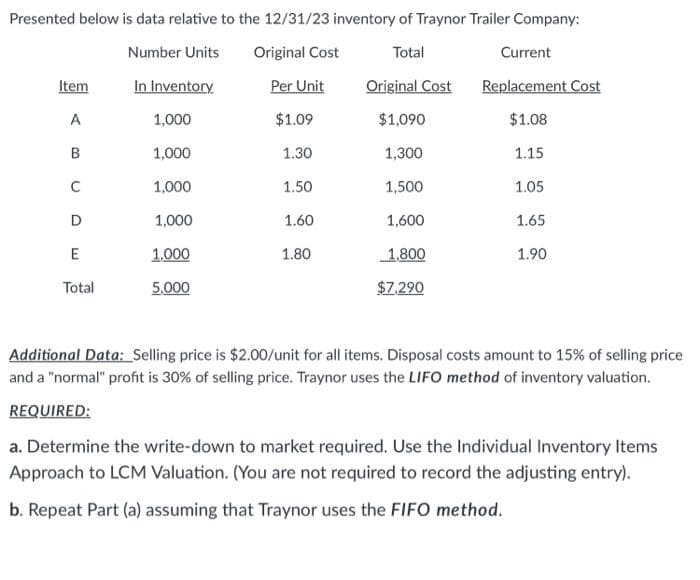

Presented below is data relative to the 12/31/23 inventory of Traynor Trailer Company: Number Units Original Cost Total Current Item In Inventory Per Unit Original Cost Replacement Cost A 1,000 $1.09 $1,090 $1.08 1,000 1.30 1,300 1.15 C 1,000 1.50 1,500 1.05 D 1,000 1.60 1,600 1.65 1,000 1.80 1,800 1.90 Total 5.000 $7,290 Additional Data: Selling price is $2.00/unit for all items. Disposal costs amount to 15% of s and a "normal" profit is 30% of selling price. Traynor uses the LIFO method of inventory valu REQUIRED: a. Determine the write-down to market required. Use the Individual Inventory Approach to LCM Valuation. (You are not required to record the adjusting entr b. Repeat Part (a) assuming that Traynor uses the FIFO method.

Presented below is data relative to the 12/31/23 inventory of Traynor Trailer Company: Number Units Original Cost Total Current Item In Inventory Per Unit Original Cost Replacement Cost A 1,000 $1.09 $1,090 $1.08 1,000 1.30 1,300 1.15 C 1,000 1.50 1,500 1.05 D 1,000 1.60 1,600 1.65 1,000 1.80 1,800 1.90 Total 5.000 $7,290 Additional Data: Selling price is $2.00/unit for all items. Disposal costs amount to 15% of s and a "normal" profit is 30% of selling price. Traynor uses the LIFO method of inventory valu REQUIRED: a. Determine the write-down to market required. Use the Individual Inventory Approach to LCM Valuation. (You are not required to record the adjusting entr b. Repeat Part (a) assuming that Traynor uses the FIFO method.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter20: Accounting For Inventory

Section20.2: Determining The Cost Of Merchandise Inventory

Problem 1OYO

Related questions

Question

100%

Transcribed Image Text:Presented below is data relative to the 12/31/23 inventory of Traynor Trailer Company:

Number Units

Original Cost

Total

Current

Item

In Inventory

Per Unit

Original Cost

Replacement Cost

1,000

$1.09

$1,090

$1.08

1,000

1.30

1,300

1.15

C

1,000

1.50

1,500

1.05

D

1,000

1.60

1,600

1.65

E

1,000

1.80

1,800

1.90

Total

5.000

$7.290

Additional Data: Selling price is $2.00/unit for all items. Disposal costs amount to 15% of selling price

and a "normal" profit is 30% of selling price. Traynor uses the LIFO method of inventory valuation.

REQUIRED:

a. Determine the write-down to market required. Use the Individual Inventory Items

Approach to LCM Valuation. (You are not required to record the adjusting entry).

b. Repeat Part (a) assuming that Traynor uses the FIFO method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning