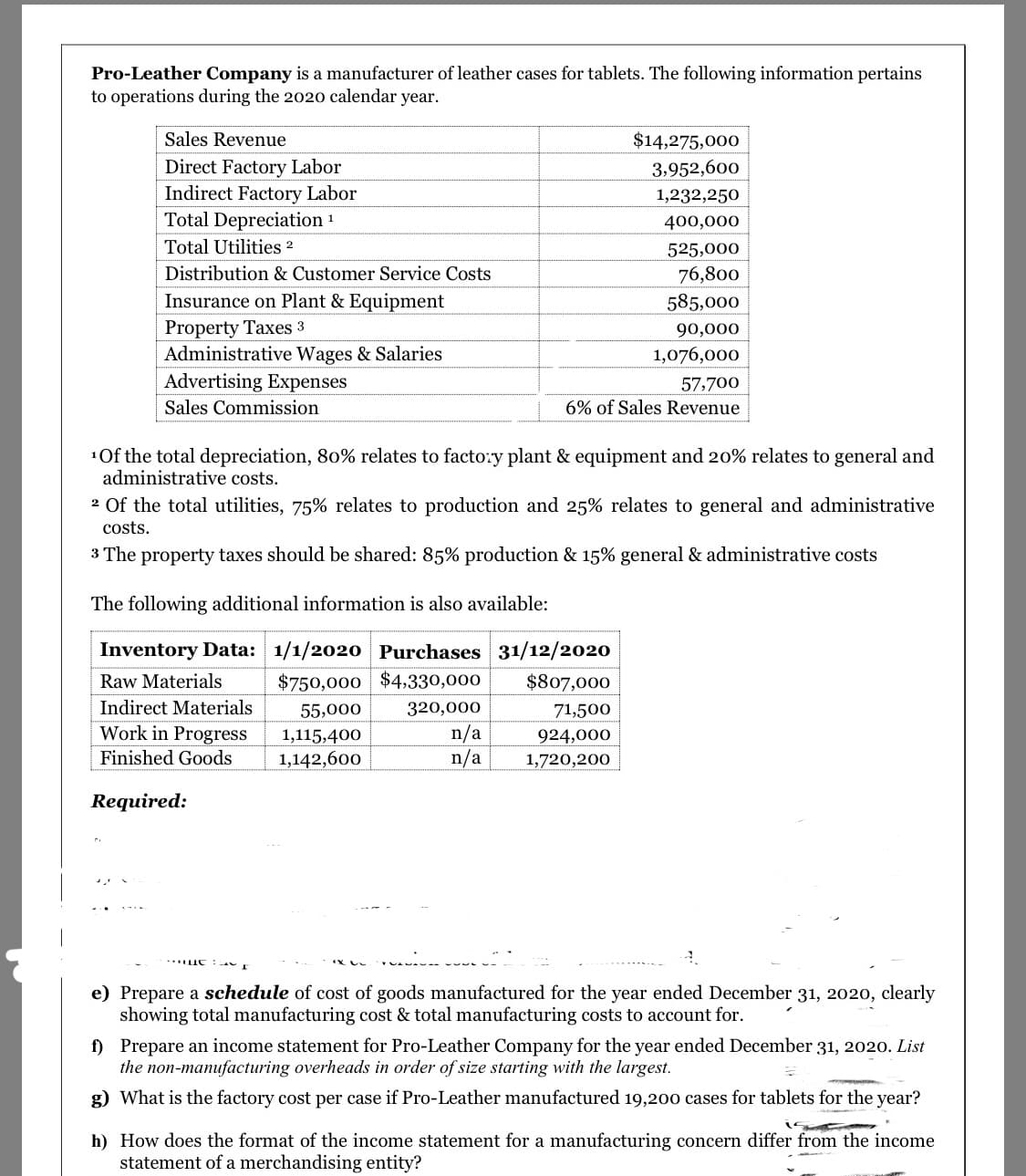

Pro-Leather Company is a manufacturer of leather cases for tablets. The following information pertains to operations during the 2020 calendar year. Sales Revenue $14,275,000 Direct Factory Labor Indirect Factory Labor Total Depreciation ! 3,952,600 1,232,250 400,000 Total Utilities 2 525,000 Distribution & Customer Service Costs 76,800 Insurance on Plant & Equipment Property Taxes 3 Administrative Wages & Salaries 585,000 90,000 1,076,000 Advertising Expenses 57,700 6% of Sales Revenue Sales Commission 1Of the total depreciation, 80% relates to facto:y plant & equipment and 20% relates to general and administrative costs. 2 Of the total utilities, 75% relates to production and 25% relates to general and administrative costs. 3 The property taxes should be shared: 85% production & 15% general & administrative costs The following additional information is also available: Inventory Data: 1/1/2020 Purchases 31/12/2020 Raw Materials $750,000 $4,330,000 $807,000 Indirect Materials 55,000 320,000 71,500 Work in Progress n/a n/a 924,000 1,115,400 1,142,600 Finished Goods 1,720,200 Required: e) Prepare a schedule of cost of goods manufactured for the year ended December 31, 2020, clearly showing total manufacturing cost & total manufacturing costs to account for. f) Prepare an income statement for Pro-Leather Company for the year ended December 31, 2020. List the non-manufacturing overheads in order of size starting with the largest. g) What is the factory cost per case if Pro-Leather manufactured 19,20o cases for tablets for the year?

Pro-Leather Company is a manufacturer of leather cases for tablets. The following information pertains to operations during the 2020 calendar year. Sales Revenue $14,275,000 Direct Factory Labor Indirect Factory Labor Total Depreciation ! 3,952,600 1,232,250 400,000 Total Utilities 2 525,000 Distribution & Customer Service Costs 76,800 Insurance on Plant & Equipment Property Taxes 3 Administrative Wages & Salaries 585,000 90,000 1,076,000 Advertising Expenses 57,700 6% of Sales Revenue Sales Commission 1Of the total depreciation, 80% relates to facto:y plant & equipment and 20% relates to general and administrative costs. 2 Of the total utilities, 75% relates to production and 25% relates to general and administrative costs. 3 The property taxes should be shared: 85% production & 15% general & administrative costs The following additional information is also available: Inventory Data: 1/1/2020 Purchases 31/12/2020 Raw Materials $750,000 $4,330,000 $807,000 Indirect Materials 55,000 320,000 71,500 Work in Progress n/a n/a 924,000 1,115,400 1,142,600 Finished Goods 1,720,200 Required: e) Prepare a schedule of cost of goods manufactured for the year ended December 31, 2020, clearly showing total manufacturing cost & total manufacturing costs to account for. f) Prepare an income statement for Pro-Leather Company for the year ended December 31, 2020. List the non-manufacturing overheads in order of size starting with the largest. g) What is the factory cost per case if Pro-Leather manufactured 19,20o cases for tablets for the year?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 22E: Ellerson Company provided the following information for the last calendar year: During the year,...

Related questions

Question

Transcribed Image Text:Pro-Leather Company is a manufacturer of leather cases for tablets. The following information pertains

to operations during the 2020 calendar year.

Sales Revenue

$14,275,000

Direct Factory Labor

Indirect Factory Labor

Total Depreciation 1

3,952,600

1,232,250

400,000

Total Utilities 2

525,000

Distribution & Customer Service Costs

76,800

Insurance on Plant & Equipment

585,000

Property Taxes 3

Administrative Wages & Salaries

Advertising Expenses

90,000

1,076,000

57,700

Sales Commission

6% of Sales Revenue

1Of the total depreciation, 80% relates to facto:y plant & equipment and 20% relates to general and

administrative costs.

2 Of the total utilities, 75% relates to production and 25% relates to general and administrative

costs.

3 The property taxes should be shared: 85% production & 15% general & administrative costs

The following additional information is also available:

Inventory Data: 1/1/2020 Purchases 31/12/2020

$750,000 $4,330,000

Raw Materials

$807,000

Indirect Materials

55,000

320,000

71,500

Work in Progress

n/a

n/a

1,115,400

924,000

Finished Goods

1,142,600

1,720,200

Required:

e) Prepare a schedule of cost of goods manufactured for the year ended December 31, 2020, clearly

showing total manufacturing cost & total manufacturing costs to account for.

f) Prepare an income statement for Pro-Leather Company for the year ended December 31, 2020. List

the non-manufacturing overheads in order of size starting with the largest.

g) What is the factory cost per case if Pro-Leather manufactured 19,200o cases for tablets for the year?

h) How does the format of the income statement for a manufacturing concern differ from the income

statement of a merchandising entity?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning