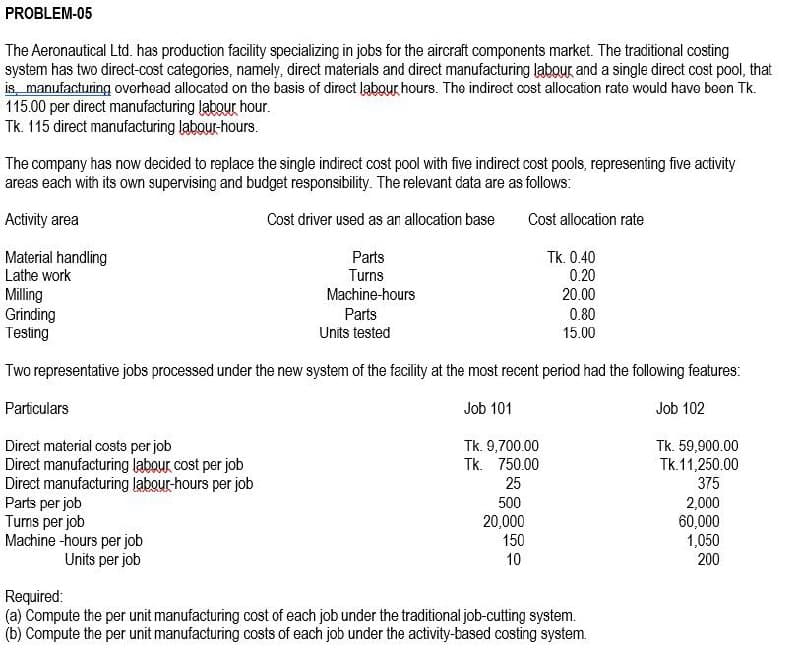

PROBLEM-05 The Aeronautical Ltd. has production facility specializing in jobs for the aircraft components market. The traditional costing system has two direct-cost categories, namely, direct materials and direct manufacturing labour and a single direct cost pool, that is manufacturing overhead allocated on the basis of direct labour hours. The indirect cost allocation rate would have been Tk. 115.00 per direct manufacturing labour hour. Tk. 115 direct manufacturing labour-hours. The company has now decided to replace the single indirect cost pool with five indirect cost pools, representing five activity areas each with its own supervising and budget responsibility. The relevant data are as follows: Activity area Cost driver used as an allocation base Cost allocation rate Material handling Parts Tk. 0.40 Lathe work 0.20 Turns Machine-hours Milling 20.00 Grinding 0.80 Parts Units tested Testing 15.00 Two representative jobs processed under the new system of the facility at the most recent period had the following features: Particulars Job 101 Job 102 Direct material costs per job Tk. 9,700.00 Tk. 59,900.00 Direct manufacturing labour cost per job Tk. 750.00 Tk.11,250.00 Direct manufacturing labour-hours per job 25 375 Parts per job 500 2,000 Turns per job 20,000 60,000 Machine -hours per job 150 1,050 Units per job 10 200 Required: (a) Compute the per unit manufacturing cost of each job under the traditional job-cutting system. (b) Compute the per unit manufacturing costs of each job under the activity-based costing system.

PROBLEM-05 The Aeronautical Ltd. has production facility specializing in jobs for the aircraft components market. The traditional costing system has two direct-cost categories, namely, direct materials and direct manufacturing labour and a single direct cost pool, that is manufacturing overhead allocated on the basis of direct labour hours. The indirect cost allocation rate would have been Tk. 115.00 per direct manufacturing labour hour. Tk. 115 direct manufacturing labour-hours. The company has now decided to replace the single indirect cost pool with five indirect cost pools, representing five activity areas each with its own supervising and budget responsibility. The relevant data are as follows: Activity area Cost driver used as an allocation base Cost allocation rate Material handling Parts Tk. 0.40 Lathe work 0.20 Turns Machine-hours Milling 20.00 Grinding 0.80 Parts Units tested Testing 15.00 Two representative jobs processed under the new system of the facility at the most recent period had the following features: Particulars Job 101 Job 102 Direct material costs per job Tk. 9,700.00 Tk. 59,900.00 Direct manufacturing labour cost per job Tk. 750.00 Tk.11,250.00 Direct manufacturing labour-hours per job 25 375 Parts per job 500 2,000 Turns per job 20,000 60,000 Machine -hours per job 150 1,050 Units per job 10 200 Required: (a) Compute the per unit manufacturing cost of each job under the traditional job-cutting system. (b) Compute the per unit manufacturing costs of each job under the activity-based costing system.

Chapter5: Process Costing

Section: Chapter Questions

Problem 2PB: The following product costs are available for Kellee Company on the production of eyeglass frames:...

Related questions

Question

Kindly solve accordingly

Transcribed Image Text:PROBLEM-05

The Aeronautical Ltd. has production facility specializing in jobs for the aircraft components market. The traditional costing

system has two direct-cost categories, namely, direct materials and direct manufacturing labour and a single direct cost pool, that

is manufacturing overhead allocated on the basis of direct labour hours. The indirect cost allocation rate would have been Tk.

115.00 per direct manufacturing labour hour.

Tk. 115 direct manufacturing labour-hours.

The company has now decided to replace the single indirect cost pool with five indirect cost pools, representing five activity

areas each with its own supervising and budget responsibility. The relevant data are as follows:

Activity area

Cost driver used as an allocation base

Cost allocation rate

Material handling

Parts

Tk. 0.40

Lathe work

0.20

Turns

Machine-hours

Milling

20.00

Grinding

0.80

Parts

Units tested

Testing

15.00

Two representative jobs processed under the new system of the facility at the most recent period had the following features:

Particulars

Job 101

Job 102

Direct material costs per job

Tk. 9,700.00

Tk. 59,900.00

Direct manufacturing labour cost per job

Tk.

750.00

Tk.11,250.00

Direct manufacturing labour-hours per job

25

375

Parts per job

500

2,000

Turns per job

20,000

60,000

Machine -hours per job

150

1,050

200

Units per job

10

Required:

(a) Compute the per unit manufacturing cost of each job under the traditional job-cutting system.

(b) Compute the per unit manufacturing costs of each job under the activity-based costing system.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning