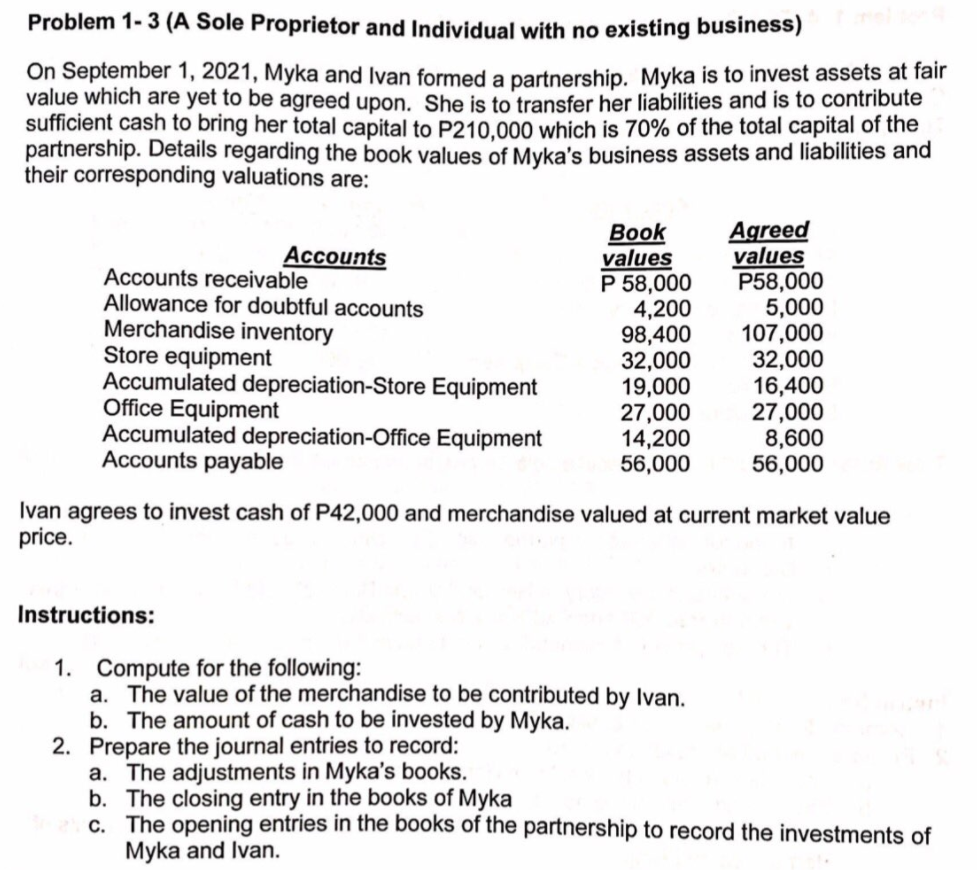

Problem 1- 3 (A Sole Proprietor and Individual with no existing business) On September 1, 2021, Myka and Ivan formed a partnership. Myka is to invest assets at fair value which are yet to be agreed upon. She is to transfer her liabilities and is to contribute sufficient cash to bring her total capital to P210.000 which is 70% of the total capital of the partnership. Details regarding the book values of Myka's business assets and liabilities and their corresponding valuations are: Вook values P 58,000 4,200 98,400 32,000 19,000 27,000 14,200 56,000 Agreed values P58,000 5,000 107,000 32,000 16,400 27,000 8,600 56,000 Accounts Accounts receivable Allowance for doubtful accounts Merchandise inventory Store equipment Accumulated depreciation-Store Equipment Office Equipment Accumulated depreciation-Office Equipment Accounts payable Ivan agrees to invest cash of P42,000 and merchandise valued at current market value price. Instructions: 1. Compute for the following: a. The value of the merchandise to be contributed by Ivan. b. The amount of cash to be invested by Myka. 2. Prepare the journal entries to record: a. The adjustments in Myka's books. b. The closing entry in the books of Myka c. The opening entries in the books of the partnership to record the investments of Myka and Ivan.

Partnership Accounting

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings, admission of a new partner, etc.

Partner Admission and Withdrawal

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as a partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings of a partner, etc.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images