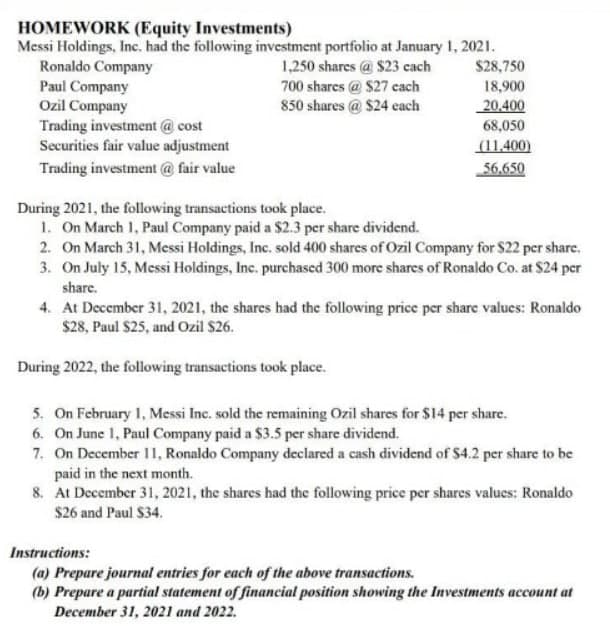

HOMEWORK (Equity Investments) Messi Holdings, Inc. had the following investment portfolio at January 1, 2021. Ronaldo Company Paul Company Ozil Company Trading investment @ cost Securities fair value adjustment 1,250 shares @ $23 cach 700 shares @ $27 cach 850 shares @ $24 cach $28,750 18,900 20.400 68,050 11.400) 56,650 Trading investment @ fair value During 2021, the following transactions took place. 1. On March 1, Paul Company paid a $2.3 per share dividend. 2. On March 31, Messi Holdings, Inc. sold 400 shares of Ozil Company for $22 per share. 3. On July 15, Messi Holdings, Inc. purchased 300 more shares of Ronaldo Co. at $24 per share. 4. At December 31, 2021, the shares had the following price per share values: Ronaldo $28, Paul $25, and Ozil $26. During 2022, the following transactions took place. 5. On February 1, Messi Inc. sold the remaining Ozil shares for $14 per share. 6. On June 1, Paul Company paid a $3.5 per share dividend. 7. On December 11, Ronaldo Company declared a cash dividend of $4.2 per share to be paid in the next month. 8. At December 31, 2021, the shares had the following price per shares values: Ronaldo $26 and Paul $34. Instructions: (a) Prepare journal entries for each of the above transactions. (b) Prepare a partial statement of financial position showing the Investments account at December 31, 2021 and 2022.

HOMEWORK (Equity Investments) Messi Holdings, Inc. had the following investment portfolio at January 1, 2021. Ronaldo Company Paul Company Ozil Company Trading investment @ cost Securities fair value adjustment 1,250 shares @ $23 cach 700 shares @ $27 cach 850 shares @ $24 cach $28,750 18,900 20.400 68,050 11.400) 56,650 Trading investment @ fair value During 2021, the following transactions took place. 1. On March 1, Paul Company paid a $2.3 per share dividend. 2. On March 31, Messi Holdings, Inc. sold 400 shares of Ozil Company for $22 per share. 3. On July 15, Messi Holdings, Inc. purchased 300 more shares of Ronaldo Co. at $24 per share. 4. At December 31, 2021, the shares had the following price per share values: Ronaldo $28, Paul $25, and Ozil $26. During 2022, the following transactions took place. 5. On February 1, Messi Inc. sold the remaining Ozil shares for $14 per share. 6. On June 1, Paul Company paid a $3.5 per share dividend. 7. On December 11, Ronaldo Company declared a cash dividend of $4.2 per share to be paid in the next month. 8. At December 31, 2021, the shares had the following price per shares values: Ronaldo $26 and Paul $34. Instructions: (a) Prepare journal entries for each of the above transactions. (b) Prepare a partial statement of financial position showing the Investments account at December 31, 2021 and 2022.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 80E: Stockholders' Equity Terminology A list of terms and a list of definitions or examples are presented...

Related questions

Question

I need the answer as soon as possible

Transcribed Image Text:HOMEWORK (Equity Investments)

Messi Holdings, Inc. had the following investment portfolio at January 1, 2021.

Ronaldo Company

Paul Company

Ozil Company

Trading investment @ cost

Securities fair value adjustment

1,250 shares @ $23 cach

700 shares @ $27 cach

850 shares @ $24 each

$28,750

18,900

20.400

68,050

(11.400)

Trading investment @ fair value

56.650

During 2021, the following transactions took place.

1. On March 1, Paul Company paid a $2.3 per share dividend.

2. On March 31, Messi Holdings, Inc. sold 400 shares of Ozil Company for $22 per share.

3. On July 15, Messi Holdings, Inc. purchasced 300 more shares of Ronaldo Co. at $24 per

share.

4. At December 31, 2021, the shares had the following price per share values: Ronaldo

$28, Paul $25, and Ozil $26.

During 2022, the following transactions took place.

5. On February 1, Messi Inc. sold the remaining Ozil shares for $14 per share.

6. On June 1, Paul Company paid a $3.5 per share dividend.

7. On December 11, Ronaldo Company declared a cash dividend of S4.2 per share to be

paid in the next month.

8. At December 31, 2021, the shares had the following price per shares values: Ronaldo

$26 and Paul $34.

Instructions:

(a) Prepare journal entries for each of the above transactions.

(b) Prepare a partial statement of financial position showing the Investments account at

December 31, 2021 and 2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT