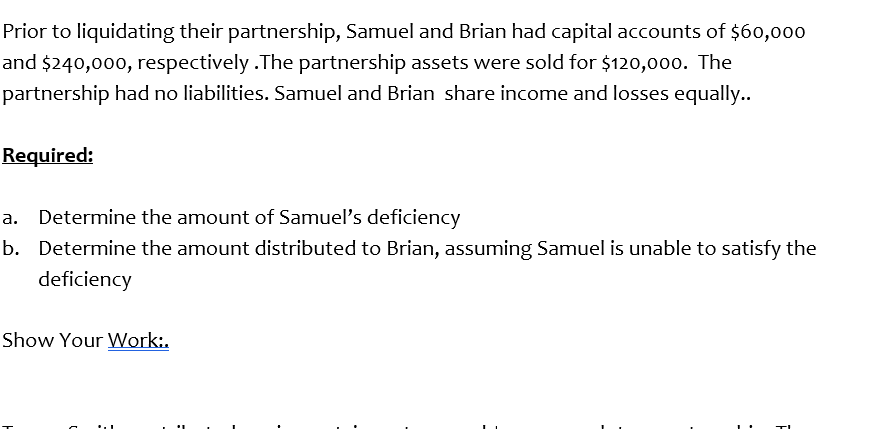

Prior to liquidating their partnership, Samuel and Brian had capital accounts of $60,000 and $240,000, respectively .The partnership assets were sold for $120,000. The partnership had no liabilities. Samuel and Brian share income and losses equally.. Required: a. Determine the amount of Samuel's deficiency b. Determine the amount distributed to Brian, assuming Samuel is unable to satisfy the deficiency

Prior to liquidating their partnership, Samuel and Brian had capital accounts of $60,000 and $240,000, respectively .The partnership assets were sold for $120,000. The partnership had no liabilities. Samuel and Brian share income and losses equally.. Required: a. Determine the amount of Samuel's deficiency b. Determine the amount distributed to Brian, assuming Samuel is unable to satisfy the deficiency

Chapter10: Partnerships: Formation, Operation, And Basis

Section: Chapter Questions

Problem 59P

Related questions

Question

Transcribed Image Text:Prior to liquidating their partnership, Samuel and Brian had capital accounts of $60,000

and $240,000, respectively .The partnership assets were sold for $120,000. The

partnership had no liabilities. Samuel and Brian share income and losses equally..

Required:

a. Determine the amount of Samuel's deficiency

b. Determine the amount distributed to Brian, assuming Samuel is unable to satisfy the

deficiency

Show Your Work:.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT