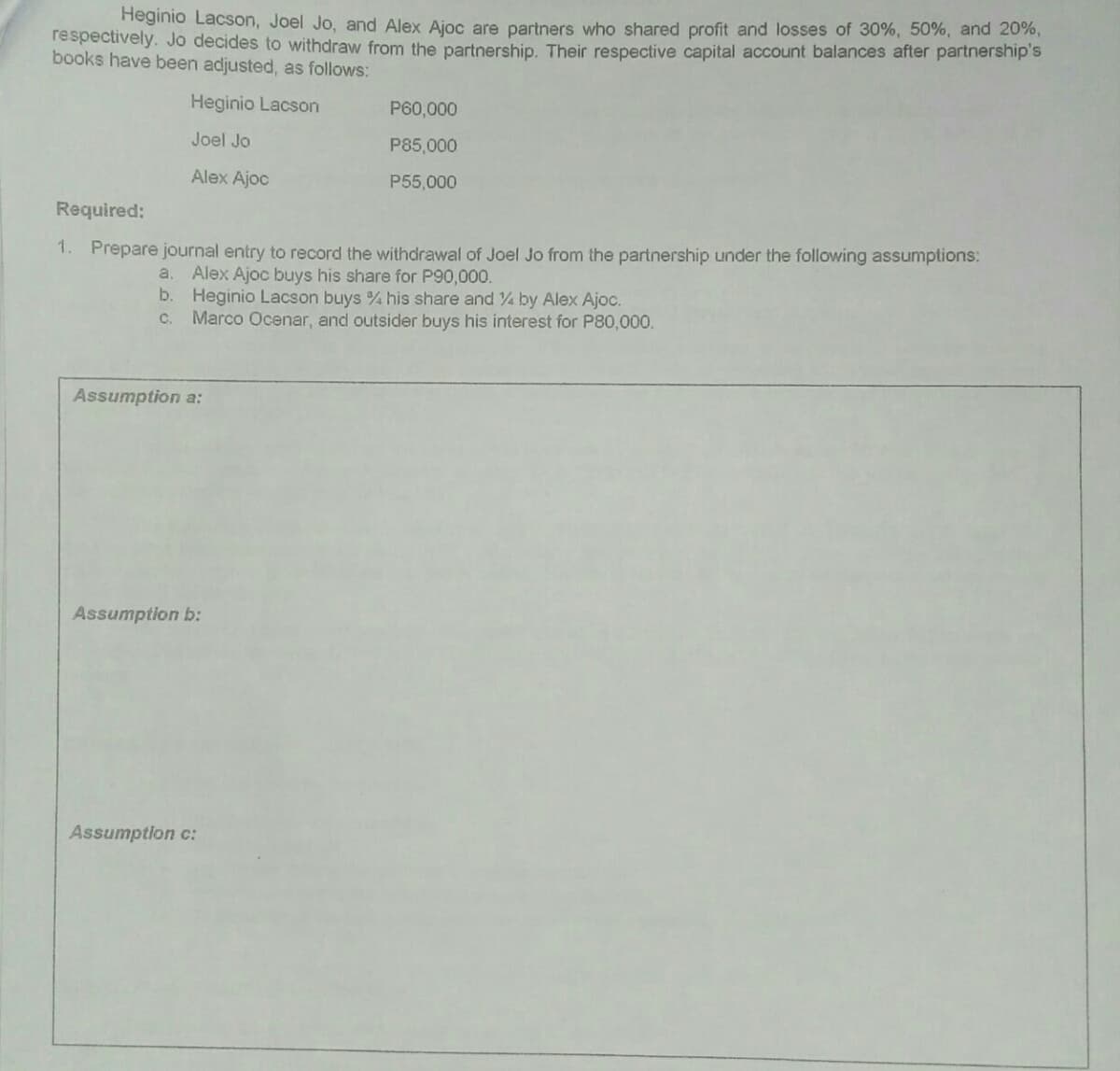

Heginio Lacson, Joel Jo, and Alex Ajoc are partners who shared profit and losses of 30%, 50%, and 20%, respectively. Jo decides to withdraw from the partnership. Their respective capital account balances after partnership s books have been adjusted, as follows: Heginio Lacson P60,000 Joel Jo P85,000 Alex Ajoc P55,000 Required: 1. Prepare journal entry to record the withdrawal of Joel Jo from the partnership under the following assumptions: a. Alex Ajoc buys his share for P90,000. b. Heginio Lacson buys % his share and4 by Alex Ajoc. Marco Ocenar, and outsider buys his interest for P80,000. C. Assumption a:

Heginio Lacson, Joel Jo, and Alex Ajoc are partners who shared profit and losses of 30%, 50%, and 20%, respectively. Jo decides to withdraw from the partnership. Their respective capital account balances after partnership s books have been adjusted, as follows: Heginio Lacson P60,000 Joel Jo P85,000 Alex Ajoc P55,000 Required: 1. Prepare journal entry to record the withdrawal of Joel Jo from the partnership under the following assumptions: a. Alex Ajoc buys his share for P90,000. b. Heginio Lacson buys % his share and4 by Alex Ajoc. Marco Ocenar, and outsider buys his interest for P80,000. C. Assumption a:

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 43P

Related questions

Question

Transcribed Image Text:Heginio Lacson, Joel Jo, and Alex Ajoc are partners who shared profit and losses of 30%, 50%, and 20%,

respectively. Jo decides to withdraw from the partnership. Their respective capital account balances after partnership s

books have been adjusted, as follows:

Heginio Lacson

P60,000

Joel Jo

P85,000

Alex Ajoc

P55,000

Required:

1. Prepare journal entry to record the withdrawal of Joel Jo from the partnership under the following assumptions:

Alex Ajoc buys his share for P90,000.

b. Heginio Lacson buys his share and4 by Alex Ajoc.

Marco Ocenar, and outsider buys his interest for P80,000.

a.

C.

Assumption a:

Assumption b:

Assumption c:

Transcribed Image Text:2. Determine the capitalization of the partnership after Joel Jo's withdrawal in each of the given assumption.

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College