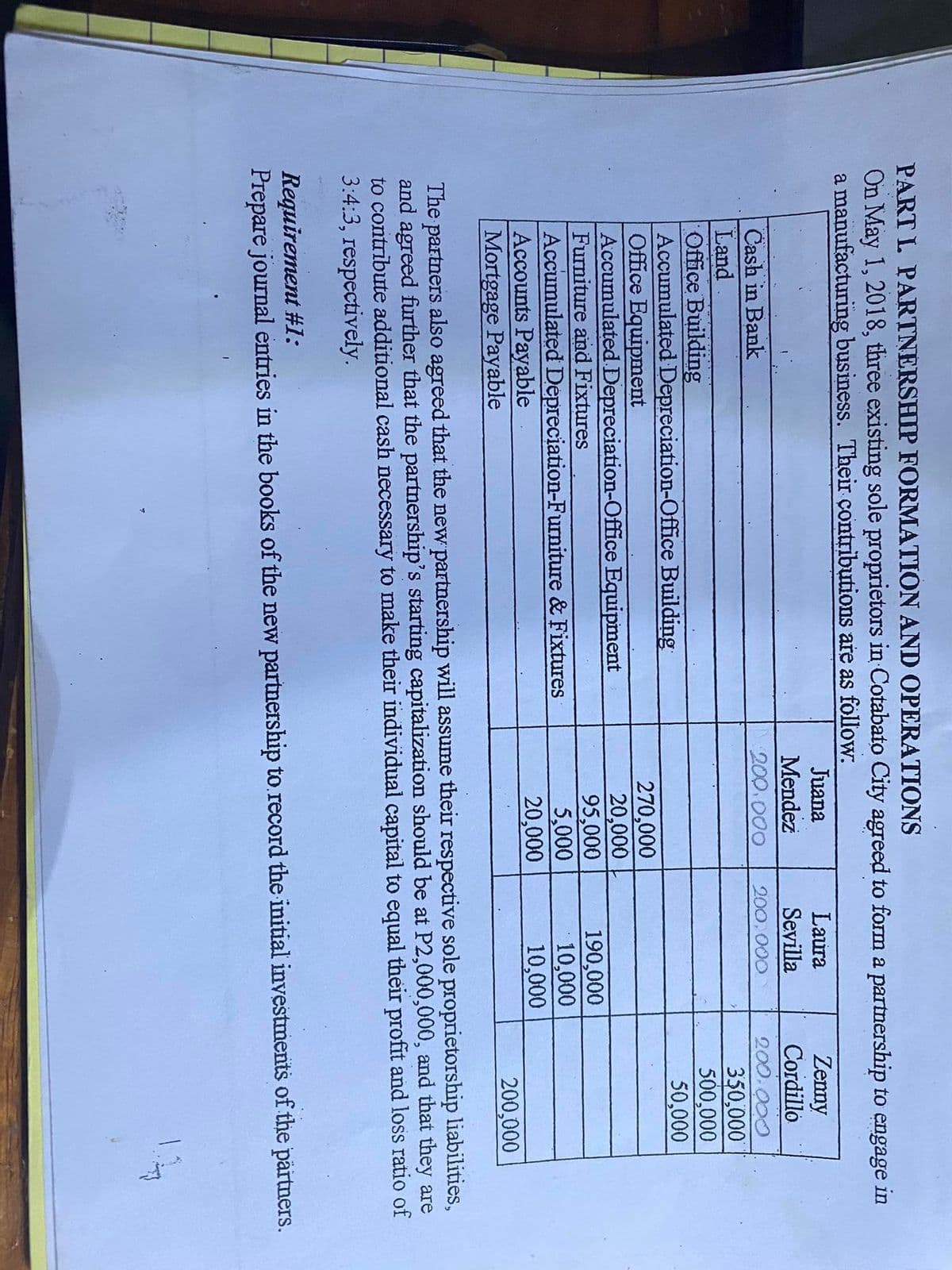

PART L PARTNERSHIP FORMATION AND OPERATIONS On May 1, 2018, three existing sole proprietors in Cotabato City agreed to form a partnership to engage in a manufacturing business. Their contributions are as follow. Juana Laura Mendez 200.000 Zemmy Cordillo Sevilla Cash in Bank Land Office Building Accumulated Depreciation-Office Building Office Equipment Accumulated Depreciation-Office Equipment Furniture and Fixtures Accumulated Depreciation-Furniture & Fixtures Accounts Payable Mortgage Payable 200.000 350,000 500,000 50,000 200, 000 270,000 20,000 95,000 5,000 20,000 190,000 10,000 10,000 200,000 The partners also agreed that the new partnership will assume their respective sole proprietorship liabilities, and agreed further that the partnership's starting capitalization should be at P2,000,000, and that they are to contribute additional cash necessary to make their individual capital to equal their profit and loss ratio of 3:4:3, respectively. Requirement #1: Prepare journal entries in the books of the new partnership to.record the initial investments of the pärtners. 11

Partnership Accounting

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings, admission of a new partner, etc.

Partner Admission and Withdrawal

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as a partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings of a partner, etc.

Step by step

Solved in 2 steps with 1 images