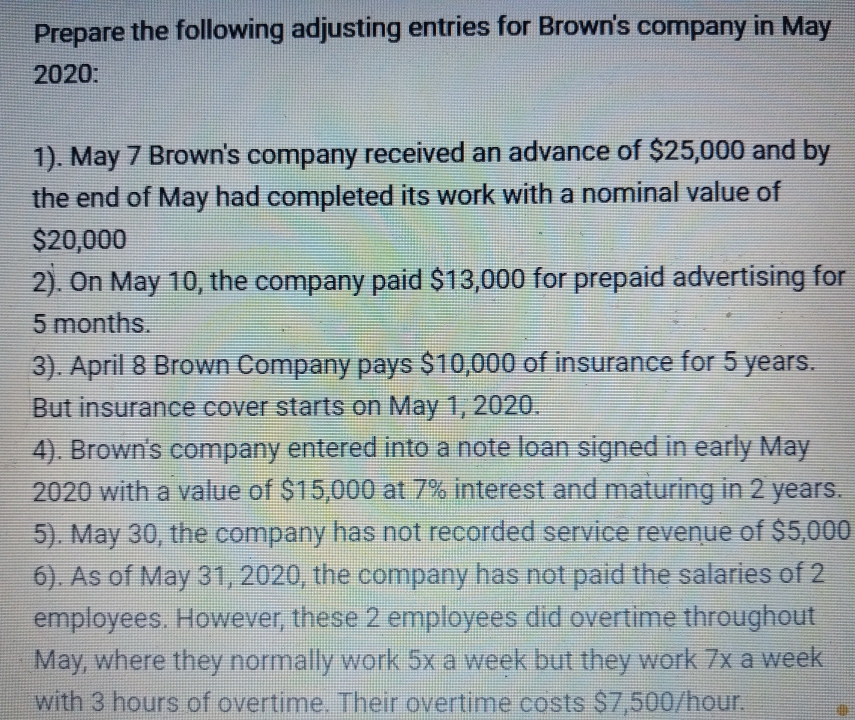

Prepare the following adjusting entries for Brown's company in May 2020: 1). May 7 Brown's company received an advance of $25,000 and by the end of May had completed its work with a nominal value of $20,000 2). On May 10, the company paid $13,000 for prepaid advertising for 5 months. 3). April 8 Brown Company pays $10,000 of insurance for 5 years. But insurance cover starts on May 1, 2020. 4). Brown's company entered into a note loan signed in early May 2020 with a value of $15,000 at 7% interest and maturing in 2 years. 5). May 30, the company has not recorded service revenue of $5,000 6). As of May 31, 2020, the company has not paid the salaries of 2 employees. However, these 2 employees did overtime throughout May, where they normally work 5x a week but they work 7x a week with 3 hours of overtime Their overtiime costs $7.500/hour.

Prepare the following adjusting entries for Brown's company in May 2020: 1). May 7 Brown's company received an advance of $25,000 and by the end of May had completed its work with a nominal value of $20,000 2). On May 10, the company paid $13,000 for prepaid advertising for 5 months. 3). April 8 Brown Company pays $10,000 of insurance for 5 years. But insurance cover starts on May 1, 2020. 4). Brown's company entered into a note loan signed in early May 2020 with a value of $15,000 at 7% interest and maturing in 2 years. 5). May 30, the company has not recorded service revenue of $5,000 6). As of May 31, 2020, the company has not paid the salaries of 2 employees. However, these 2 employees did overtime throughout May, where they normally work 5x a week but they work 7x a week with 3 hours of overtime Their overtiime costs $7.500/hour.

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 6EB: On September 1, a company received an advance rental payment of $12,000, to cover six months rent on...

Related questions

Question

Transcribed Image Text:Prepare the following adjusting entries for Brown's company in May

2020:

1). May 7 Brown's company received an advance of $25,000 and by

the end of May had completed its work with a nominal value of

$20,000

2). On May 10, the company paid $13,000 for prepaid advertising for

5 months.

3). April 8 Brown Company pays $10,000 of insurance for 5 years.

But insurance cover starts on May 1, 2020.

4). Brown's company entered into a note loan signed in early May

2020 with a value of $15,000 at 7% interest and maturing in 2 years.

5). May 30, the company has not recorded service revenue of $5,000

6). As of May 31, 2020, the company has not paid the salaries of 2

employees. However, these 2 employees did overtime throughout

May, where they normally work 5x a week but they work 7x a week

with 3 hours of overtime, Their overtime costs $7,500/hour.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage