Prepare the complete Depreciation and Amortisation Form 4562.

Chapter8: Depreciation And Sale Of Business Property

Section: Chapter Questions

Problem 15MCQ

Related questions

Question

Prepare the complete

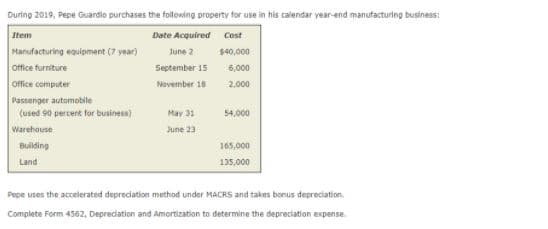

Transcribed Image Text:During 2019, Pepe Guardio purchases the following property for use in his calendar year-end manufacturing business:

Item

Date Acquired

Cost

Manufacturing equipment (7 year)

June 2

$40,000

Office furniture

September 15

6,000

Office computer

November 18

2.000

Passenger automobile

(used 90 percent for business)

May 31

54,000

Warehouse

June 23

Building

165,000

Land

135,000

Pepe uses the accelerated depreciation method under MACRS and takes bonus depreciation.

Complete Form 4562, Depredation and Amortization to determine the depreciation expense.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT