Presented below is the trial balance of Marigold Corporation at December 31, 2025. Cash Sales Revenue Debt Investments (trading) (at cost, $145,000) Cost of Goods Sold Debt Investments (long-term) Equity Investments (long torm! Debit $201,670 157,230 4,800,000 303,670 281 670 Credit $8,104,230

Presented below is the trial balance of Marigold Corporation at December 31, 2025. Cash Sales Revenue Debt Investments (trading) (at cost, $145,000) Cost of Goods Sold Debt Investments (long-term) Equity Investments (long torm! Debit $201,670 157,230 4,800,000 303,670 281 670 Credit $8,104,230

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 13P: Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and...

Related questions

Question

V 2

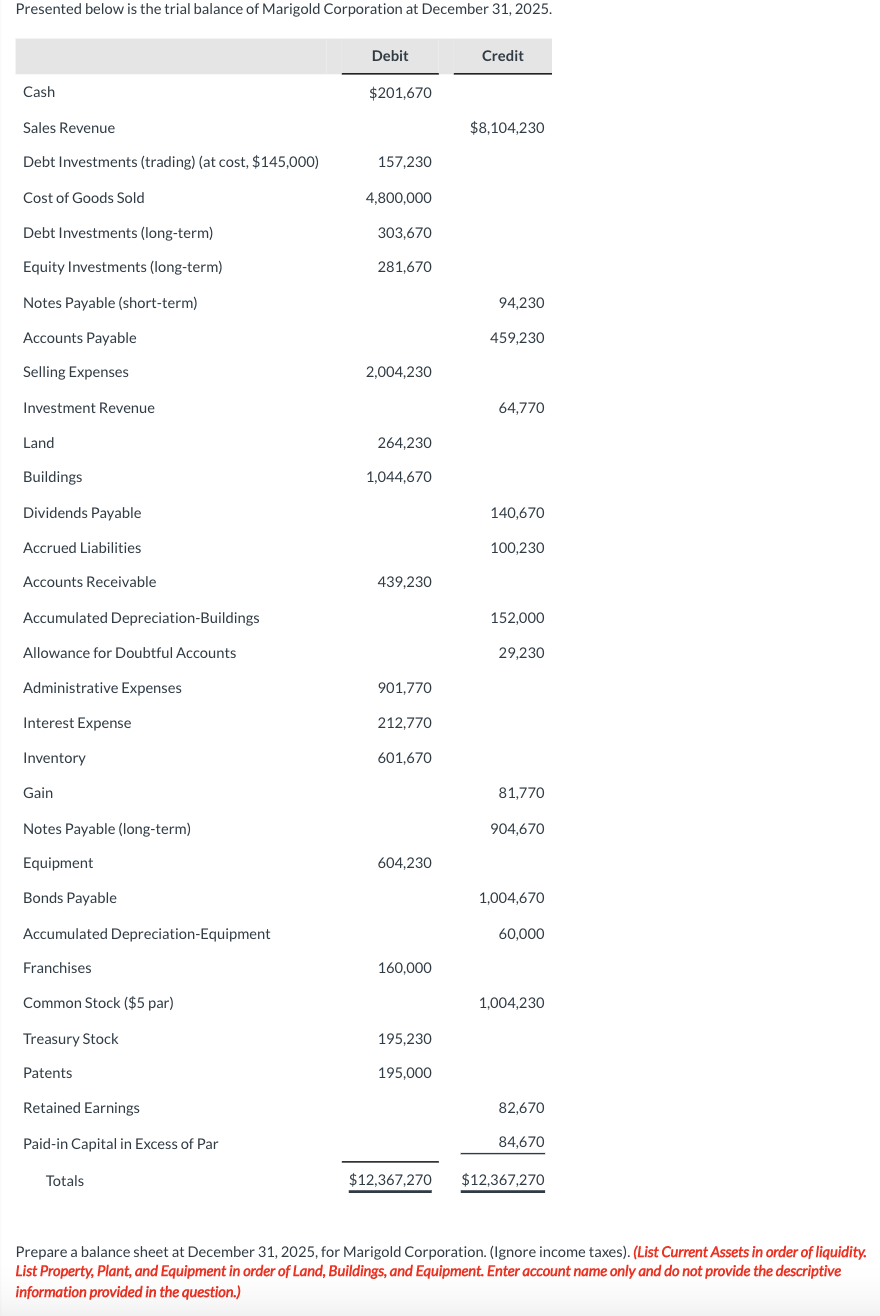

Transcribed Image Text:Presented below is the trial balance of Marigold Corporation at December 31, 2025.

Cash

Sales Revenue

Debt Investments (trading) (at cost, $145,000)

Cost of Goods Sold

Debt Investments (long-term)

Equity Investments (long-term)

Notes Payable (short-term)

Accounts Payable

Selling Expenses

Investment Revenue

Land

Buildings

Dividends Payable

Accrued Liabilities

Accounts Receivable

Accumulated Depreciation-Buildings

Allowance for Doubtful Accounts

Administrative Expenses

Interest Expense

Inventory

Gain

Notes Payable (long-term)

Equipment.

Bonds Payable

Accumulated Depreciation-Equipment

Franchises

Common Stock ($5 par)

Treasury Stock

Patents

Retained Earnings

Paid-in Capital in Excess of Par

Totals

Debit

$201,670

157,230

4,800,000

303,670

281,670

2,004,230

264,230

1,044,670

439,230

901,770

212.770

601,670

604,230

160,000

195,230

195,000

$12,367,270

Credit

$8,104,230

94,230

459,230

64,770

140,670

100,230

152,000

29,230

81,770

904,670

1,004,670

60,000

1,004,230

82,670

84,670

$12,367,270

Prepare a balance sheet at December 31, 2025, for Marigold Corporation. (Ignore income taxes). (List Current Assets in order of liquidity.

List Property, Plant, and Equipment in order of Land, Buildings, and Equipment. Enter account name only and do not provide the descriptive

information provided in the question.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning