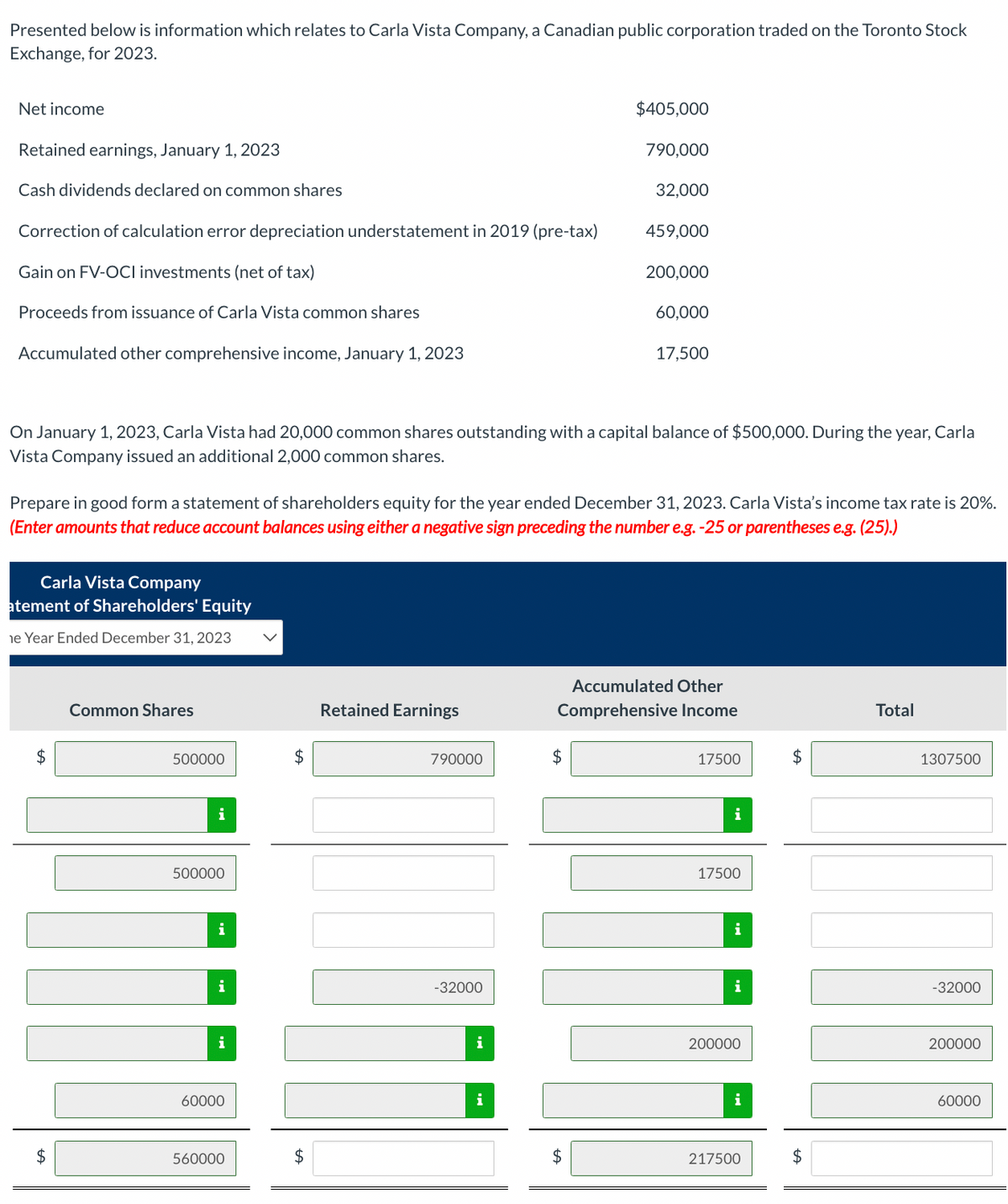

Presented below is information which relates to Carla Vista Company, a Canadian public corporation traded on the Toronto Stock Exchange, for 2023. Net income Retained earnings, January 1, 2023 Cash dividends declared on common shares Correction of calculation error depreciation understatement in 2019 (pre-tax) Gain on FV-OCI investments (net of tax) $405,000 790,000 32,000 459,000 200,000

Presented below is information which relates to Carla Vista Company, a Canadian public corporation traded on the Toronto Stock Exchange, for 2023. Net income Retained earnings, January 1, 2023 Cash dividends declared on common shares Correction of calculation error depreciation understatement in 2019 (pre-tax) Gain on FV-OCI investments (net of tax) $405,000 790,000 32,000 459,000 200,000

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.7AP

Related questions

Question

pls answer the following question

Transcribed Image Text:Presented below is information which relates to Carla Vista Company, a Canadian public corporation traded on the Toronto Stock

Exchange, for 2023.

Net income

Retained earnings, January 1, 2023

Cash dividends declared on common shares

Correction of calculation error depreciation understatement in 2019 (pre-tax)

Gain on FV-OCI investments (net of tax)

Proceeds from issuance of Carla Vista common shares

Accumulated other comprehensive income, January 1, 2023

Carla Vista Company

atement of Shareholders' Equity

he Year Ended December 31, 2023

$

$

Common Shares

500000

On January 1, 2023, Carla Vista had 20,000 common shares outstanding with a capital balance of $500,000. During the year, Carla

Vista Company issued an additional 2,000 common shares.

i

Prepare in good form a statement of shareholders equity for the year ended December 31, 2023. Carla Vista's income tax rate is 20%.

(Enter amounts that reduce account balances using either a negative sign preceding the number e.g. -25 or parentheses e.g. (25).)

500000

i

i

i

60000

560000

$

$

Retained Earnings

790000

-32000

i

$405,000

790,000

$

32,000

$

459,000

200,000

60,000

17,500

Accumulated Other

Comprehensive Income

17500

i

17500

i

i

200000

i

217500

$

$

Total

1307500

-32000

200000

60000

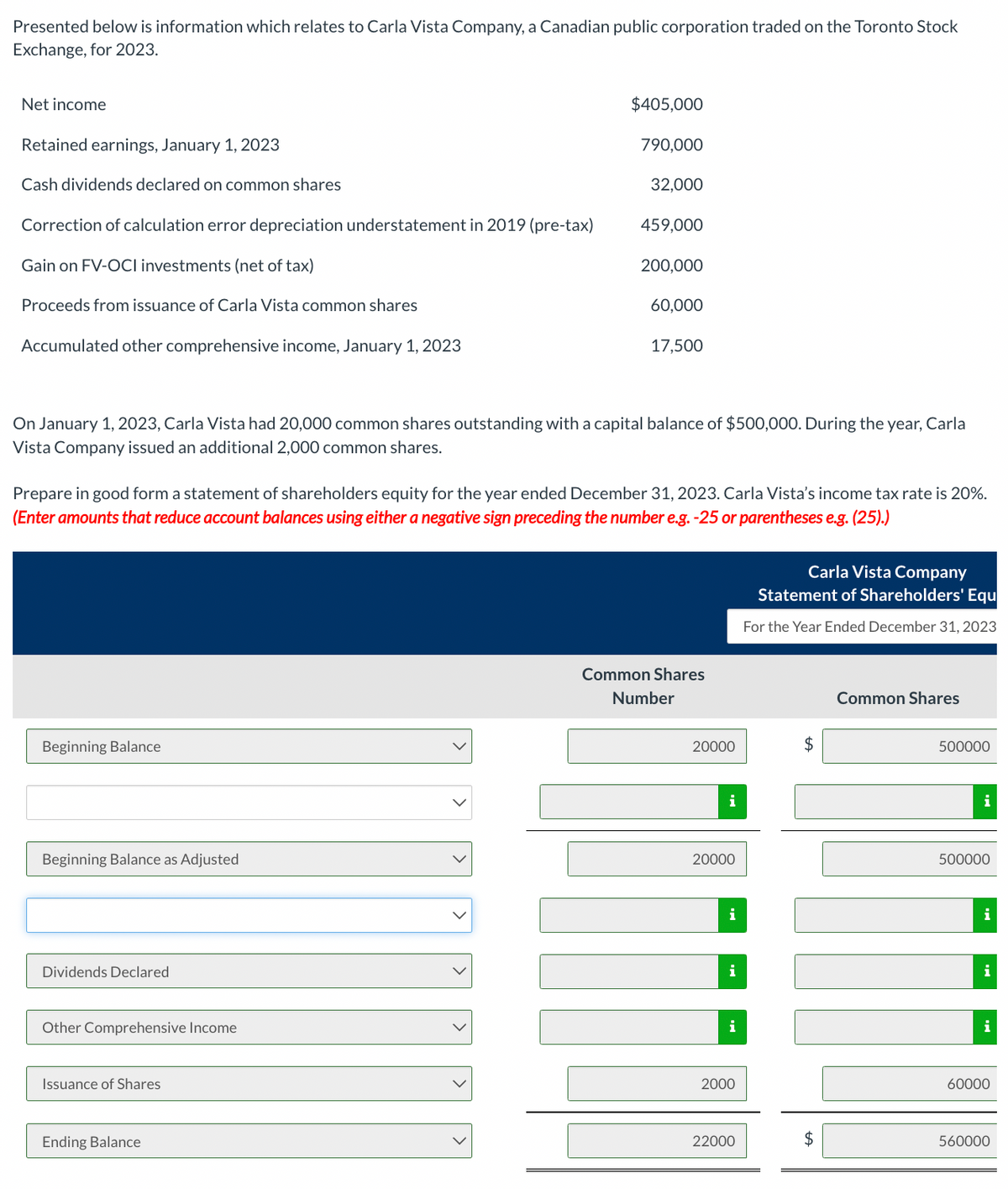

Transcribed Image Text:Presented below is information which relates to Carla Vista Company, a Canadian public corporation traded on the Toronto Stock

Exchange, for 2023.

Net income

Retained earnings, January 1, 2023

Cash dividends declared on common shares

Correction of calculation error depreciation understatement in 2019 (pre-tax)

Gain on FV-OCI investments (net of tax)

Proceeds from issuance of Carla Vista common shares

Accumulated other comprehensive income, January 1, 2023

Beginning Balance

Beginning Balance as Adjusted

Dividends Declared

Other Comprehensive Income

$405,000

Issuance of Shares

790,000

On January 1, 2023, Carla Vista had 20,000 common shares outstanding with a capital balance of $500,000. During the year, Carla

Vista Company issued an additional 2,000 common shares.

Ending Balance

32,000

Prepare in good form a statement of shareholders equity for the year ended December 31, 2023. Carla Vista's income tax rate is 20%.

(Enter amounts that reduce account balances using either a negative sign preceding the number e.g. -25 or parentheses e.g. (25).)

459,000

200,000

60,000

17,500

Common Shares

Number

20000

20000

i

i

2000

22000

Carla Vista Company

Statement of Shareholders' Equ

For the Year Ended December 31, 2023

$

tA

$

Common Shares

500000

500000

i

i

60000

560000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning