Presented below is the trial balance of Cullumber Corporation at December 31, 2025. Cash Sales Revenue Debt Investments (trading) (at cost, $145,000) Cost of Goods Sold Debt Investments (long-term) Debit $201,720 154,160 4,800,000 303,720 Credit $8,101,160

Presented below is the trial balance of Cullumber Corporation at December 31, 2025. Cash Sales Revenue Debt Investments (trading) (at cost, $145,000) Cost of Goods Sold Debt Investments (long-term) Debit $201,720 154,160 4,800,000 303,720 Credit $8,101,160

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter1: The Role Of Accounting In Business

Section: Chapter Questions

Problem 1.17E: Financial statements Each of the following items is shown in the financial statements of ExxonMobil...

Related questions

Question

Please do not give solution in image format thanku

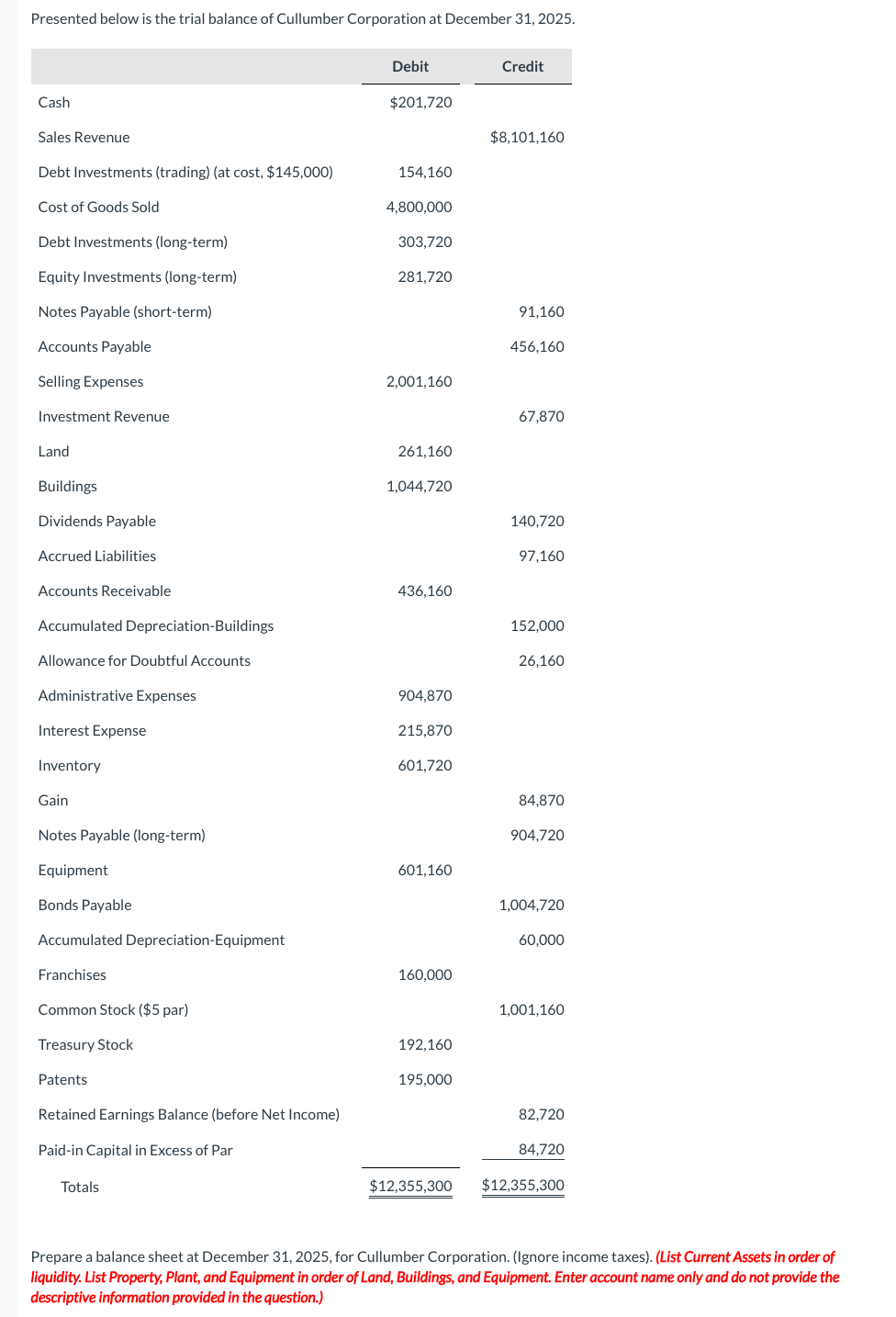

Transcribed Image Text:Presented below is the trial balance of Cullumber Corporation at December 31, 2025.

Cash

Sales Revenue

Debt Investments (trading) (at cost, $145,000)

Cost of Goods Sold

Debt Investments (long-term)

Equity Investments (long-term)

Notes Payable (short-term)

Accounts Payable

Selling Expenses

Investment Revenue

Land

Buildings

Dividends Payable

Accrued Liabilities.

Accounts Receivable

Accumulated Depreciation-Buildings

Allowance for Doubtful Accounts

Administrative Expenses

Interest Expense

Inventory

Gain

Notes Payable (long-term)

Equipment

Bonds Payable

Accumulated Depreciation-Equipment

Franchises

Common Stock ($5 par)

Treasury Stock

Patents

Retained Earnings Balance (before Net Income)

Paid-in Capital in Excess of Par

Totals

Debit

$201,720

154,160

4,800,000

303,720

281,720

2,001,160

261,160

1,044,720

436,160

904,870

215,870

601.720

601,160

160,000

192,160

195,000

$12,355,300

Credit

$8,101,160

91,160

456,160

67,870

140,720

97,160

152,000

26,160

84,870

904,720

1,004,720

60,000

1,001,160

82,720

84,720

$12,355,300

Prepare a balance sheet at December 31, 2025, for Cullumber Corporation. (Ignore income taxes). (List Current Assets in order of

liquidity. List Property, Plant, and Equipment in order of Land, Buildings, and Equipment. Enter account name only and do not provide the

descriptive information provided in the question.)

Transcribed Image Text:> >

CULLUMBER CORPORATION

Balance Sheet

$

Assets

Liabilities and Stockholders' Equity

$

Liabilities and Stockholders' Equity

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning