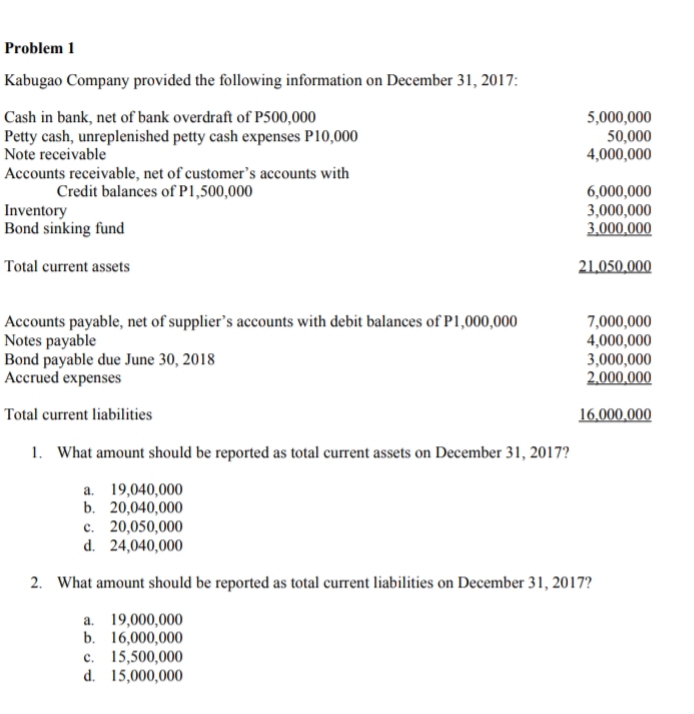

Problem 1 Kabugao Company provided the following information on December 31, 2017: Cash in bank, net of bank overdraft of P500,000 Petty cash, unreplenished petty cash expenses P10,000 Note receivable Accounts receivable, net of customer's accounts with Credit balances of PI,500,000 Inventory Bond sinking fund 5,000,000 50,000 4,000,000 6,000,000 3,000,000 3.000,000 Total current assets 21.050,000 Accounts payable, net of supplier's accounts with debit balances of P1,000,000 Notes payable Bond payable due June 30, 2018 Accrued expenses 7,000,000 4,000,000 3,000,000 2.000,000 Total current liabilities 16,000,000 1. What amount should be reported as total current assets on December 31, 2017? a. 19,040,000 b. 20,040,000 c. 20,050,000 d. 24,040,000 2. What amount should be reported as total current liabilities on December 31, 2017? a. 19,000,000 b. 16,000,000 c. 15,500,000 d. 15,000,000

Problem 1 Kabugao Company provided the following information on December 31, 2017: Cash in bank, net of bank overdraft of P500,000 Petty cash, unreplenished petty cash expenses P10,000 Note receivable Accounts receivable, net of customer's accounts with Credit balances of PI,500,000 Inventory Bond sinking fund 5,000,000 50,000 4,000,000 6,000,000 3,000,000 3.000,000 Total current assets 21.050,000 Accounts payable, net of supplier's accounts with debit balances of P1,000,000 Notes payable Bond payable due June 30, 2018 Accrued expenses 7,000,000 4,000,000 3,000,000 2.000,000 Total current liabilities 16,000,000 1. What amount should be reported as total current assets on December 31, 2017? a. 19,040,000 b. 20,040,000 c. 20,050,000 d. 24,040,000 2. What amount should be reported as total current liabilities on December 31, 2017? a. 19,000,000 b. 16,000,000 c. 15,500,000 d. 15,000,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 11MC

Related questions

Question

Please answer 1 and 2 completely.

Transcribed Image Text:Problem 1

Kabugao Company provided the following information on December 31, 2017:

Cash in bank, net of bank overdraft of P500,000

Petty cash, unreplenished petty cash expenses P10,000

Note receivable

Accounts receivable, net of customer's accounts with

5,000,000

50,000

4,000,000

6,000,000

3,000,000

3.000,000

Credit balances of P1,500,000

Inventory

Bond sinking fund

Total current assets

21,050,000

Accounts payable, net of supplier's accounts with debit balances of P1,000,000

Notes payable

Bond payable due June 30, 2018

Accrued expenses

7,000,000

4,000,000

3,000,000

2,000,000

Total current liabilities

16,000,000

1. What amount should be reported as total current assets on December 31, 2017?

a. 19,040,000

b. 20,040,000

c. 20,050,000

d. 24,040,000

2. What amount should be reported as total current liabilities on December 31, 2017?

a. 19,000,000

b. 16,000,000

c. 15,500,000

d. 15,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning