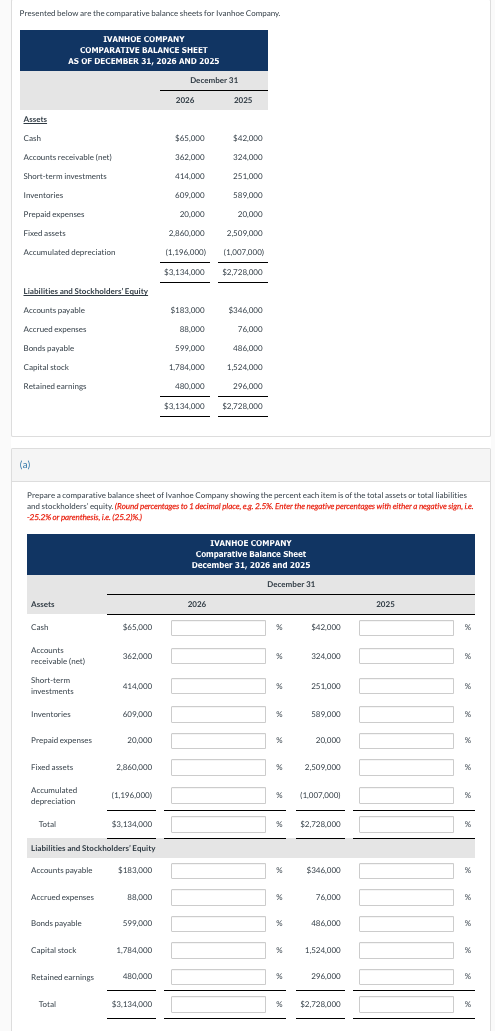

Prepare a comparative balance sheet of Ivanhoe Company showing the percent each item is of the total assets or total liabilities and stockholders' equity. (Round percentages to 1 decimal place, eg 2.5%. Enter the negative percentages with either a negative sign, Le. -25.2% or parenthesis, L. (25.23%) Assets Cash Accounts receivable (net) Short-term investments Inventories Prepaid expenses Fixed assets Accumulated depreciation Total Accrued expenses Bonds payable Capital stock Retained earnings $65,000 Total 362,000 414,000 609,000 20,000 2,860,000 (1,196,000) Liabilities and Stockholders' Equity Accounts payable $183,000 $3,134,000 88,000 599,000 1,784,000 480,000 $3,134,000 IVANHOE COMPANY Comparative Balance Sheet December 31, 2026 and 2025 December 31 2026 % % % % % % $42,000 324,000 251.000 589,000 20,000 2,509,000 (1,007,000) $2.728.000 $346,000 76,000 486,000 1,524,000 296.000 $2,728.000 2025

Prepare a comparative balance sheet of Ivanhoe Company showing the percent each item is of the total assets or total liabilities and stockholders' equity. (Round percentages to 1 decimal place, eg 2.5%. Enter the negative percentages with either a negative sign, Le. -25.2% or parenthesis, L. (25.23%) Assets Cash Accounts receivable (net) Short-term investments Inventories Prepaid expenses Fixed assets Accumulated depreciation Total Accrued expenses Bonds payable Capital stock Retained earnings $65,000 Total 362,000 414,000 609,000 20,000 2,860,000 (1,196,000) Liabilities and Stockholders' Equity Accounts payable $183,000 $3,134,000 88,000 599,000 1,784,000 480,000 $3,134,000 IVANHOE COMPANY Comparative Balance Sheet December 31, 2026 and 2025 December 31 2026 % % % % % % $42,000 324,000 251.000 589,000 20,000 2,509,000 (1,007,000) $2.728.000 $346,000 76,000 486,000 1,524,000 296.000 $2,728.000 2025

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 75E

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:Presented below are the comparative balance sheets for Ivanhoe Company.

Assets

Cash

Accounts receivable (net)

Short-term investments

Inventories

Prepaid expenses

Fixed assets

Accumulated depreciation

Liabilities and Stockholders' Equity

Accounts payable

Accrued expenses

Bonds payable

Capital stock

Retained earnings

(a)

IVANHOE COMPANY

COMPARATIVE BALANCE SHEET

AS OF DECEMBER 31, 2026 AND 2025

Assets

Cash

Accounts

receivable (net)

Short-term

investments

Inventories

Prepaid expenses

Fixed assets

Accumulated

depreciation

Total

Accrued expenses

Bonds payable

Capital stock

Retained earnings

Total

$65,000

362,000

Prepare a comparative balance sheet of Ivanhoe Company showing the percent each item is of the total assets or total liabilities

and stockholders' equity. (Round percentages to 1 decimal place, e.g. 2.5%. Enter the negative percentages with either a negative sign, Le.

-25.2% or parenthesis, i.e. (25.21%)

414,000

609,000

Liabilities and Stockholders' Equity

Accounts payable

20,000

2,860,000

(1,196,000)

$3,134,000

$183,000

88,000

599,000

1,784,000

480,000

December 31

$3,134,000

2026

$65,000

362,000

414,000

609,000

20,000

2,860,000

(1,196,000)

$3,134,000

$183,000

88,000

599,000

1,784,000

480,000

$3,134,000

2025

$42,000

324,000

251,000

589,000

2026

20,000

2,509,000

(1.007.000)

$2,728,000

$346,000

76,000

486,000

1,524,000

296,000

$2,728,000

IVANHOE COMPANY

Comparative Balance Sheet

December 31, 2026 and 2025

December 31

%

%

%

%

%

%

%

$42,000

%

324,000

251,000

% (1,007,000)

589,000

20,000

2,509,000

$2,728,000

$346,000

76,000

486,000

1,524,000

296,000

% $2,728,000

2025

%

%

%

%

%

%

%

%

%

%

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning