PRESTON GIFTS Income Statement Year Ended December 31, 20X1 Cash Collected from Customers Cost of Goods Sold Merchandise Inventory, Jan. 1 Payments to Suppliers Less: Merchandise Inventory, Dec. 31 Cost of Goods Sold Gross Profit on Sales Operating Expenses Automobile Expense Salaries of Employees Payroll Taxes Expense Rent Expense Advertising Expense Utilities Expense Total Expenses Net Loss $ 50,000 90,000 140,000 38,000 69,000 51,200 4,600 13,600 3,100 4,700 $ 140,000 102,000 38,000 146,200 $ (108,200) Additional information provided by owner: All sales were for cash. The beginning and ending merchandise inventories were valued at their estimated selling price. The actual cost of the ending inventory is estimated to be $32,000. The actual cost of the beginning inventory is estimated to be $40,000. On December 31, 20X1, suppliers of merchandise are owed $31,000. On January 1, 20X1, they were owed $24,000. The owner paid her personal monthly car lease of $5,750 per month using business funds and charged this amount to the Automobile Expense account. A check for $1,000 to cover the December rent on the owner's personal apartment was issued from the firm's bank account. This amount was charged to Rent Expense. Using the additional information provided by the owner, prepare an income statement in accordance with generally accepted accounting principles. (Input all amounts as positive values except "Net loss" which should be indicated with a minus sign.)

PRESTON GIFTS Income Statement Year Ended December 31, 20X1 Cash Collected from Customers Cost of Goods Sold Merchandise Inventory, Jan. 1 Payments to Suppliers Less: Merchandise Inventory, Dec. 31 Cost of Goods Sold Gross Profit on Sales Operating Expenses Automobile Expense Salaries of Employees Payroll Taxes Expense Rent Expense Advertising Expense Utilities Expense Total Expenses Net Loss $ 50,000 90,000 140,000 38,000 69,000 51,200 4,600 13,600 3,100 4,700 $ 140,000 102,000 38,000 146,200 $ (108,200) Additional information provided by owner: All sales were for cash. The beginning and ending merchandise inventories were valued at their estimated selling price. The actual cost of the ending inventory is estimated to be $32,000. The actual cost of the beginning inventory is estimated to be $40,000. On December 31, 20X1, suppliers of merchandise are owed $31,000. On January 1, 20X1, they were owed $24,000. The owner paid her personal monthly car lease of $5,750 per month using business funds and charged this amount to the Automobile Expense account. A check for $1,000 to cover the December rent on the owner's personal apartment was issued from the firm's bank account. This amount was charged to Rent Expense. Using the additional information provided by the owner, prepare an income statement in accordance with generally accepted accounting principles. (Input all amounts as positive values except "Net loss" which should be indicated with a minus sign.)

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 36E: The following data were extracted from the accounting records of Harkins Company for the year ended...

Related questions

Question

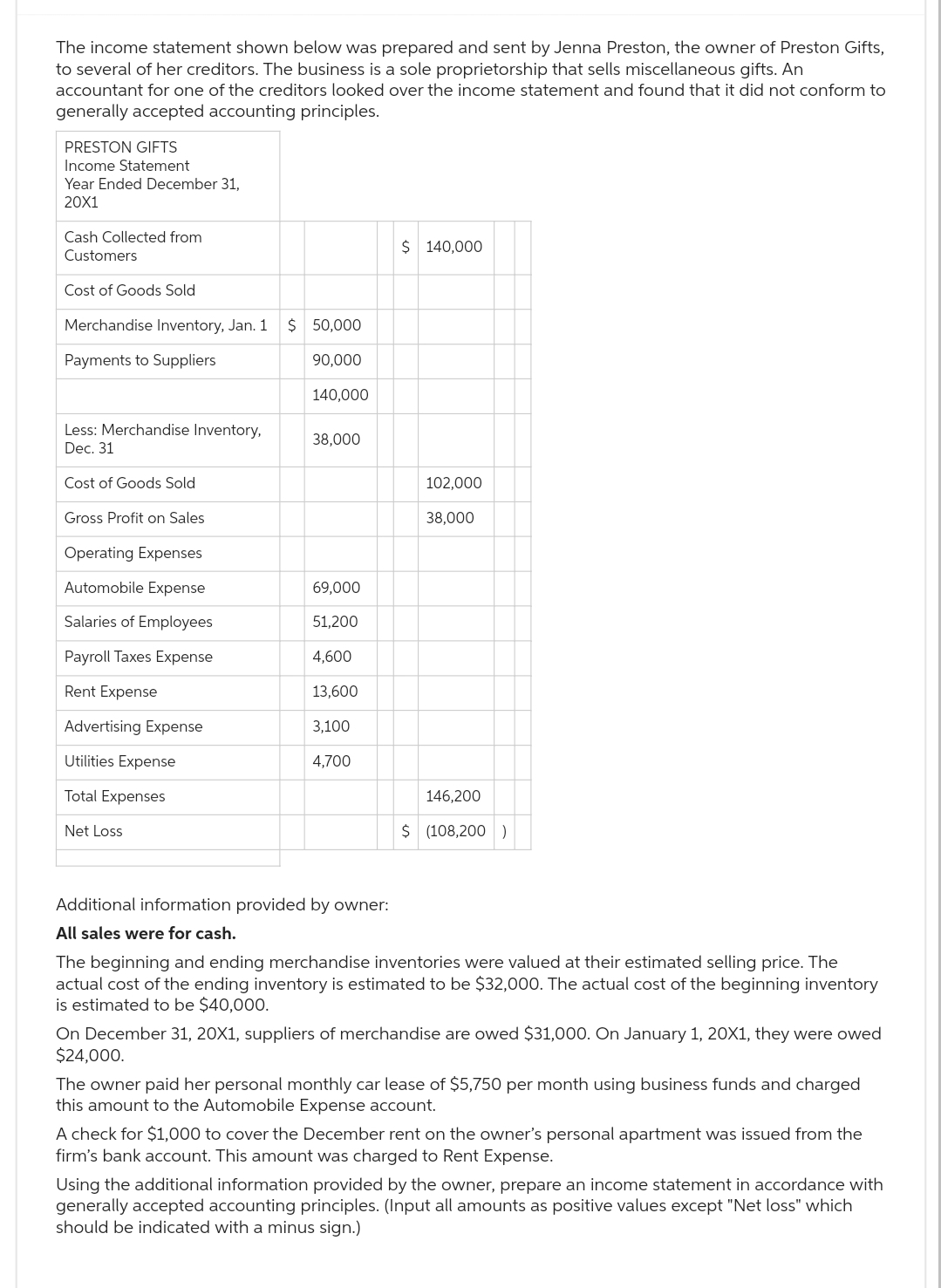

Transcribed Image Text:The income statement shown below was prepared and sent by Jenna Preston, the owner of Preston Gifts,

to several of her creditors. The business is a sole proprietorship that sells miscellaneous gifts. An

accountant for one of the creditors looked over the income statement and found that it did not conform to

generally accepted accounting principles.

PRESTON GIFTS

Income Statement

Year Ended December 31,

20X1

Cash Collected from

Customers

Cost of Goods Sold

Merchandise Inventory, Jan. 1

Payments to Suppliers

Less: Merchandise Inventory,

Dec. 31

Cost of Goods Sold

Gross Profit on Sales

Operating Expenses

Automobile Expense

Salaries of Employees

Payroll Taxes Expense

Rent Expense

Advertising Expense

Utilities Expense

Total Expenses

Net Loss

$ 50,000

90,000

140,000

38,000

69,000

51,200

4,600

13,600

3,100

4,700

$ 140,000

102,000

38,000

146,200

$ (108,200)

Additional information provided by owner:

All sales were for cash.

The beginning and ending merchandise inventories were valued at their estimated selling price. The

actual cost of the ending inventory is estimated to be $32,000. The actual cost of the beginning inventory

is estimated to be $40,000.

On December 31, 20X1, suppliers of merchandise are owed $31,000. On January 1, 20X1, they were owed

$24,000.

The owner paid her personal monthly car lease of $5,750 per month using business funds and charged

this amount to the Automobile Expense account.

A check for $1,000 to cover the December rent on the owner's personal apartment was issued from the

firm's bank account. This amount was charged to Rent Expense.

Using the additional information provided by the owner, prepare an income statement in accordance with

generally accepted accounting principles. (Input all amounts as positive values except "Net loss" which

should be indicated with a minus sign.)

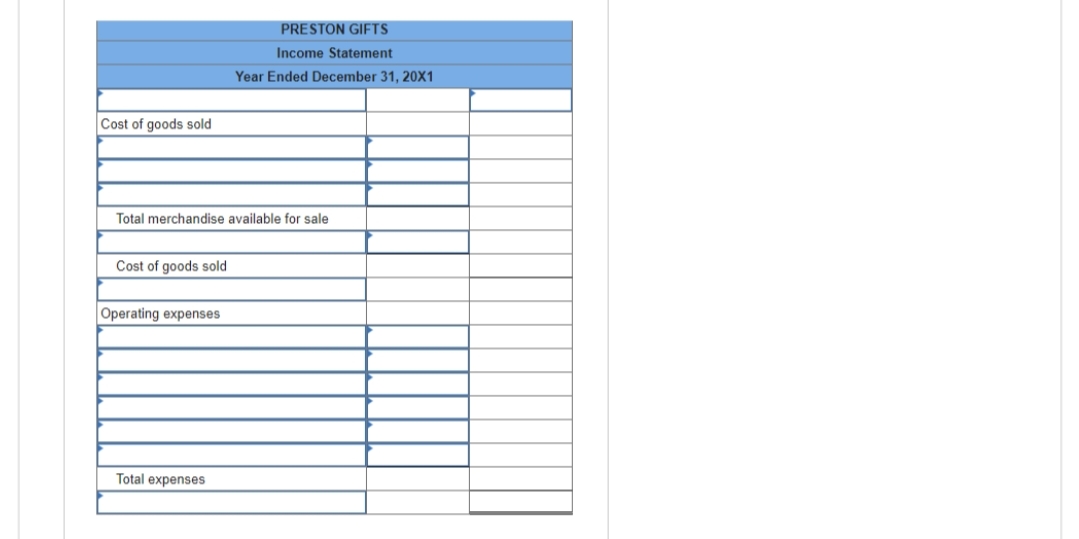

Transcribed Image Text:Cost of goods sold

Total merchandise available for sale

Cost of goods sold

Operating expenses

PRESTON GIFTS

Income Statement

Year Ended December 31, 20X1

Total expenses

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,