percentage of sales approach and using information included in the materials below to support assumptions that correspond for each revenue and expense. Each line item (e.g., marketing expenses) should have a note and an explanation on how it was calculated.

Prepare a basic income statement forecast for the subsequent fiscal year, using a percentage of sales approach and using information included in the materials below to support assumptions that correspond for each revenue and expense. Each line item (e.g., marketing expenses) should have a note and an explanation on how it was calculated.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter2: Financial Statements, Cash Flow,and Taxes

Section: Chapter Questions

Problem 1Q: Define each of the following terms:

Annual report; balance sheet; income statement

Common...

Related questions

Question

Prepare a basic income statement

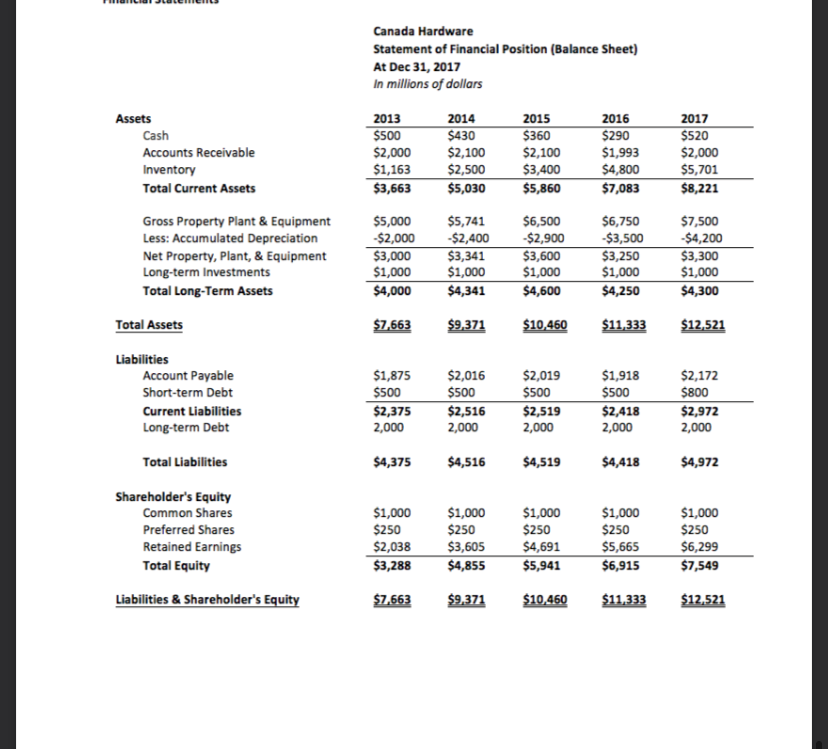

Transcribed Image Text:Assets

Cash

Accounts Receivable

Inventory

Total Current Assets

Gross Property Plant & Equipment

Less: Accumulated Depreciation

Net Property, Plant, & Equipment

Long-term Investments

Total Long-Term Assets

Account Payable

Short-term Debt

Current Liabilities

Long-term Debt

Total Liabilities

Shareholder's Equity

Common Shares

Preferred Shares

Retained Earnings

Total Equity

Liabilities & Shareholder's Equity

Total Assets

Liabilities

Canada Hardware

Statement of Financial Position (Balance Sheet)

At Dec 31, 2017

In millions of dollars

2013

2014

2015

2016

2017

$500

$430

$360

$290

$520

$2,000

$2,100 $2,100

$1,993

$2,000

$1,163

$2,500

$3,400

$4,800

$5,701

$3,663 $5,030

$5,860

$7,083

$8,221

$5,000

$5,741

$6,500

$6,750

$7,500

-$2,000

-$2,400

-$2,900

-$3,500

-$4,200

$3,000

$3,341

$3,600

$3,250

$3,300

$1,000

$1,000

$1,000

$1,000

$1,000

$4,000

$4,341

$4,600

$4,250

$4,300

$7,663

$9,371

$10,460

$11,333

$12,521

$1,875

$2,016

$2,019

$1,918

$2,172

$500

$500

$500

$500

$800

$2,375

$2,516

$2,519

$2,418

$2,972

2,000

2,000

2,000

2,000

2,000

$4,375

$4,516

$4,519

$4,418

$4,972

$1,000

$1,000

$1,000

$1,000

$1,000

$250

$250

$250

$250

$250

$2,038

$3,605

$4,691

$5,665

$6,299

$3,288

$4,855

$5,941

$6,915

$7,549

$7,663 $9,371

$10,460 $11,333 $12,521

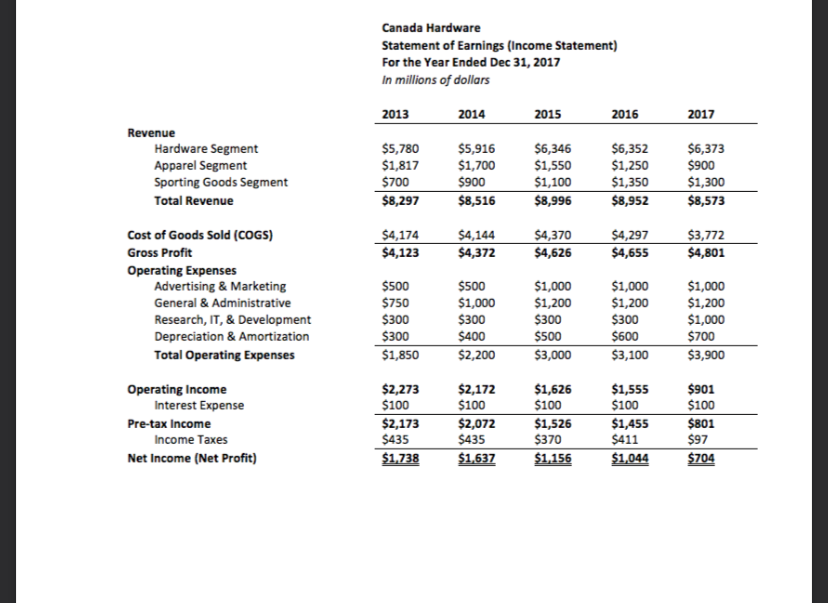

Transcribed Image Text:Revenue

Hardware Segment

Apparel Segment

Sporting Goods Segment

Total Revenue

Cost of Goods Sold (COGS)

Gross Profit

Operating Expenses

Advertising & Marketing

General & Administrative

Research, IT, & Development

Depreciation & Amortization

Total Operating Expenses

Operating Income

Interest Expense

Pre-tax Income

Income Taxes

Net Income (Net Profit)

Canada Hardware

Statement of Earnings (Income Statement)

For the Year Ended Dec 31, 2017

In millions of dollars

2013

2014

2015

2016

$5,780

$5,916

$6,346

$6,352

$1,817

$1,700

$1,550

$1,250

$700

$900

$1,100

$1,350

$8,297

$8,516

$8,996

$8,952

$4,174

$4,144

$4,370

$4,297

$4,123

$4,372

$4,626

$4,655

$500

$500

$1,000

$1,000

$750

$1,000

$1,200

$1,200

$300

$300

$300

$300

$300

$400

$500

$600

$1,850

$2,200

$3,000

$3,100

$2,273

$2,172

$1,626

$1,555

$100

$100

$100

$100

$2,173

$2,072

$1,526

$1,455

$435

$435

$370

$411

$1,738

$1,637

$1,156

$1,044

2017

$6,373

$900

$1,300

$8,573

$3,772

$4,801

$1,000

$1,200

$1,000

$700

$3,900

$901

$100

$801

$97

$704

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you