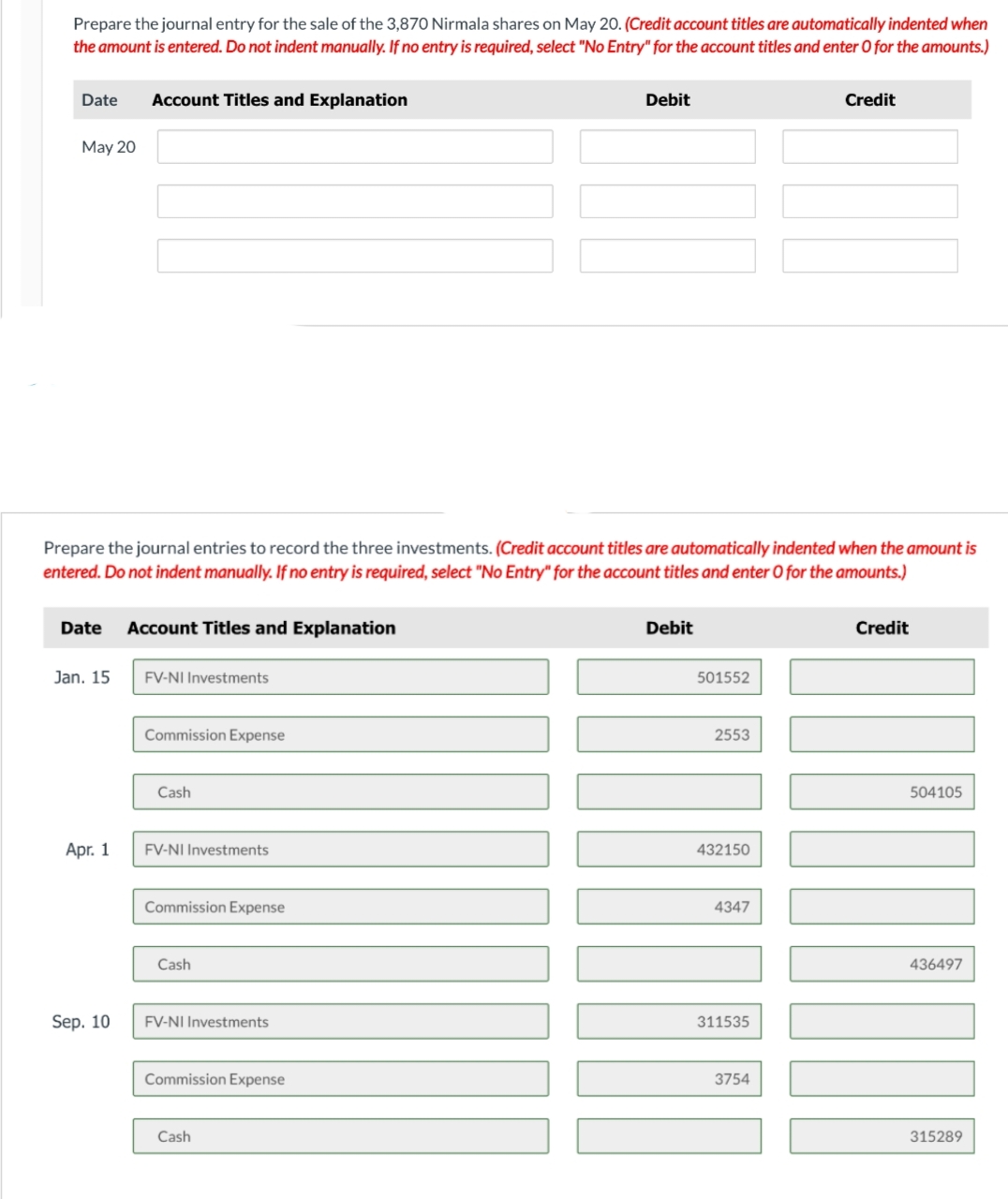

Prepare the journal entry for the sale of the 3,870 Nirmala shares on May 20. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation May 20 Debit Credit Prepare the journal entries to record the three investments. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Prepare the journal entry for the sale of the 3,870 Nirmala shares on May 20. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation May 20 Debit Credit Prepare the journal entries to record the three investments. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 9P

Related questions

Question

Help me

Transcribed Image Text:Prepare the journal entry for the sale of the 3,870 Nirmala shares on May 20. (Credit account titles are automatically indented when

the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Date Account Titles and Explanation

May 20

Date Account Titles and Explanation

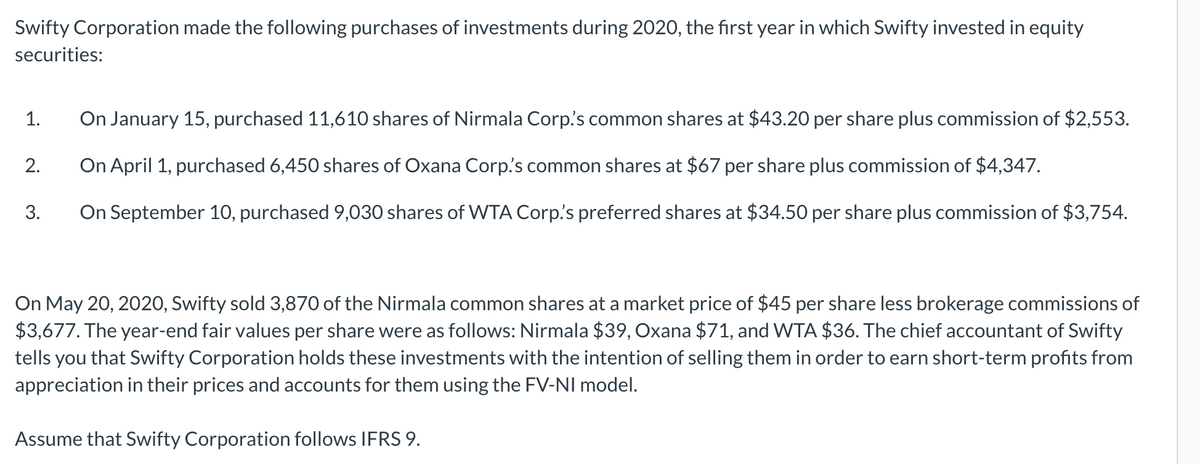

Prepare the journal entries to record the three investments. (Credit account titles are automatically indented when the amount is

entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Jan. 15

Apr. 1

Sep. 10

FV-NI Investments

Commission Expense

Cash

FV-NI Investments

Commission Expense

Cash

FV-NI Investments

Commission Expense

Debit

Cash

Debit

501552

2553

432150

4347

311535

Credit

3754

Credit

504105

436497

315289

Transcribed Image Text:Swifty Corporation made the following purchases of investments during 2020, the first year in which Swifty invested in equity

securities:

1.

2.

3.

On January 15, purchased 11,610 shares of Nirmala Corp.'s common shares at $43.20 per share plus commission of $2,553.

On April 1, purchased 6,450 shares of Oxana Corp.'s common shares at $67 per share plus commission of $4,347.

On September 10, purchased 9,030 shares of WTA Corp's preferred shares at $34.50 per share plus commission of $3,754.

On May 20, 2020, Swifty sold 3,870 of the Nirmala common shares at a market price of $45 per share less brokerage commissions of

$3,677. The year-end fair values per share were as follows: Nirmala $39, Oxana $71, and WTA $36. The chief accountant of Swifty

tells you that Swifty Corporation holds these investments with the intention of selling them in order to earn short-term profits from

appreciation in their prices and accounts for them using the FV-NI model.

Assume that Swifty Corporation follows IFRS 9.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning