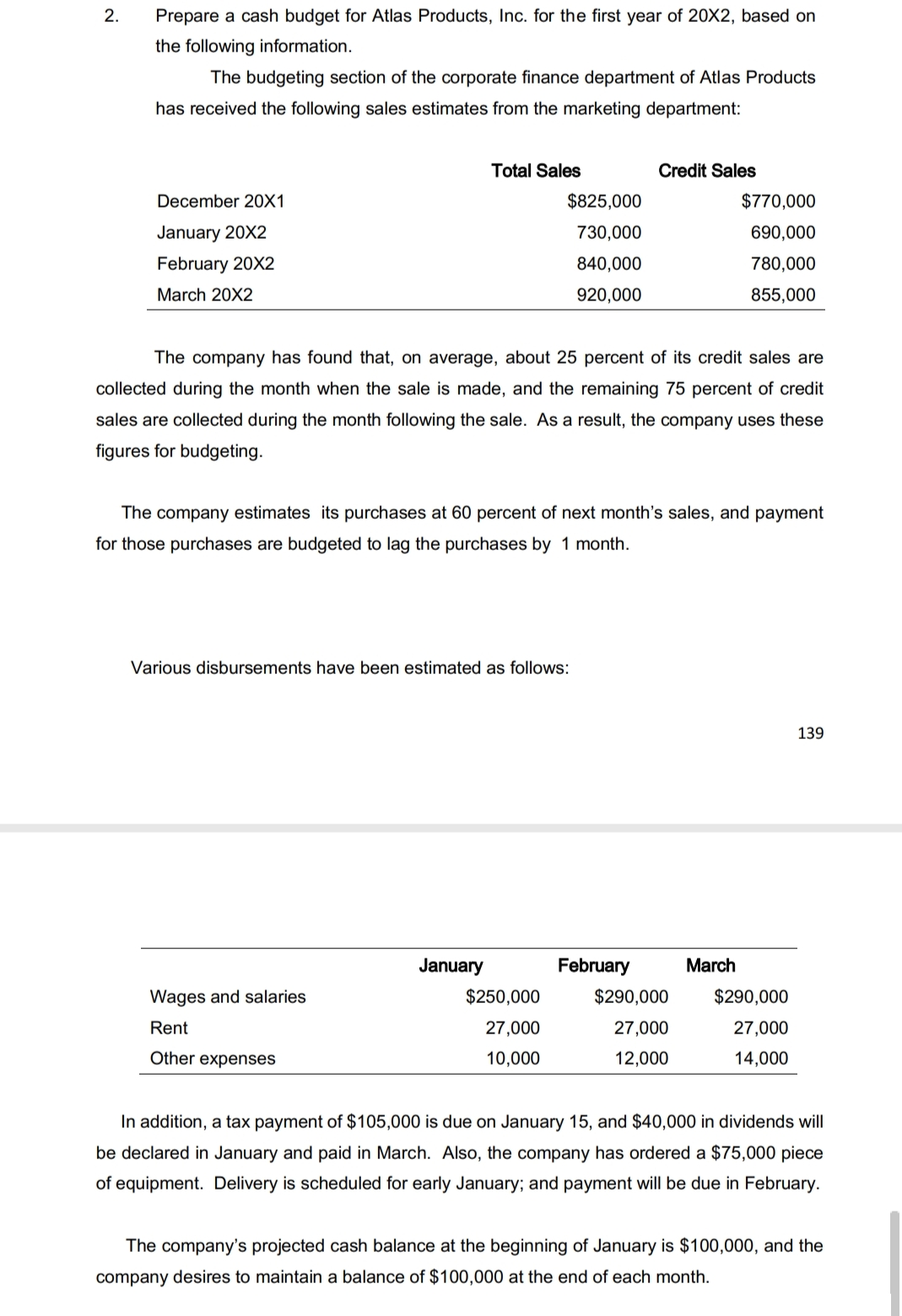

Prepare a cash budget for Atlas Products, Inc. for the first year of 20X2, based on the following information. The budgeting section of the corporate finance department of Atlas Products has received the following sales estimates from the marketing department: Total Sales Credit Sales December 20X1 $825,000 $770,000 January 20X2 730,000 690,000 February 20X2 840,000 780,000 March 20X2 920,000 855,000 The company has found that, on average, about 25 percent of its credit sales are collected during the month when the sale is made, and the remaining 75 percent of credit sales are collected during the month following the sale. As a result, the company uses these figures for budgeting. The company estimates its purchases at 60 percent of next month's sales, and payment for those purchases are budgeted to lag the purchases by 1 month. Various disbursements have been estimated as follows: 139 January February March Wages and salaries $250,000 $290,000 $290,000 Rent 27,000 27,000 27,000 Other expenses 10,000 12,000 14,000 In addition, a tax payment of $105,000 is due on January 15, and $40,000 in dividends will be declared in January and paid in March. Also, the company has ordered a $75,000 piece of equipment. Delivery is scheduled for early January; and payment will be due in February. The company's projected cash balance at the beginning of January is $100,000, and the company desires to maintain a balance of $100,000 at the end of each month. 2.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images