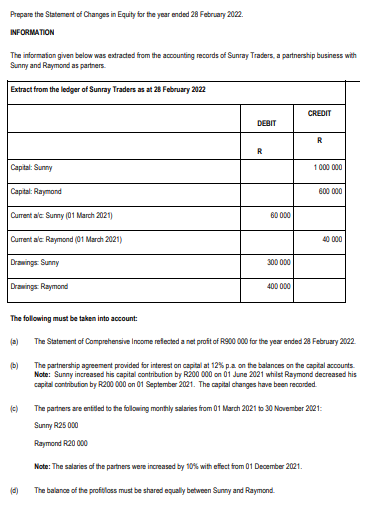

Prepare the Statement of Changes in Equity tor the year ended 28 February 2022.

Q: On January 1, 2021, Simple Company pre information. 10,000,000 Ordinary share capital, P100, 100,000…

A: Earning Per Share: Net profit divided by the number of common shares issued and outstanding is the…

Q: Fischer, Inc.'s trial balance contains the following balances: Cash $371 Accounts Payable $268…

A: Introduction: Trial Balance: All the final ledger accounts balances are posted in Trial balance to…

Q: MANGO store had the following purchases during its first year of operations. They purchased 1880…

A: Lets understand the basics. For calculating ending inventory, we will need to use below formula.…

Q: campi Traders as at 28 February 2022. Note: The Statement of Comprehensive Income and the

A: The statement of financial position as,

Q: EX 10-9 Depreciation by two methods OBJ.2 A computer system acquired on January 1 at a cost of…

A: Note: Hi! Thank you for the question As per the honor code, We’ll answer the first question since…

Q: Find the payment necessary to amortize a 4% loan of $900 compounded quarterly, with 15 quarterly…

A: Quarterly compounding is a form of compounding in which interest is earned every quarter and such…

Q: 43 The trial balance for Greenway Corporation appears as follows Greenway Corporation Trial Balance…

A: Adjusting entries are prepared by management to ensure the accrual basis accounting system. These…

Q: You need to go the office of DTI if you will register your corporation. true or false?

A: Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: Illustration 2. Business Combination Achieved in Stages and without transfer of consideration On…

A: Goodwill is an invaluable property acquired when one firm buys another. Goodwill is defined as the…

Q: Ben Corporation is deciding whether to pursue a restricted or relaxed working capital investment…

A: Times Interest Earned ratio is a measure of a company abilitybto meet out its debt (Interest…

Q: Katie's brother died in March 2020, and as a result, at that time, she inherited the following…

A: GIVEN Katie's brother died in March 2020, and as a result, at that time, she inherited the…

Q: woll aleo al ghn EX 7-4 Perpetual inventory using LIFOE lo alinu gniwollol od lo 120 blo2 OBJ. 2,3…

A:

Q: pare the Sta Changes in Equity for year February INFORMATION The information given below was…

A: Statement of Changes in Equity The purpose of preparing the Statement of changes in equity to know…

Q: Which of the following is not a benefit of record keeping?

A: The answers for the multiple choice questions and relevant explanation are presented hereunder : One…

Q: Damon Corporation, a sports equipment manufacturer, has a machine currently in use that was…

A: NOTE: Hi! Thank you for the question, As per the honor code, we are allowed to answer three…

Q: ciety who are suffering due to lack of food due to distorted trade in the country. After a lot of…

A: A trial balance is a list of ledger account closing balances at a given time. On the other hand,…

Q: Prepare the journal entries to record the exchange on the books of both companies. Assume that the…

A: Journal entries should not be used to record routine transactions such as customer billings and…

Q: s digital cameras for drones. Their basic digital camera uses $80 im the camera further to enhance…

A: The operational earnings refer to the sum value of profits that a company gains by deducting its…

Q: Reliable Enterprises sells distressed merchandise on extended credit terms. Collections on these…

A: Revenue recognition criteria provides as under: There exist an arrangement between the buyer and…

Q: 6. Which of the following service contributions would enhance a nonfinancial asset? A. A roofing…

A: The value of a nonfinancial asset is derived from its physical qualities. Real estate and…

Q: Cost of Goods Sold Calculation The accounts of Berrett Company have the following balances for 2017:…

A: Cost of goods sold is calculated by adding various direct cost associated with the manufacture or…

Q: Here are some items that appear on an income statement. Operating 650 Income tax expense expenses…

A: Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: ven the following information for Franklin Jewelers, by how much did the gross profit percentage go…

A:

Q: Refer to the following financial information of Scholz Company: NOPAT…

A: Formulas: Depreciation and amortization expense = EBITDA - Earnings before tax - Interest expense…

Q: Under Section 1031 a personal residence or an automobile used solely for personal purposes will…

A: A 1031 exchange is provision of the IRC that allows the business to defer the federal tax on some…

Q: Required: Explain to your friend the principal requirements of MFRS 116 Property, Plant and…

A: The principal requirements of MFRS 116 and the measurement model of P P E and its subsequent…

Q: Prepare the Statement of Changes in Equity for the year ended 28 February 2022. INFORMATION The…

A: Salary Sunny = (25000x 9) + (25000 x 110% x 3) = 307500 Raymond = (20000 x 9) + (20000x 110% x 3) =…

Q: Accounting AA, BB and CC formed a partnership on January 1, 2022. Their capital balances before…

A: A partnership is a legally binding agreement between two or more persons to manage and run a…

Q: Mr B aged 63 years, has earned rupees 75,00,000 out of his business . His ex- wife gifted him cash…

A: Introduction: Taxes are obligatory payments imposed by a government agency, whether local, regional,…

Q: For a transaction to qualify as a third-party exchange: I. the exchange must be completed within 1…

A: For a transaction to qualify as a third-party exchange: I. The exchange must be completed within 1…

Q: On January 1, 2016, a company issued $400,000 of 10-year, 12% bonds. The interest is payable…

A: The expense of borrowing money is known as interest expense. It appears on the income statement as a…

Q: Assuming no employees are subject to ceilings for their earnings, Harris Company has the following…

A: Salaries payable is the amount of salary which is due but not yet paid.

Q: LANY Corporation is deciding whether to pursue a restricted or relaxed working capital investment…

A: The Fixed Assets Turnover Ratio is Activity Ratio. It is calculated with the help of following…

Q: Use the following information to calculate the change in value that would result i achieved for this…

A: Change in net operating income would change the value added that is according to the capitalization…

Q: Prepare the Statement of Changes in Equity for the year ended 28 February 2022.

A: Sunny and Raymond are partners in Sunny Traders. Provided to us are the capital related transactions…

Q: Consider the following statements about absorption costing and variable costing: Variable costing…

A: Absorption costing and variable costing are managerial accounting and financial reporting cost…

Q: iven: Net Sales P7,500,000, beginning total assets P3,200,000, asset turnover 2.5. Compute the…

A: "Since you have asked multiple questions, we will solve first question for you. If you want any…

Q: A bidders disclosure statement under the Williams Amendment must be submitted when the bidder:…

A: William Amendment is there to protect the shareholders who might become target of hostile takeover.…

Q: A machine costs Php 400,000 with a salvage value of 200,000. Life of it is six years. In the first…

A: Formulas: Depreciation per hour = (Cost of the machine - Salvage value) / Expected flow of the…

Q: inventory purchases on credit 241,000 and ending inventory 53,400 with 1.11 index journal entry and…

A: Cost of Goods Sold refers to cost of goods sold sold to customer.

Q: A company makes and sells keyboarc

A: Formula to calculate EOQ EOQ = 2DSH x (1-(dp))

Q: The contribution margin per unit is P5, while the direct fixed costs are P30,000 and the allocated…

A: The break-even formula is calculated by dividing the total fixed costs associated with production by…

Q: MediSecure, Incorporated, uses the FIFO method in its process costing system. It produces clear…

A: First In, First Out: First in, first out (also known as FIFO) is an asset-management and valuation…

Q: Select the correct statement: A. In managing the firm's accounts receivable, it is possible to…

A: Accounts Receivables are those customer accounts to whom business has made credit sales and amount…

Q: Why do entrepreneurs need to begin from the users’ or customers’ hidden needs when they are about to…

A: The entrepreneurs wants to start the business and the business which has been started by the…

Q: Provide the answers to the following questions. (1) What amount of interest expense is reported for…

A: Interest expenditure refers to the cost of borrowing money. A lender will charge a borrower a fee…

Q: Net income for 2020 was P1,825,600. In 2021, it decreased by 53%. Still using the 2020 net income as…

A: Introduction:- Net income denotes the amount of a profit a company after deduction of all expenses.…

Q: Marilyn sells 200 shares of General Motors stock for $80 per share. She pays a $100 commission on…

A: Introduction:- The following basic information as follows under:- Marilyn sells 200 shares of…

Q: In 2021, Dunder Mifflin's warranty deduction for tax purposes exceeded its warranty expense for book…

A: Income Tax Expense = $42800 x 27% = $11556.00 Income Tax Payable = ($42800 - $654) x 27% =…

Q: What is the quantity of units available for sale for the year?

A: Units available for sale is the number of units which the company is having or had available for the…

Step by step

Solved in 2 steps

- Prepare the Statement of Changes in Equity for the year ended 28 February 2022.INFORMATIONThe information given below was extracted from the accounting records of Sunray Traders, a partnership business withSunny and Raymond as partners.Extract from the ledger of Sunray Traders as at 28 February 2022DEBITCREDITRRCapital: Sunny 1 000 000Capital: Raymond 600 000Current a/c: Sunny (01 March 2021) 60 000Current a/c: Raymond (01 March 2021) 40 000Drawings: Sunny 300 000Drawings: Raymond 400 000The following must be taken into account:(a) The Statement of Comprehensive Income reflected a net profit of R900 000 for the year ended 28 February 2022.(b) The partnership agreement provided for interest on capital at 12% p.a. on the balances on the capital accounts.Note: Sunny increased his capital contribution by R200 000 on 01 June 2021 whilst Raymond decreased hiscapital contribution by R200 000 on 01 September 2021. The capital changes have been recorded.(c) The partners are entitled to the…Prepare the Statement of Changes in Equity for the year ended 28 February 2021.INFORMATIONThe information given below was extracted from the accounting records of Preston Traders, a partnership business withPresley and Tony as partners.Extract from the trial balance of Preston Traders on 28 February 2021Debit CreditR RCapital: Presley 600 000Capital: Tony 400 000Current a/c: Presley (01 March 2020) 40 000Current a/c: Tony (01 March 2020) 50 000Drawings: Presley 340 000Drawings: Tony 360 000The following must be taken into account:(a) The Statement of Comprehensive Income reflected a net profit of R900 000 on 28 February 2021.(b) The partners are entitled to interest at 12% p.a. on their capital balances.Note: Presley decreased his capital by R200 000 on 01 June 2020 whilst Tony increased his capital byR200 000 on 01 September 2020. These capital changes have been recorded.(c) The partners are entitled to the following monthly salaries for each of the two six-month periods:01 March 2020…The information given below was extracted from the accounting records of Ndlove Traders, a partnership business with Brian and Taryn as partners. REQUIRED Use the information provided to prepare the Statement of Changes in Equity for the year ended 29 February 2020. INFORMATION Extract from the ledger of Britar Traders as at 29 February 2020 Debit Credit R R Capital: Brian 900 000 Capital: Taryn 600 000 Current a/c: Brian (01 March 2019) 50 000 Current a/c: Taryn (01 March 2019) 30 000 Drawings: Brian 350 000 Drawings: Taryn 250 000 The following must be taken into account: 1. On 29 February 2020 the Statement of Comprehensive Incomec reflected, amongst others, the following: Sales R1 200 000 Sales returns R50 000 Net profit R700 000 2. The partners earn interest at 12% p.a. on their capital balances. Note: Brian increased his capital…

- Prepare the Statement of Changes in Equity of Camray Traders for the year ended 28 February 2021. The information given below was extracted from the accounting records of Camray Traders, a partnership business with Camy and Raymond as partners. The financial year ends on the last day of February each year. Balances in the ledger on 28 February 2021 Debit Credit R R Capital: Camy 1 200 000 Capital: Raymond 800 000 Current a/c: Camy (01 March 2020) 50 000 Current a/c: Raymond (01 March 2020) 60 000 Drawings: Camy 360 000 Drawings: Raymond 320 000 The following must be taken into account: (a) The net profit according to the statement of comprehensive income amounted to R1 400 000 on 28 February 2021. (b) The partnership agreement made provision for the following: ¦ Interest on capital must be provided at 18% per annum on the balances in the capital accounts. Note: Camy increased her capital by R240 000 on 01 September 2020. Raymond decreased his capital by R120 000 on the same date. The…The information given below was extracted from the accounting records of Veco Traders, a partnershipbusiness with Bobby and Vincent.Required:Prepare the Statement of Changes in Equity as at: 28 February 2021.INFORMATIONBalances in the ledger 28 February 2019Debit CreditCapital: Bobby 500 000Capital: Vincent 300 000Current account: Bobby (1 Mar 2020) 20 000Current account: Vincent (1 Mar 2020) 15 000Drawings: Bobby 250 000Drawings: Vincent 200 000Additional information1.The net profit according to the Profit and Loss account amounted to R500 000 on 28February 2021.2.The partnership agreement made provision for the following:1.Interest on capital must be provided at 15% per annum on the balances in the capitalAccounts from 1 March 2020 to 31 August 2020. With effect from 1 September 2019 theinterest rate on capital increases to 18% per annum.2.The partners are entitled to the following monthly salaries: Bobby R11 000Vincent R10 0003.Bobby is entitled to a bonus of 15% of the net profit…REQUIRED Use the information provided below to prepare the Statement of Changes in Equity of Sooraya Enterprises/Partnership for the year ended 28 February 2022. INFORMATION Extract from the ledger of Sooraya Enterprises on 28 February 2022 R Capital: Soo 450 000 Capital: Raya 350 000 Current a/c: Soo (01 March 2021) Current a/c: Raya (01 March 2021) Drawings: Soo Drawings: Raya The following must be taken into account: 30 000 CR 25000 DR 220 000 260 000 1. On 28 February 2022 the Profit and Loss account reflected a net profit of R 880 000. 2. Partners are entitled to interest at 12% p.a. on their capital balances. Note: Soo increased her capital contribution by R180 000 on 01 September 2021. The capital increase has been recorded. 3. The partners are entitled to the following monthly salaries for the first 6 months of the financial year: Soo R15 000 Raya R11 000 From 01 September 2021, the partners will be entitled to annual salaries of R144 000 each. 4. Raya is entitled to a bonus…

- Prepare the Statement of Changes in Equity of Camray Traders for the year ended 28 February 2021 using template provided The following must be taken into account:(a) The net profit according to the statement of comprehensive income amounted to R1 400 000 on 28 February2021.(b) The partnership agreement made provision for the following:¦ Interest on capital must be provided at 18% per annum on the balances in the capital accounts.Note: Camy increased her capital by R240 000 on 01 September 2020. Raymond decreased his capital byR120 000 on the same date. The capital changes have been recorded.¦ The partners are entitled to the following monthly salaries:Camy R26 000Raymond R25 000Note: The partners’ salaries were increased by 10% with effect from 01 December 2020.¦ Camy and Raymond share the remaining profits or losses equally.Keri & Nick Consulting’s partners’ equity accounts reflected the following balances on August 31, 2020: Keri Lee, Capital $ 85,000 Nick Kalpakian, Capital 209,000 Lee and Kalpakian share profit/losses in a 2:3 ratio, respectively. On September 1, 2020, Liam Court is admitted to the partnership with a cash investment of $126,000. Required: Prepare the journal entry to record the admission of Liam under each of the following unrelated assumptions, where he is given: a. A 30% interest in equity -Record the admission of new partner b. A 20% interest in equity -Record the admission of new partner c. A 50% interest in equity -Record the admission of new partnerThe information given below was extracted from the accounting records of Total Limited, a partnership business with Glen and Murry as partners. Information:Extract from the ledger of Total Limited on 30 June 2021 R Capital: Glen 400 000 Capital: Murry 300 000 Current a/c: Glen (01 July 2020) 45 000 CR Current a/c: Murry (01 July 2020) 42 000 DR Drawings: Glen 95 000 Drawings: Murry 110 000 The following must be taken into account:1. On 30 June 2021 the Profit and Loss account reflected a net profit of R940 000.2. Partners are entitled to interest at 14% p.a. on their capital balances.Note: Glen decreased his capital contribution by R90 000 on 01 July 2020.This capital decrease has been recorded.3. Partners are entitled to the following monthly salaries:• Glen R13 000 for the first ten months of the financial year and R15 000• for the next two months.• Murry R10 000 per month throughout the year.4. Partner Murry is entitled to a bonus equal to 10% of the…

- Income summary shows a credit balance of 1,800,000 at the end of the first year of operations.1. By what amount will the capital balance of MAR182 be credited on January 1, 2018?2. By what amount will the capital balance of MAR186 be credited on January 1, 2018?3. How much is the total assets of the partnership at the date of formation?4. What is the net effect of the adjustments made on January 1 to MAR186 capital balance?5. What is the weighted average capital of MAR182 in 2018?6. How much is the bonus given to MAR186?7. How much is the share of MAR182 in the partnership net income?8. How much is the share of MAR186 in the partnership net income?9. What is the ending adjusted capital balance of MAR182?10. What is the ending adjusted capital balance of MAR186?Hosea, Riziki and Zarika are trading as Horizon enterprises. They share profits and losses in the ratio of 2:2:1 respectively. The following is the statement of comprehensive income for the partnership for the year ended 31 December 2018: Shs. Shs. Sales Opening stock Purchases Closing stock Gross profit Less: Salaries Repairs and maintenance Interest Goodwill Depreciation Mortgage repayment Insurance Auditee Legal fee Equipment purchase Rent and rates Net profit 300,000 4,000,000 (600,000) 900,000 100,000 480,000 198,000 142,000 200,000 384,220 315,780 100,000 200,000 18,0000 8,000,000 (3700,000) 4,300,000 (3,200,000) 1,100,000 Additional information 1. Opening inventory and closing inventory were overvalued by 30%. 2. Included in interest expense is interest on capital to partners of Sh. 80,000. This amount was to be shared in the profit sharing ratio. The balance of interest relates to an…On December 31, 2030, the Statement of Financial Position of ABC Partnership provided the following data with profit or loss ratio of 5:1:4: Current Assets P 3,000,000 Total Liabilities P 1,000,000 Noncurrent Assets 4,000,000 A, Capital 2,200,000 B, Capital 2,400,000 C, Capital 1,400,000 On January 1, 2030, D is admitted to the partnership by investing P1,000,000 to the partnership for 10% capital interest. The total agreed capitalization of the new partnership is P6,000,000. What is the share of A in the asset impairment?