prepare a trial balance asap

Q: Create a Trial Balance.

A: The trial balance has been prepared from the general journal. The general journal and trial balance…

Q: Prepare the post closing trial balance

A: Trial balance refers to the statement or workbook in which all the closing balances of ledgers are…

Q: Prepare a ledger using T-accounts. Enter the trial balance amounts and post the adjusting entries. (

A: Given:

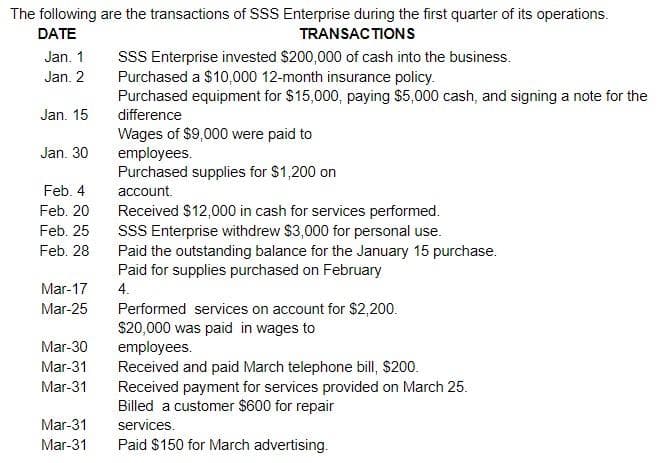

Q: Required: Prepare the journal entries, T accounts and trial balance for this business.

A:

Q: Rearrange the following steps in the accounting cycle in proper sequence: Transactions are analyzed…

A: Following is the appropriate procedure structure of accounting cycle:

Q: Please prepare a trial balance for Kate

A:

Q: Summary account will showa balance of

A: It is pertinent to note that nominal accounts that is income , expense , losses and profit accounts…

Q: The term Journalizing is related to which of the following? O a. Reporting O b. Identifying and…

A: The term "Journalizing" is the main process that is involved in recording a business transaction in…

Q: ial

A: First of all we need to make journal entry of the same. Journal Entry S.No Date Particular…

Q: balances, prepare the trial balance for Craymar Fu ure Repair's accounts.)

A: A trial balance is a list of all the ledger accounts with their closing balances reflecting on the…

Q: rder the following steps in the accounting process that focus on analyzing and recording…

A: Solution- A trial balance is a listing of all accounts (in this order: asset, liability, equity,…

Q: Transform the raw data into an ordered trial balance. Then pass adjusting entries in pure journal…

A: Adjusting entries are entries that are prepared at the end of the period in order to accurately…

Q: What purpose is served by preparing a trial balance in the accounting cycle?

A: Trial Balance: it is the statement of account balance which is prepared from closing balances of the…

Q: Order the following steps in the accounting process that focus on analyzing and recording…

A: Accounting: It can be defined as the process of summarizing and recording all the financial events…

Q: What is used in preparing trial balance? a. Ledger Accounts. b. General Journal. c. Specialized…

A: Trial balance is something which is usually prepared to verify if the debits in the books are equal…

Q: a. Prepare the necessary adjusting entry.

A: Journal entry: Journal entry is the book of original entry where first transactions are recorded in…

Q: Question: Explain the steps of the preparation of the trial balance.

A: The financial statements of the business including income statement, and balance sheet are prepared…

Q: Define the term adjusted trial balance.

A: Trial balance: Trial balance is a summary of all the asset, liability, and equity accounts and their…

Q: Requirements: • Posting • Trial Balance • Worksheet

A: Hi student Since there are multiple subparts, we will answer only first three subparts.

Q: prepare a trial balance on the sheet provided for the trial balance i included a photo the format…

A: Preparation of trial balance is the third phase in the accounting process. After posting the…

Q: A Trial balance is prepared:(a) After preparation financial statement.(b) After recording…

A: Trial balance: Trial balance is a summary of all the ledger accounts balances presented in a tabular…

Q: What do you mean by adjusted trial balance? What is a worksheet, how is it used to help prepare an…

A: Adjusted trial balance: Adjusted trial balance refers to an internal document that is prepared that…

Q: prepare the adjusted trial balance The table above is the reference

A: Adjusted trial balance is summary of all general ledger account balances of the business after all…

Q: Requirements: a. Journalize each transaction and prepare the necessary adjusting entries.

A: The transactions for the month of Dec 2021 for K-Dynamite company are given to us. The Company has…

Q: ournalize adjusting entries and prepare a trial balance

A: Trail Balance:- Trail balance helps to check the arithmetic accuracy of books of accounts. Trail…

Q: prepare a corrected trial balance

A: Debit Credit Cash (38400+2400-4200) 36,600 Accounts Receivable…

Q: Transactions are initially recorded in the a. general ledger. b. general journal. c. trial balance.…

A: "Hey, since there are multiple questions posted, we will answer the first question. If you want any…

Q: al entry, t-accounts, trial balance, and balance sheet

A: Transactions are first recorded in journal entries which affect two ledgers and then transferred to…

Q: Prepare the T-Account

A:

Q: Which sequence correctly summarizes the accounting process? Journalize transactions, post to the…

A: Financial accounting: Financial accounting is the process of recording, summarizing, and reporting…

Q: a. Post the Transactions to T-Account b. Prepare a Trial Balance

A: Cash Account Date Particulars Dr. Amount Date Particulars Cr. Amount 01-Jun To Farooq Capital…

Q: Summarize the adjusting process.

A:

Q: Prepare a trial balance using the journal entries. If an amount box does not require an entry, leave…

A: In Trial Balance , its necessary that both the Debit side and Credit should be equal, if its not…

Q: Prepare an adjusted Trial Balance from the following...

A: Adjusted Trial Balance is summary of all general ledger account balances after making all the…

Q: How do I word the data for adjustments in the trial balance?

A: Trial balance: It is a statement that shows the balance of balances. It is prepared at the end of…

Q: ARRANGE AND PREPARE A BALANCE SHEET Use a Separate Sheet an

A: Balance Sheet- Balance sheet accounts are permanent accounts, and their balances carry over to the…

Q: Explain the processes that take place before the Trial Balance is prepared. Describe the elements…

A: Trial Balance: It is a worksheet in bookkeeping process in which all general ledger accounts are…

Q: can u please make transaction summary table, general journal, general ledger and unadjusted trial…

A: Financial statements consists of the following:- Statement of Financial position; Income Statement;…

Q: REQUIRED: JOURNAL ENTRIES AND TRIAL BALANCE

A: Journal entries recording is the first step of accounting cycle process, under which atleast one…

Q: how the requisite journal entries to correct the balance.

A: Here to made the correction entry to clear the suspense account which was incurred shortage due to…

Q: Is Warehouse included in a post closing trial balance?

A: All balance sheet accounts with non-zero balances at the conclusion of an accounting cycle are…

Q: From the financial transactions in c, prepare the pro-forma templates for the following: i. Journal…

A: Accounting cycle is a step-by-step process of recording, classifying, and preparing summary of…

Q: Make income statement , retained earnings and balance sheet from trial balance.

A: The income statement of a firm includes the revenue and expenses. If the revenue is greater than the…

Q: Order the following steps in the accounting process that focus on analyzing and recording…

A: Accounting process: It can be defined as the process of gathering and recording the financial data…

Q: Posting:a. involves transferring the information in journal entries to the general ledger.b. is an…

A: Companies maintain detailed records of their balances, whether they be revenues, costs, or…

Q: Prepare normal adjusted trial balance.

A:

Q: Post this journal to ledgers then trial balance. Please use column format for ledgers, not T account…

A: A ledger is a log or list of accounts that keeps track of account transfers. A trial balance's main…

prepare a

Step by step

Solved in 2 steps with 1 images

- A business has the following transactions: A. The business is started by receiving cash from an investor in exchange for common stock $10,000. B. Rent of $1,250 is paid for the first month. C. Office supplies are purchased for $375. D. Services worth $3,450 are performed. Cash is received for half. E. Customers pay $1,250 for services to be performed next month. F. $6,000 is paid for a one year insurance policy. G. We receive 25% of the money owed by customers in D. H. A customer has placed an order for $475 of services to be done this coming week. How much total revenue does the company have?Krespy Corp. has a cash balance of $7,500 before the following transactions occur: A. received customer payments of $965 B. supplies purchased on account $435 C. services worth $850 performed, 25% is paid in cash the rest will be billed D. corporation pays $275 for an ad in the newspaper E. bill is received for electricity used $235. F. dividends of $2,500 are distributed What is the balance in cash after these transactions are journalized and posted?Jada Company had the following transactions during the year: Purchased a machine for $500,000 using a long-term note to finance it Paid $500 for ordinary repair Purchased a patent for $45,000 cash Paid $200,000 cash for addition to an existing building Paid $60,000 for monthly salaries Paid $250 for routine maintenance on equipment Paid $10,000 for major repairs Depreciation expense recorded for the year is $25,000 If all transactions were recorded properly, what is the amount of increase to the Property, Plant, and Equipment section of Jadas balance sheet resulting from this years transactions? What amount did Jada report on the income statement for expenses for the year?

- Analyzing Transactions. Using the analytical framework, indicate the effect of the following related transactions of a firm. a. January 1: Issued 10,000 shares of common stock for 50,000. b. January 1: Acquired a building costing 35,000, paying 5,000 in cash and borrowing the remainder from a bank. c. During the year: Acquired inventory costing 40,000 on account from various suppliers. d. During the year: Sold inventory costing 30,000 for 65,000 on account. e. During the year: Paid employees 15,000 as compensation for services rendered during the year. f. During the year: Collected 45,000 from customers related to sales on account. g. During the year: Paid merchandise suppliers 28,000 related to purchases on account. h. December 31: Recognized depreciation on the building of 7,000 for financial reporting. Depreciation expense for income tax purposes was 10,000. i. December 31: Recognized compensation for services rendered during the last week in December but not paid by year-end of 4,000. j. December 31: Recognized and paid interest on the bank loan in Part b of 2,400 for the year. k. Recognized income taxes on the net effect of the preceding transactions at an income tax rate of 40%. Assume that the firm pays cash immediately for any taxes currently due to the government.Determine the following amounts: a. The amount of the liabilities of a business that has 60,800 in assets and in which the owner has 34,500 equity. b. The equity of the owner of a tour bus that cost 57,000 and on which is owed 21,800 on an installment loan payable to the bank. c. The amount of the assets of a business that has 11,780 in liabilities and in which the owner has 28,500 equity.Johnson, Incorporated had the following transactions during the year: Purchased a building for $5,000,000 using a mortgage for financing Paid $2,000 for ordinary repair on a piece of equipment Sold product on account to customers for $1,500,600 Purchased a copyright for $5,000 cash Paid $20,000 cash to add a storage shed in the corner of an existing building Paid $360,000 in monthly salaries Paid $25,000 for routine maintenance on equipment Paid $110,000 for major repairs If all transactions were recorded properly, what amount did Johnson capitalize for the year, and what amount did Johnson expense for the year?

- Johnson, Incorporated, had the following transactions during the year: Purchased a building for $5,000,000 using a mortgage for financing Paid $2,000 for ordinary repair on a piece of equipment Sold product on account to customers for $1,500,600 Paid $20,000 cash to add a storage shed in the corner of an existing building Paid $360,000 in monthly salaries Paid $25,000 for routine maintenance on equipment Paid $110,000 for extraordinary repairs Depreciation expense recorded for the year is $15,000. If all transactions were recorded properly, what is the amount of increase to the Property, Plant, and Equipment section of Johnsons balance sheet resulting from this years transactions? What amount did Johnson report on the income statement for expenses for the year?The following information is provided for the first month of operations for Legal Services Inc.: A. The business was started by selling $100,000 worth of common stock. B. Six months rent was paid in advance, $4,500. C. Provided services in the amount of $1,000. The customer will pay at a later date. D. An office worker was hired. The worker will be paid $275 per week. E. Received $500 in payment from the customer in C. F. Purchased $250 worth of supplies on credit. G. Received the electricity bill. We will pay the $110 in thirty days. H. Paid the worker hired in D for one weeks work. I. Received $100 from a customer for services we will provide next week. J. Dividends in the amount of $1,500 were distributed. Prepare the necessary journal entries to record these transactions. If an entry is not required for any of these transactions, state this and explain why.Consider the following situations and determine (1) which type of liability should be recognized (specific account), and (2) how much should be recognized in the current period (year). A. A business sets up a line of credit with a supplier. The company purchases $10,000 worth of equipment on credit. Terms of purchase are 5/10, n/30. B. A customer purchases a watering hose for $25. The sales tax rate is 5%. C. Customers pay in advance for season tickets to a soccer game. There are fourteen customers, each paying $250 per season ticket. Each customer purchased two season tickets. D. A company issues 2,000 shares of its common stock with a price per share of $15.

- On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501. e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012. g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307. i. Received and paid the heating bill, 248, Ck. No. 504. j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128. k. Sold catering services for cash for the remainder of the month, 2,649. l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.Analyzing the Accounts The controller for Summit Sales Inc. provides the following information on transactions that occurred during the year: a. Purchased supplies on credit, $18,600 b. Paid $14,800 cash toward the purchase in Transaction a c. Provided services to customers on credit1 $46,925 d. Collected $39,650 cash from accounts receivable e. Recorded depreciation expense, $8,175 f. Employee salaries accrued, $15,650 g. Paid $15,650 cash to employees for salaries earned h. Accrued interest expense on long-term debt, $1,950 i. Paid a total of $25,000 on long-term debt, which includes $1.950 interest from Transaction h j. Paid $2,220 cash for l years insurance coverage in advance k. Recognized insurance expense, $1,340, that was paid in a previous period l. Sold equipment with a book value of $7,500 for $7,500 cash m. Declared cash dividend, $12,000 n. Paid cash dividend declared in Transaction m o. Purchased new equipment for $28,300 cash. p. Issued common stock for $60,000 cash q. Used $10,700 of supplies to produce revenues Summit Sales uses the indirect method to prepare its statement of cash flows. Required: 1. Construct a table similar to the one shown at the top of the next page. Analyze each transaction and indicate its effect on the fundamental accounting equation. If the transaction increases a financial statement element, write the amount of the increase preceded by a plus sign (+) in the appropriate column. If the transaction decreases a financial statement element, write the amount of the decrease preceded by a minus sign (-) in the appropriate column. 2. Indicate whether each transaction results in a cash inflow or a cash outflow in the Effect on Cash Flows column. If the transaction has no effect on cash flow, then indicate this by placing none in the Effect on Cash Flows column. 3. For each transaction that affected cash flows, indicate whether the cash flow would be classified as a cash flow from operating activities, cash flow from investing activities, or cash flow from financing activities. If there is no effect on cash flows, indicate this as a non-cash activity.Mohammed LLC is a growing consulting firm. The following transactions take place during the current year. A. On June 10, Mohammed borrows $270,000 from a bank to cover the initial cost of expansion. Terms of the loan are payment due in four months from June 10, and annual interest rate of 5%. B. On July 9, Mohammed borrows an additional $100,000 with payment due in four months from July 9, and an annual interest rate of 12%. C. Mohammed pays their accounts in full on October 10 for the June 10 loan, and on November 9 for the July 9 loan. Record the journal entries to recognize the initial borrowings, and the two payments for Mohammed.