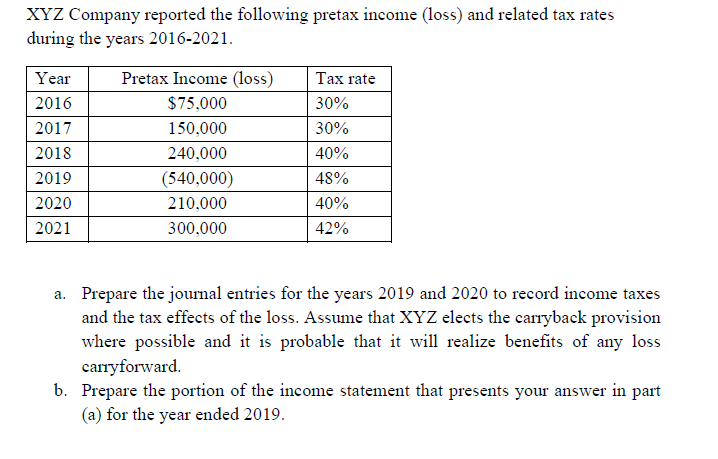

XYZ Company reported the following pretax income (loss) and related tax rates during the years 2016-2021. Year Pretax Income (loss) Таx rate 2016 $75,000 30% 2017 150,000 30% 2018 240,000 40% 2019 (540,000) 48% 2020 210,000 40% 2021 300,000 42% a. Prepare the journal entries for the years 2019 and 2020 to record income taxes and the tax effects of the loss. Assume that XYZ elects the carryback provision where possible and it is probable that it will realize benefits of any loss carryforward. b. Prepare the portion of the income statement that presents your answer in part (a) for the year ended 2019.

XYZ Company reported the following pretax income (loss) and related tax rates during the years 2016-2021. Year Pretax Income (loss) Таx rate 2016 $75,000 30% 2017 150,000 30% 2018 240,000 40% 2019 (540,000) 48% 2020 210,000 40% 2021 300,000 42% a. Prepare the journal entries for the years 2019 and 2020 to record income taxes and the tax effects of the loss. Assume that XYZ elects the carryback provision where possible and it is probable that it will realize benefits of any loss carryforward. b. Prepare the portion of the income statement that presents your answer in part (a) for the year ended 2019.

Chapter14: Taxes On The Financial Statements

Section: Chapter Questions

Problem 4BCRQ

Related questions

Question

Transcribed Image Text:XYZ Company reported the following pretax income (loss) and related tax rates

during the years 2016-2021.

Year

Pretax Income (loss)

Таx rate

2016

$75,000

30%

2017

150,000

30%

2018

240,000

40%

2019

(540,000)

48%

2020

210,000

40%

2021

300,000

42%

a. Prepare the journal entries for the years 2019 and 2020 to record income taxes

and the tax effects of the loss. Assume that XYZ elects the carryback provision

where possible and it is probable that it will realize benefits of any loss

carryforward.

b. Prepare the portion of the income statement that presents your answer in part

(a) for the year ended 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning