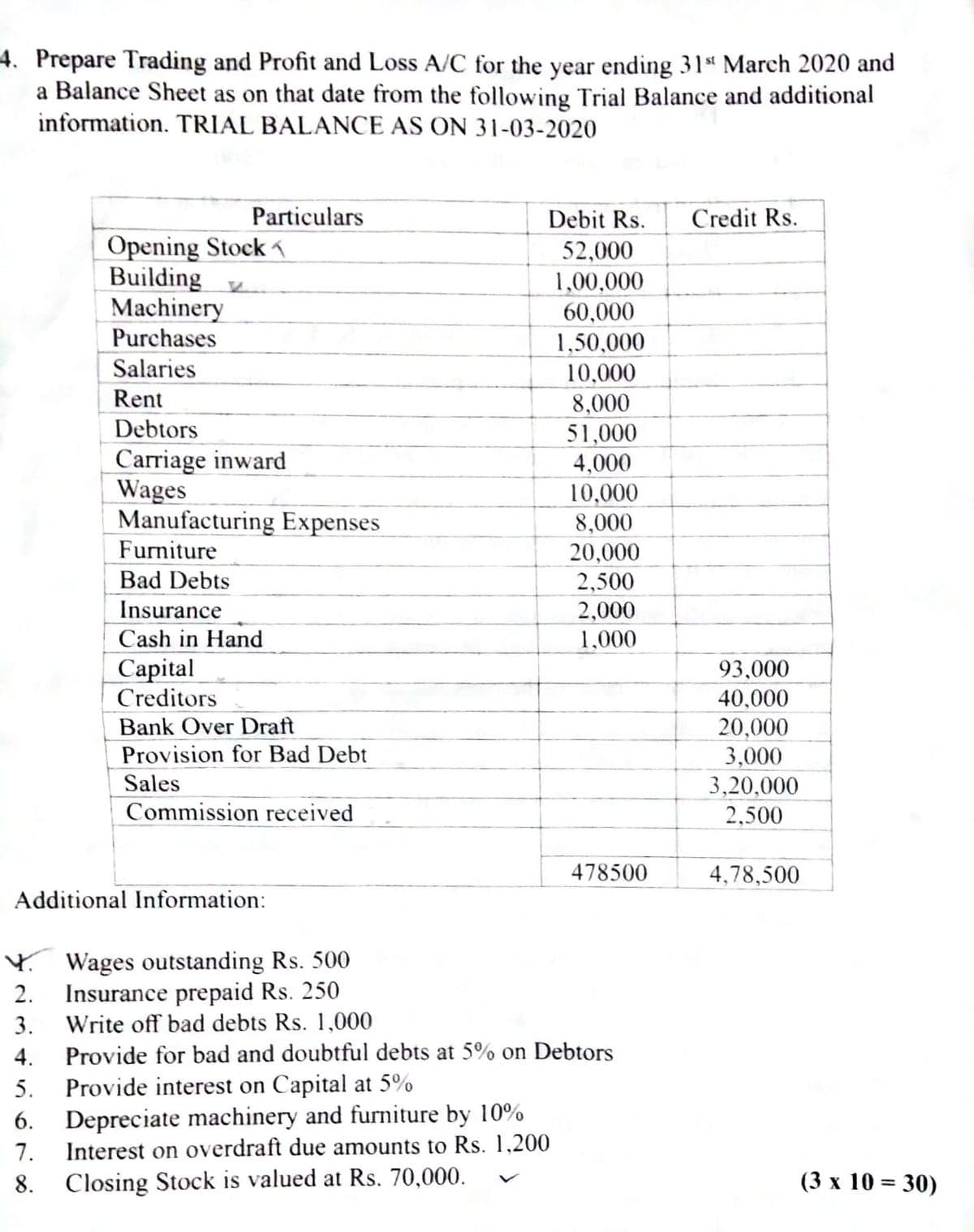

Prepare Trading and Profit and Loss A/C for the year ending 31* March 2020 and a Balance Sheet as on that date from the following Trial Balance and additional information. TRIAL BALANCE AS ON 31-03-2020

Prepare Trading and Profit and Loss A/C for the year ending 31* March 2020 and a Balance Sheet as on that date from the following Trial Balance and additional information. TRIAL BALANCE AS ON 31-03-2020

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter4: The Balance Sheet And The Statement Of Shareholders' Equity

Section: Chapter Questions

Problem 8E: Balance Sheet Calculations Dawson Companys balance sheet information at the end of 2019 and 2020 is...

Related questions

Question

Transcribed Image Text:4. Prepare Trading and Profit and Loss A/C for the year ending 31 March 2020 and

a Balance Sheet as on that date from the following Trial Balance and additional

information. TRIAL BALANCE AS ON 31-03-2020

Particulars

Debit Rs.

Credit Rs.

Opening Stock 1

Building

Machinery

Purchases

52,000

1,00,000

60,000

1,50,000

10,000

8,000

51,000

4,000

Salaries

Rent

Debtors

Carriage inward

Wages

Manufacturing Expenses

Furniture

Bad Debts

Insurance

10,000

8,000

20,000

2,500

2,000

1,000

Cash in Hand

Capital

Creditors

Bank Over Draft

Provision for Bad Debt

93,000

40,000

20,000

Sales

Commission received

3,000

3,20,000

2,500

478500

4,78,500

Additional Information:

Y Wages outstanding Rs. 500

2. Insurance prepaid Rs. 250

Write off bad debts Rs. 1,000

4. Provide for bad and doubtful debts at 5% on Debtors

5. Provide interest on Capital at 5%

6. Depreciate machinery and furniture by 10%

Interest on overdraft due amounts to Rs. 1,200

3.

7.

8. Closing Stock is valued at Rs. 70,000.

(3 х 10%3D 30)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning