1. Using the information above, complete the calculation of accounting ratios and percentages and comment briefly on the performance of the company for the two years. 2. By reference to requirement 1, identify the areas that are subject to increased audit risk and describe the further audit work you would perform in response to those risks.

1. Using the information above, complete the calculation of accounting ratios and percentages and comment briefly on the performance of the company for the two years. 2. By reference to requirement 1, identify the areas that are subject to increased audit risk and describe the further audit work you would perform in response to those risks.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter7: Planning The Audit: Identifying, Assessing, And Responding To The Risk Of Material Misstatement

Section: Chapter Questions

Problem 19RQSC

Related questions

Question

100%

1. Using the information above, complete the calculation of accounting ratios and

percentages and comment briefly on the performance of the company for the two

years.

2. By reference to requirement 1, identify the areas that are subject to increased audit

risk and describe the further audit work you would perform in response to those risks.

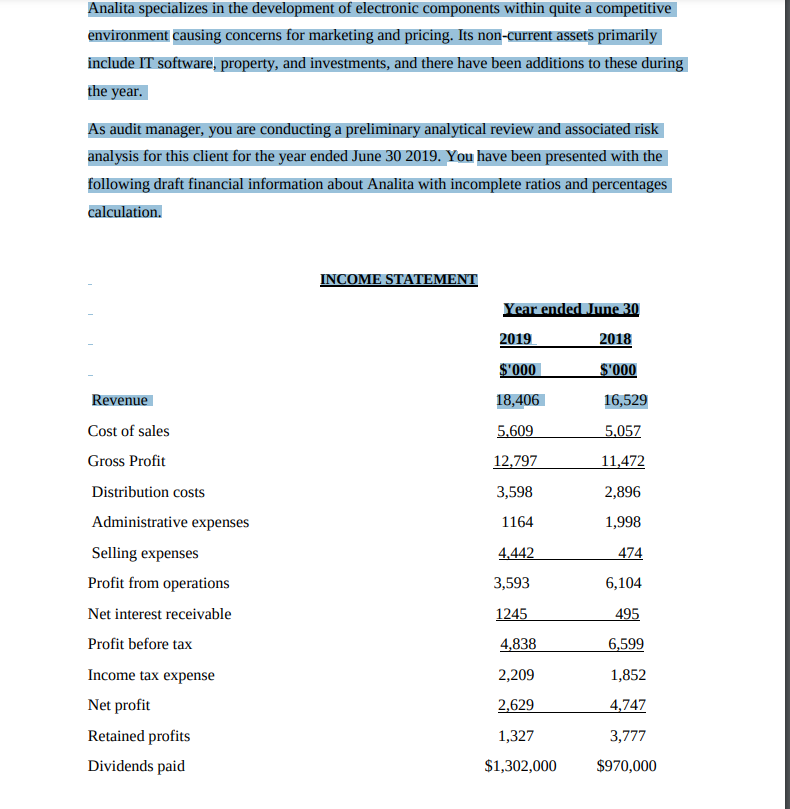

Transcribed Image Text:Analita specializes in the development of electronic components within quite a competitive

environment causing concerns for marketing and pricing. Its non-current assets primarily

include IT software, property, and investments, and there have been additions to these during

the year.

As audit manager, you are conducting a preliminary analytical review and associated risk

analysis for this client for the year ended June 30 2019. You have been presented with the

following draft financial information about Analita with incomplete ratios and percentages

calculation.

Revenue

Cost of sales

Gross Profit

Distribution costs

Administrative expenses

Selling expenses

Profit from operations

Net interest receivable

Profit before tax

Income tax expense

Net profit

Retained profits

Dividends paid

INCOME STATEMENT

Year ended June 30

2019

2018

$'000

$'000

18,406

16,529

5,609

5,057

12,797

11,472

3,598

2,896

1164

1,998

4,442

474

6,104

495

6,599

1,852

4,747

3,777

$970,000

3,593

1245

4,838

2,209

2,629

1,327

$1,302,000

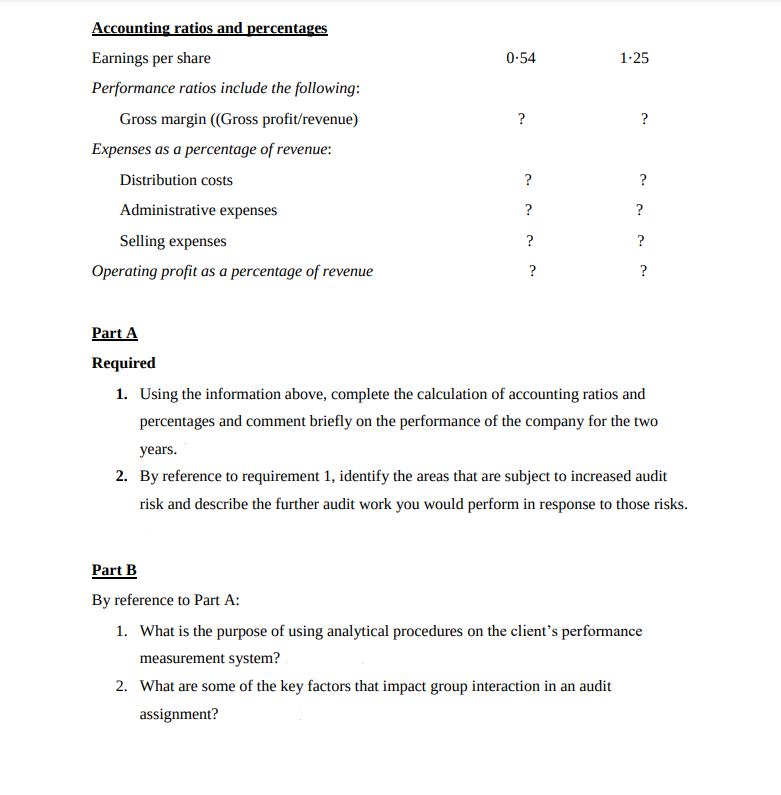

Transcribed Image Text:Accounting ratios and percentages

Earnings per share

Performance ratios include the following:

Gross margin ((Gross profit/revenue)

Expenses as a percentage of revenue:

Distribution costs

Administrative expenses

Selling expenses

Operating profit as a percentage of revenue

0.54

?

?

?

?

?

1.25

?

?

?

?

?

Part A

Required

1. Using the information above, complete the calculation of accounting ratios and

percentages and comment briefly on the performance of the company for the two

years.

2. By reference to requirement 1, identify the areas that are subject to increased audit

risk and describe the further audit work you would perform in response to those risks.

Part B

By reference to Part A:

1. What is the purpose of using analytical procedures on the client's performance

measurement system?

2. What are some of the key factors that impact group interaction in an audit

assignment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning