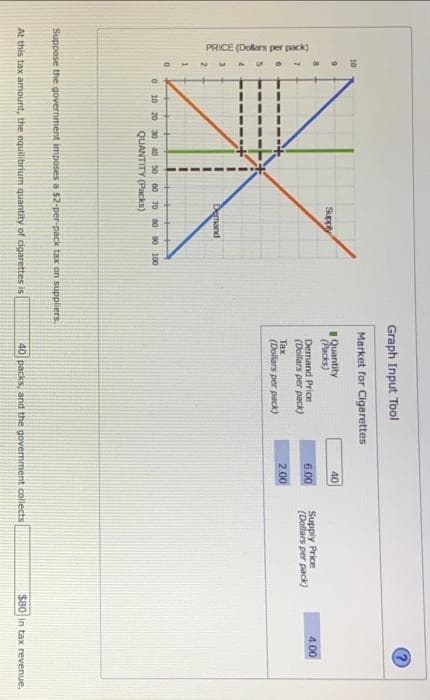

PRICE (Dollars per pack) 10 40 AU NE 0 Supply Demand 0 10 20 30 40 50 60 70 80 90 100 QUANTITY (Packs) Suppose the government imposes a $2-per-pack tax on suppliers. At this tax amount, the equilibrium quantity of cigarettes is Graph Input Tool Market for Cigarettes Quantity (Packs) Demand Price (Dollars per pack) Tax (Dollars per pack) 40 6.00 2.00 Supply Price (Dollars per pack) 40 packs, and the government collects 4.00 $80 in tax revenue.

PRICE (Dollars per pack) 10 40 AU NE 0 Supply Demand 0 10 20 30 40 50 60 70 80 90 100 QUANTITY (Packs) Suppose the government imposes a $2-per-pack tax on suppliers. At this tax amount, the equilibrium quantity of cigarettes is Graph Input Tool Market for Cigarettes Quantity (Packs) Demand Price (Dollars per pack) Tax (Dollars per pack) 40 6.00 2.00 Supply Price (Dollars per pack) 40 packs, and the government collects 4.00 $80 in tax revenue.

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter4: Estimating Demand

Section: Chapter Questions

Problem 6E

Related questions

Question

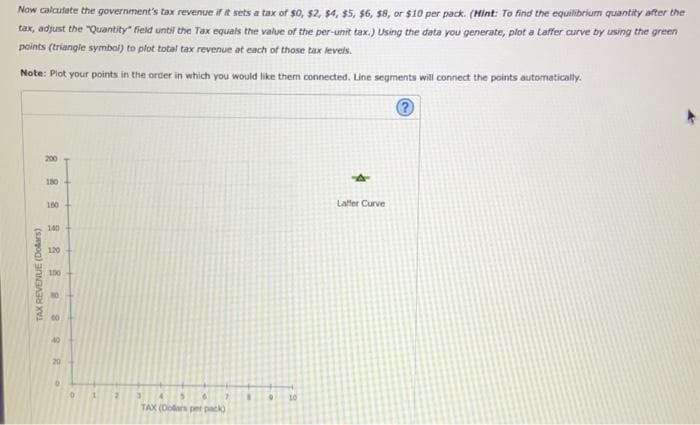

Transcribed Image Text:Now calculate the government's tax revenue if it sets a tax of $0, $2, $4, 55, 56, 58, or $10 per pack. (Hint: To find the equilibrium quantity after the

tax, adjust the "Quantity" field until the Tax equals the value of the per-unit tax.) Using the data you generate, plot a Laffer curve by using the green

points (triangle symbol) to plot total tax revenue at each of those tax levels.

Note: Plot your points in the order in which you would like them connected. Line segments will connect the points automatically.

TAX REVENUE (Dollars)

200

180

160

140

120

100

40

20

o

3

TAX (Dolars per pack)

10

A

Laffer Curve

Transcribed Image Text:PRICE (Dollars per pack)

10

9

ton

AND

0

Supply

Demand

0 10 20 30 40 50 60 70 80 90 100

QUANTITY (Packs)

Suppose the government imposes a $2-per-pack tax on suppliers.

At this tax amount, the equilibrium quantity of cigarettes is

Graph Input Tool

Market for Cigarettes

Quantity

(Packs)

Demand Price

(Dollars per pack)

Tax

(Dollars per pack)

40

6.00

2.00

Supply Price

(Dollars per pack)

40 packs, and the government collects

4.00

$80 in tax revenue.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning