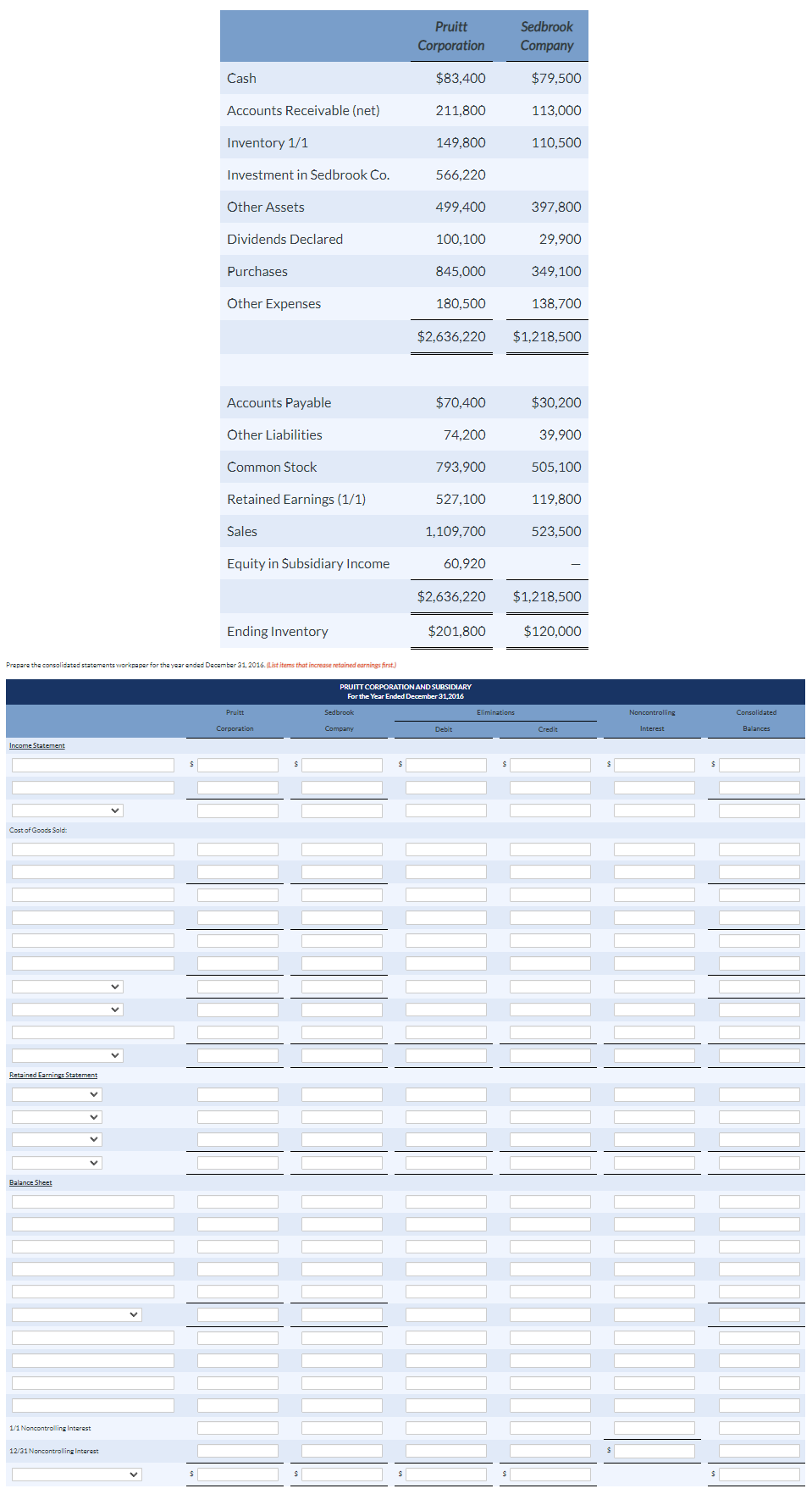

Prepare the consolidated statements workpaper for the year ended December 31, 2016. (List items that increase retained earnings first.) Income Statement Pruitt Corporation S PRUITT CORPORATION AND SUBSIDIARY For the Year Ended December 31, 2016 Sedbrook Company Debit Eliminations S Credit Noncontrolling Interest S Consolidated Balances

Prepare the consolidated statements workpaper for the year ended December 31, 2016. (List items that increase retained earnings first.) Income Statement Pruitt Corporation S PRUITT CORPORATION AND SUBSIDIARY For the Year Ended December 31, 2016 Sedbrook Company Debit Eliminations S Credit Noncontrolling Interest S Consolidated Balances

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 18E

Related questions

Question

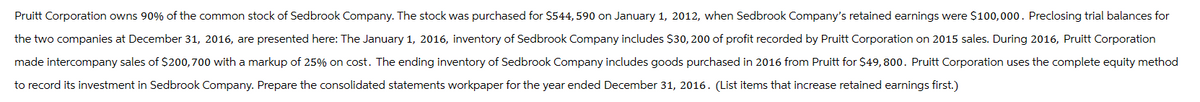

Transcribed Image Text:Pruitt Corporation owns 90% of the common stock of Sedbrook Company. The stock was purchased for $544, 590 on January 1, 2012, when Sedbrook Company's retained earnings were $100,000. Preclosing trial balances for

the two companies at December 31, 2016, are presented here: The January 1, 2016, inventory of Sedbrook Company includes $30, 200 of profit recorded by Pruitt Corporation on 2015 sales. During 2016, Pruitt Corporation

made intercompany sales of $200,700 with a markup of 25% on cost. The ending inventory of Sedbrook Company includes goods purchased in 2016 from Pruitt for $49,800. Pruitt Corporation uses the complete equity method

to record its investment in Sedbrook Company. Prepare the consolidated statements workpaper for the year ended December 31, 2016. (List items that increase retained earnings first.)

Transcribed Image Text:Income Statement

Cost of Goods Sold:

Retained Earnings Statement

Balance Sheet

V

1/1 Noncontrolling Interest

Cash

12/31 Noncontrolling Interest

Accounts Receivable (net)

Inventory 1/1

Investment in Sedbrook Co.

Other Assets

Dividends Declared

Prepare the consolidated statements workpaper for the year ended December 31, 2016. (List items that increase retained earnings first.)

Purchases

Other Expenses

Accounts Payable

Other Liabilities

Common Stock

Retained Earnings (1/1)

Sales

Equity in Subsidiary Income

Ending Inventory

Pruitt

Corporation

Pruitt

Corporation

$83,400

Sedbrook

Company

211,800

149,800

566,220

499.400

100,100

845,000

180,500

$70,400

74,200

793,900

527,100

1,109,700

60,920

$2,636,220

$2,636,220 $1,218,500

$201,800

PRUITT CORPORATION AND SUBSIDIARY

For the Year Ended December 31,2016

Debit

Sedbrook

Company

$79,500

113,000

110,500

Eliminations

397,800

29.900

349,100

138,700

$30,200

39,900

505,100

119,800

523,500

$1,218,500

$120,000

Credit

Noncontrolling

Interest

Consolidated

Balances

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning