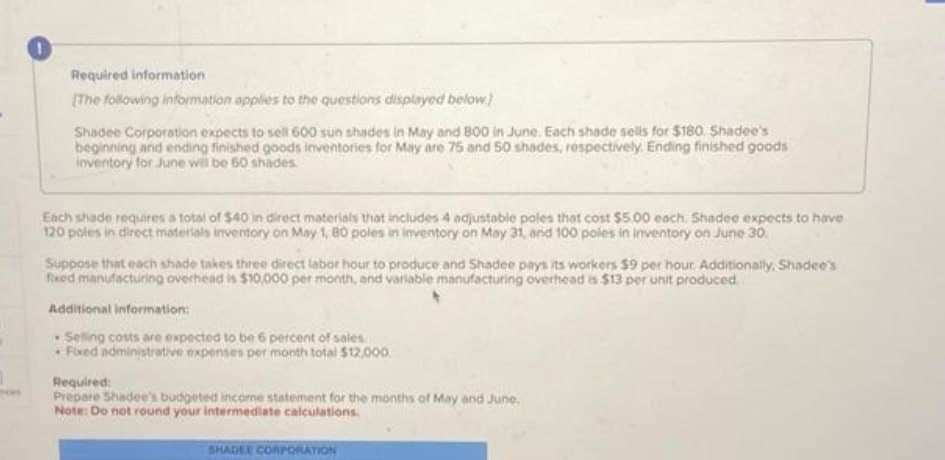

Required information [The following information applies to the questions displayed below] Shadee Corporation expects to sell 600 sun shades in May and 800 in June. Each shade sells for $180. Shadee's beginning and ending finished goods inventories for May are 75 and 50 shades, respectively. Ending finished goods inventory for June will be 60 shades. Each shade requires a total of $40 in direct materials that includes 4 adjustable poles that cost $5.00 each. Shadee expects to have 120 poles in direct materials inventory on May 1, 80 poles in inventory on May 31, and 100 poles in inventory on June 30. Suppose that each shade takes three direct labor hour to produce and Shadee pays its workers $9 per hour. Additionally, Shadee's fixed manufacturing overhead is $10,000 per month, and variable manufacturing overhead is $13 per unit produced. Additional information: Selling costs are expected to be 6 percent of sales Fixed administrative expenses per month total $12,000. Required: Prepare Shadee's budgeted income statement for the months of May and June. Note: Do not round your intermediate calculations. SHADEL

Required information [The following information applies to the questions displayed below] Shadee Corporation expects to sell 600 sun shades in May and 800 in June. Each shade sells for $180. Shadee's beginning and ending finished goods inventories for May are 75 and 50 shades, respectively. Ending finished goods inventory for June will be 60 shades. Each shade requires a total of $40 in direct materials that includes 4 adjustable poles that cost $5.00 each. Shadee expects to have 120 poles in direct materials inventory on May 1, 80 poles in inventory on May 31, and 100 poles in inventory on June 30. Suppose that each shade takes three direct labor hour to produce and Shadee pays its workers $9 per hour. Additionally, Shadee's fixed manufacturing overhead is $10,000 per month, and variable manufacturing overhead is $13 per unit produced. Additional information: Selling costs are expected to be 6 percent of sales Fixed administrative expenses per month total $12,000. Required: Prepare Shadee's budgeted income statement for the months of May and June. Note: Do not round your intermediate calculations. SHADEL

Chapter7: Budgeting

Section: Chapter Questions

Problem 14PA: Total Pops data show the following information: New machinery will be added in April. This machine...

Related questions

Question

Please provide answer in text (Without image)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below)

Shadee Corporation expects to sell 600 sun shades in May and 800 in June. Each shade sells for $180. Shadee's

beginning and ending finished goods inventories for May are 75 and 50 shades, respectively. Ending finished goods

inventory for June will be 60 shades.

Each shade requires a total of $40 in direct materials that includes 4 adjustable poles that cost $5.00 each. Shadee expects to have

120 poles in direct materials inventory on May 1, 80 poles in inventory on May 31, and 100 poles in inventory on June 30.

Suppose that each shade takes three direct labor hour to produce and Shadee pays its workers $9 per hour. Additionally, Shadee's

fixed manufacturing overhead is $10,000 per month, and variable manufacturing overhead is $13 per unit produced.

Additional information:

Selling costs are expected to be 6 percent of sales

Fixed administrative expenses per month total $12,000.

Required:

Prepare Shadee's budgeted income statement for the months of May and June.

Note: Do not round your intermediate calculations.

SHADEE CORPORATION

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning