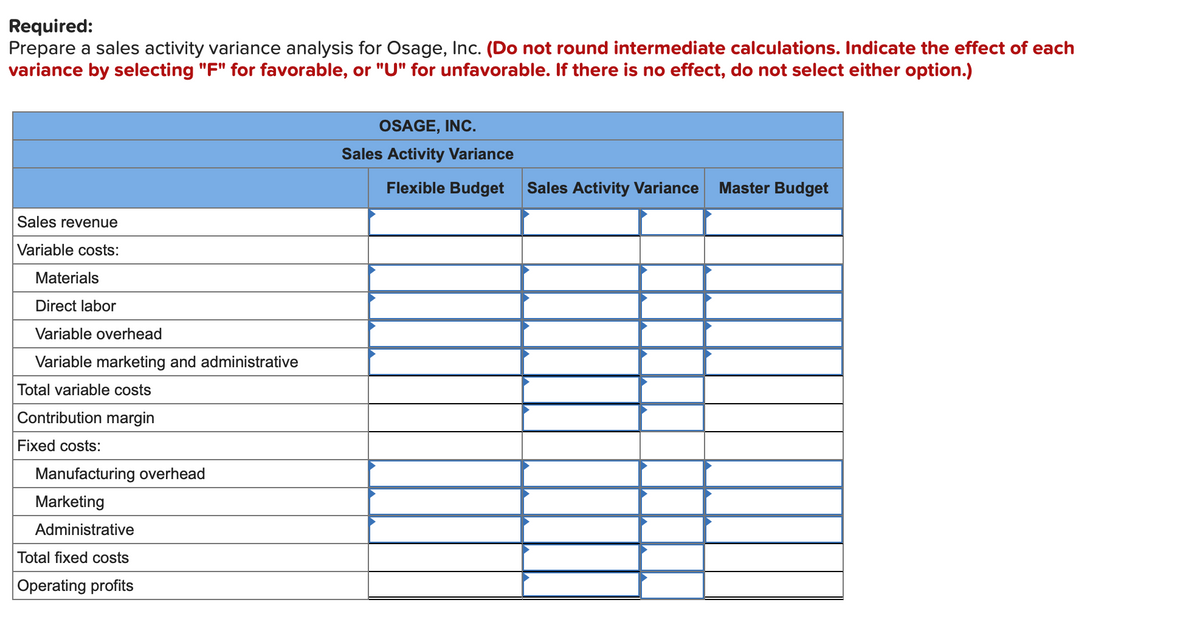

Prepare a sales activity variance analysis for Osage, Inc. (Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option.) OSAGE, INC. Sales Activity Variance Flexible Budget Sales Activity Variance Master Budget Sales revenue Variable costs: Materials Direct labor Variable overhead Variable marketing and administrative Total variable costs Contribution margin Fixed costs: Manufacturing overhead Marketing Administrative Total fixed costs Operating profits

Prepare a sales activity variance analysis for Osage, Inc. (Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option.) OSAGE, INC. Sales Activity Variance Flexible Budget Sales Activity Variance Master Budget Sales revenue Variable costs: Materials Direct labor Variable overhead Variable marketing and administrative Total variable costs Contribution margin Fixed costs: Manufacturing overhead Marketing Administrative Total fixed costs Operating profits

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter18: Pricing And Profitability Analysis

Section: Chapter Questions

Problem 20E: Eastman, Inc., manufactures and sells three products: R, S, and T. In January, Eastman, Inc.,...

Related questions

Question

Hello question is attached, thanks.

Transcribed Image Text:Required:

Prepare a sales activity variance analysis for Osage, Inc. (Do not round intermediate calculations. Indicate the effect of each

variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option.)

OSAGE, INC.

Sales Activity Variance

Flexible Budget

Sales Activity Variance

Master Budget

Sales revenue

Variable costs:

Materials

Direct labor

Variable overhead

Variable marketing and administrative

Total variable costs

Contribution margin

Fixed costs:

Manufacturing overhead

Marketing

Administrative

Total fixed costs

Operating profits

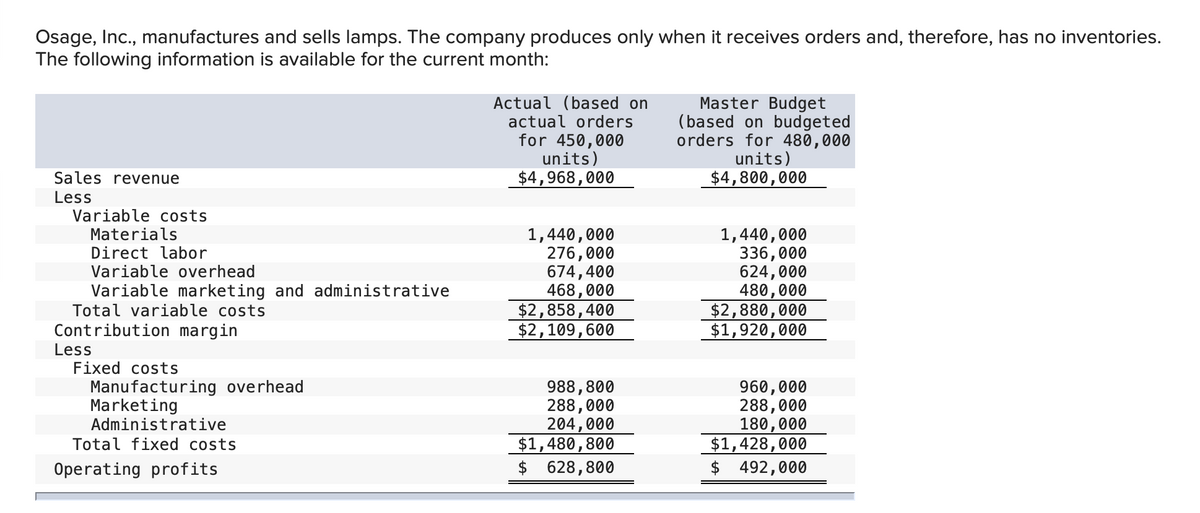

Transcribed Image Text:Osage, Inc., manufactures and sells lamps. The company produces only when it receives orders and, therefore, has no inventories.

The following information is available for the current month:

Actual (based on

actual orders

for 450,000

units)

$4,968,000

Master Budget

(based on budgeted

orders for 480,000

units)

$4,800,000

Sales revenue

Less

Variable costs

1,440,000

336,000

624,000

480,000

$2,880,000

$1,920,000

Materials

Direct labor

Variable overhead

1,440,000

276,000

674,400

468,000

$2,858,400

$2,109,600

Variable marketing and administrative

Total variable costs

Contribution margin

Less

Fixed costs

Manufacturing overhead

Marketing

Administrative

Total fixed costs

988,800

288,000

204,000

$1,480,800

$ 628,800

960,000

288,000

180,000

$1,428,000

$ 492,000

Operating profits

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning