Prepare the journal entry at December 31, 2019, to record income taxes related to the loss carryback. b) Describe two reasons why Sandalwood’s management may want to carry back its losses, and one reason why management may want to carry forward its losses. Make a recommendation as to which action Sandalwood should take, and explain why.

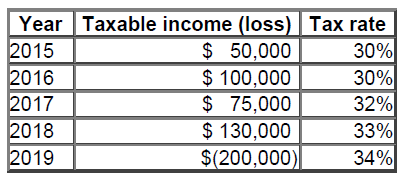

Sandalwood Inc. (Sandalwood) has NO temporary or permanent tax differences. Sandalwood has taxable income for the years 2015 through to 2019 as follows:

Please find the attached image 1

The loss in 2019 was attributable to a new competitor entering the market. Sandalwood’s management is confident that Sandalwood offers a better product than its competitor and that customers will return in the near future. As a result, management believes that the loss in 2019 is a one-time loss. Sandalwood expects to generate taxable income in the future and expects that the tax rate will increase to 36% in 2020.

a) Assume that Sandalwood elects to carry back its loss in 2019 to the earliest possible year(s) regardless of rate differences. Prepare the

b) Describe two reasons why Sandalwood’s management may want to carry back its losses, and one reason why management may want to carry forward its losses. Make a recommendation as to which action Sandalwood should take, and explain why.

Step by step

Solved in 2 steps