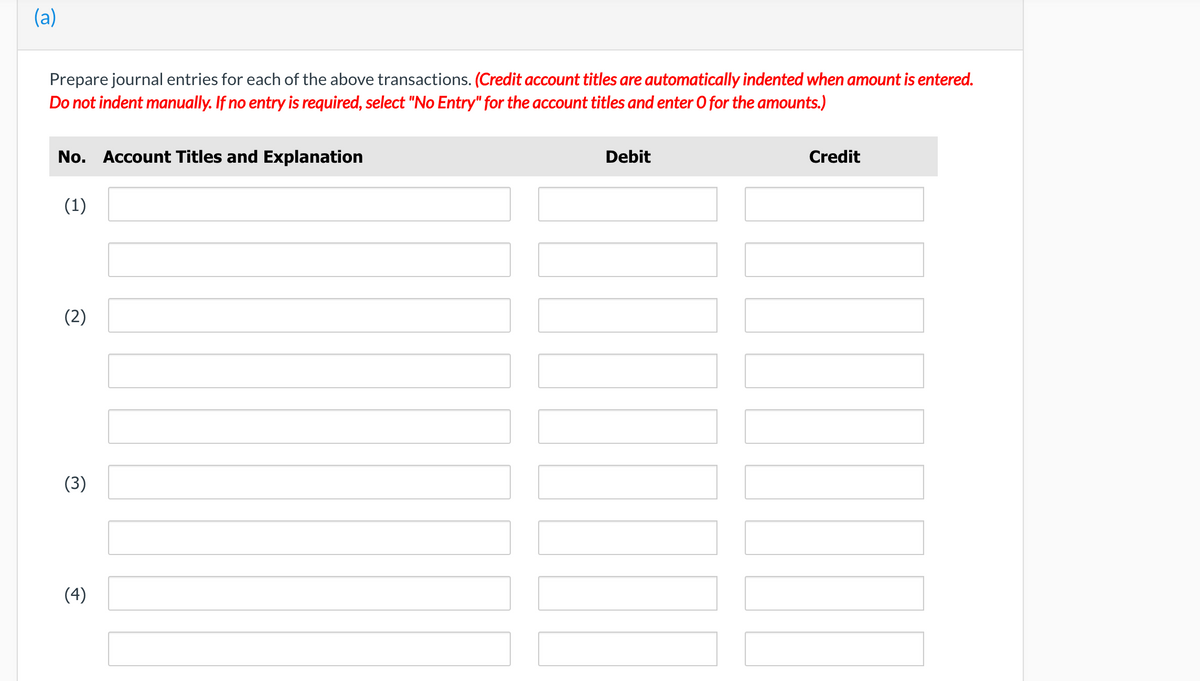

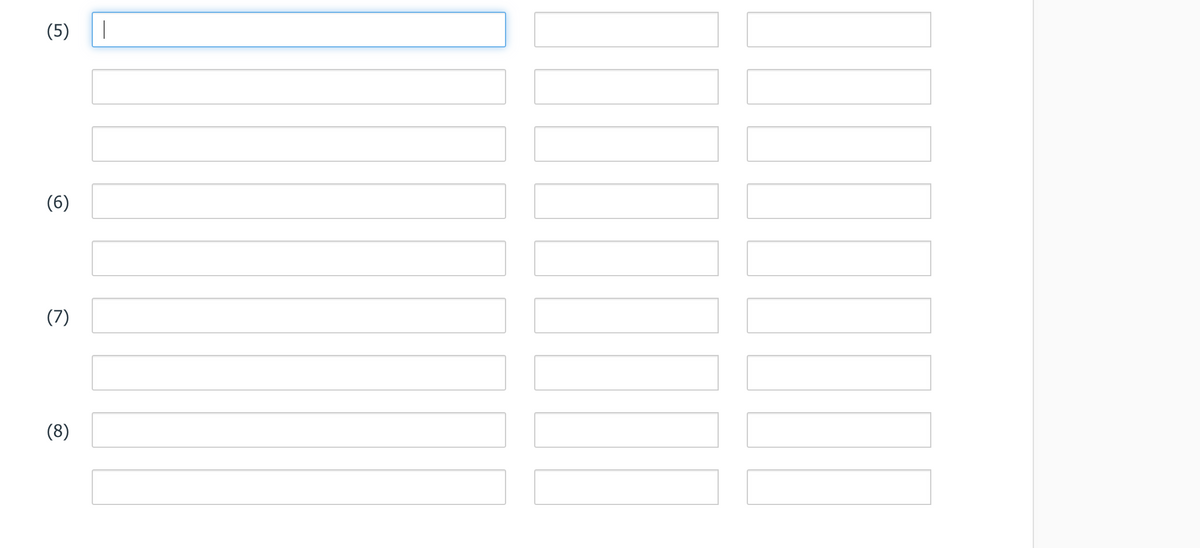

Prepare journal entries for each of the above transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Oriole, Inc. had the following equity investment portfolio at January 1, 2020.

| Evers Company | 970 shares @ $14 each | $13,580 | |||

| Rogers Company | 910 shares @ $18 each | 16,380 | |||

| Chance Company | 500 shares @ $9 each | 4,500 | |||

| Equity investments @ cost | 34,460 | ||||

| Fair value adjustment | (7,840 | ) | |||

| Equity investments @ fair value | $26,620 |

During 2020, the following transactions took place.

| 1. | On March 1, Rogers Company paid a $2 per share dividend. | |

| 2. | On April 30, Oriole, Inc. sold 290 shares of Chance Company for $11 per share. | |

| 3. | On May 15, Oriole, Inc. purchased 90 more shares of Evers Company stock at $17 per share. | |

| 4. | At December 31, 2020, the stocks had the following price per share values: Evers $18, Rogers $17, and Chance $8. |

During 2021, the following transactions took place.

| 5. | On February 1, Oriole, Inc. sold the remaining Chance shares for $8 per share. | |

| 6. | On March 1, Rogers Company paid a $2 per share dividend. | |

| 7. | On December 21, Evers Company declared a cash dividend of $3 per share to be paid in the next month. | |

| 8. | At December 31, 2021, the stocks had the following price per share values: Evers $20 and Rogers $19. |

Investments can be classified into long term investments and short term investments. Long term investments are valued at cost or carrying value whichever is lower. Any permanent decline in value is to be provided for. Whereas short term investments are valued at cost or market price whichever is lower.

Here in the question, nothing is mentioned about the period for which the investments are held. Also the fair value adjustment made is not mentioned is for which share specifically. But since the market value of all the shares as on 31st Dec 2020 is more than the cost price whatever adjustment was made in the previous year is not required and should be written back.

The market value of the shares of both the remaining equity investments as on 31st Dec 2021 is higher than the cost and hence no provision is required to be made.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps