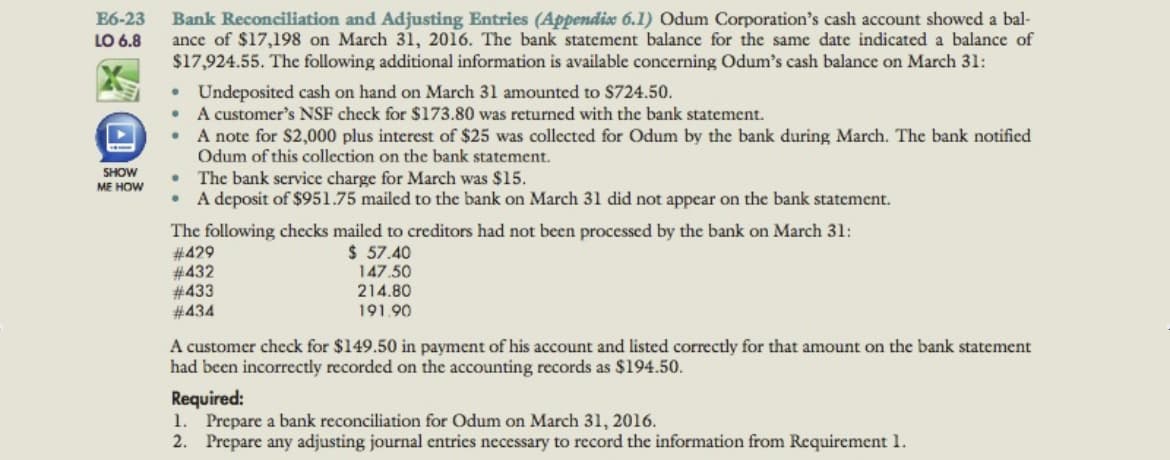

Bank Reconciliation and Adjusting Entries (Appendix 6.1) Odum Corporation's cash account showed a bal- ance of $17,198 on March 31, 2016. The bank statement balance for the same date indicated a balance of $17,924.55. The following additional information is available concerning Odum's cash balance on March 31: Undeposited cash on hand on March 31 amounted to $724.50. • A customer's NSF check for $173.80 was returned with the bank statement. • A note for $2,000 plus interest of $25 was collected for Odum by the bank during March. The bank notified Odum of this collection on the bank statement. The bank scrvice charge for March was $15. • A deposit of $951.75 mailed to the bank on March 31 did not appear on the bank statement. The following checks mailed to creditors had not been processed by the bank on March 31: #429 #432 # 433 #434 $ 57.40 147.50 214.80 191.90 A customer check for $149.50 in payment of his account and listed correctly for that amount on the bank statement had been incorrectly recorded on the accounting records as $194.50. Required: 1. Prepare a bank reconciliation for Odum on March 31, 2016. 2. Prepare any adjusting journal entries necessary to record the information from Requirement 1.

Bank Reconciliation and Adjusting Entries (Appendix 6.1) Odum Corporation's cash account showed a bal- ance of $17,198 on March 31, 2016. The bank statement balance for the same date indicated a balance of $17,924.55. The following additional information is available concerning Odum's cash balance on March 31: Undeposited cash on hand on March 31 amounted to $724.50. • A customer's NSF check for $173.80 was returned with the bank statement. • A note for $2,000 plus interest of $25 was collected for Odum by the bank during March. The bank notified Odum of this collection on the bank statement. The bank scrvice charge for March was $15. • A deposit of $951.75 mailed to the bank on March 31 did not appear on the bank statement. The following checks mailed to creditors had not been processed by the bank on March 31: #429 #432 # 433 #434 $ 57.40 147.50 214.80 191.90 A customer check for $149.50 in payment of his account and listed correctly for that amount on the bank statement had been incorrectly recorded on the accounting records as $194.50. Required: 1. Prepare a bank reconciliation for Odum on March 31, 2016. 2. Prepare any adjusting journal entries necessary to record the information from Requirement 1.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter6: Cash And Internal Control

Section: Chapter Questions

Problem 6.3E

Related questions

Question

100%

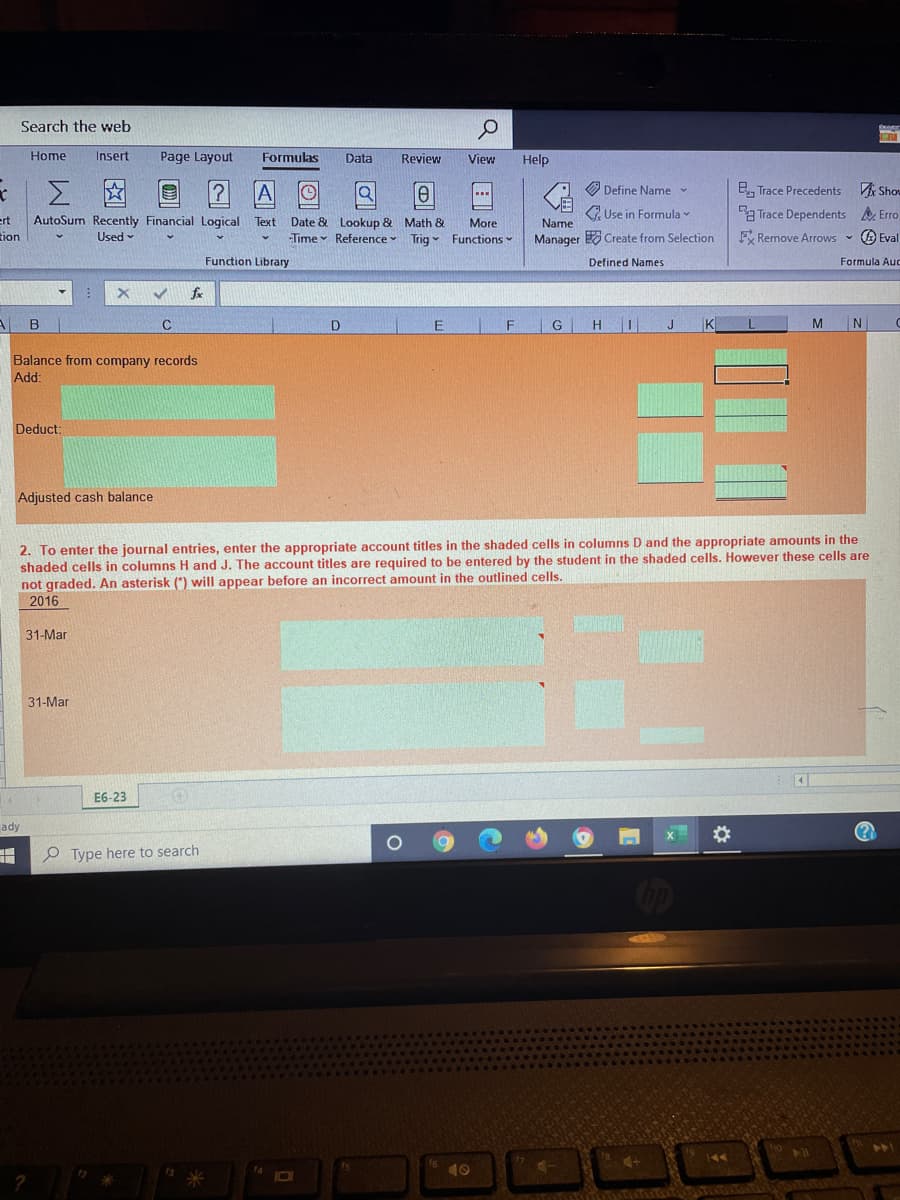

This is the excel spreadsheet to complete problem E6-23 all shaded cells in column D,H and J.

Attached is the page from the book for E6-23 and the spreadsheet is attached to where the account titles goes and amounts

Transcribed Image Text:E6-23

Bank Reconciliation and Adjusting Entries (Appendix 6.1) Odum Corporation's cash account showed a bal-

ance of $17,198 on March 31, 2016. The bank statement balance for the same date indicated a balance of

$17,924.55. The following additional information is available concerning Odum's cash balance on March 31:

LO 6.8

Undeposited cash on hand on March 31 amounted to S724.50.

A customer's NSF check for $173.80 was returned with the bank statement.

A note for S2,000 plus interest of $25 was collected for Odum by the bank during March. The bank notified

Odum of this collection on the bank statement.

SHOW

The bank service charge for March was $15.

A deposit of $951.75 mailed to the bank on March 31 did not appear on the bank statement.

ME HOW

The following checks mailed to creditors had not bcen processed by the bank on March 31:

#429

#432

#433

#434

$ 57.40

147,50

214.80

191.90

A customer check for $149.50 in payment of his account and listed correctly for that amount on the bank statement

had been incorrectly recorded on the accounting records as $194.50.

Required:

Prepare a bank reconciliation for Odum on March 31, 2016.

2. Prepare any adjusting journal entrics necessary to record the information from Requirement 1.

1.

Transcribed Image Text:Search the web

Home

Insert

Page Layout

Formulas

Data

Review

View

Help

O Define Name

B, Trace Precedents

VA Shou

2 Use in Formula

Ba Trace Dependents Erro

ert

AutoSum Recently Financial Logical Text Date & Lookup & Math &

More

Time Reference Trig Functions

Name

tion

Used -

Manager Create from Selection

F Remove Arrows - A Eval

Function Library

Defined Names

Formula Aud

fx

C

G

H

J

K

N

Balance from company records

Add:

Deduct:

Adjusted cash balance

2. To enter the journal entries, enter the appropriate account titles in the shaded cells in columns D and the appropriate amounts in the

shaded cells in columns H and J. The account titles are required to be entered by the student in the shaded cells. However these cells are

not graded. An asterisk (*) will appear before an incorrect amount in the outlined cells.

2016

31-Mar

31-Mar

E6-23

ady

%23

P Type here to search

10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,