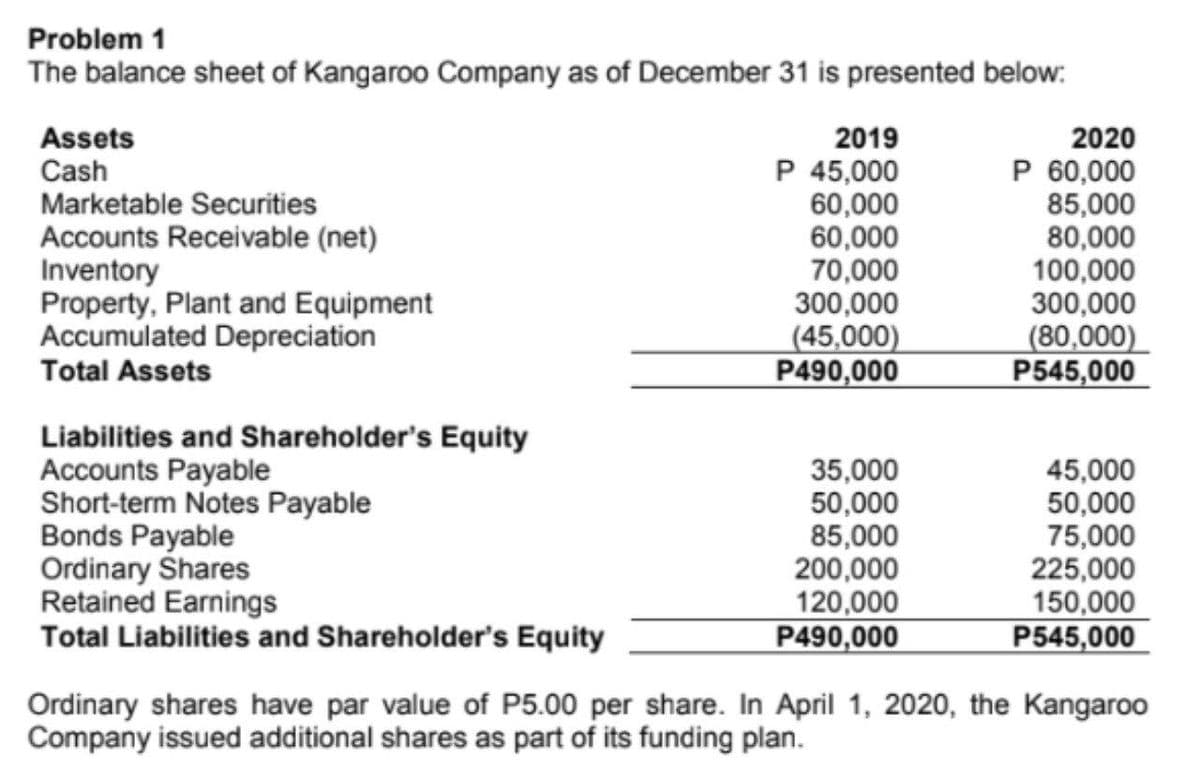

Problem 1 The balance sheet of Kangaroo Company as of December 31 is presented below: 2020 P 60,000 85,000 80,000 100,000 300,000 (80,000) P545,000 Assets Cash Marketable Securities Accounts Receivable (net) Inventory Property, Plant and Equipment Accumulated Depreciation 2019 P 45,000 60,000 60,000 70,000 300,000 (45,000) P490,000 Total Assets Liabilities and Shareholder's Equity Accounts Payable Short-term Notes Payable Bonds Payable Ordinary Shares Retained Earnings Total Liabilities and Shareholder's Equity 35,000 50,000 85,000 200,000 120,000 P490,000 45,000 50,000 75,000 225,000 150,000 P545,000 Ordinary shares have par value of P5.00 per share. In April 1, 2020, the Kangaroo Company issued additional shares as part of its funding plan.

Problem 1 The balance sheet of Kangaroo Company as of December 31 is presented below: 2020 P 60,000 85,000 80,000 100,000 300,000 (80,000) P545,000 Assets Cash Marketable Securities Accounts Receivable (net) Inventory Property, Plant and Equipment Accumulated Depreciation 2019 P 45,000 60,000 60,000 70,000 300,000 (45,000) P490,000 Total Assets Liabilities and Shareholder's Equity Accounts Payable Short-term Notes Payable Bonds Payable Ordinary Shares Retained Earnings Total Liabilities and Shareholder's Equity 35,000 50,000 85,000 200,000 120,000 P490,000 45,000 50,000 75,000 225,000 150,000 P545,000 Ordinary shares have par value of P5.00 per share. In April 1, 2020, the Kangaroo Company issued additional shares as part of its funding plan.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

Compute the following:

5. Assuming that on July 1, 2020, Kangaroo Company purchased its own share at

P10.00. How much is the book value per share for the year 2020?

6. Assuming that there is a cumulative and participating

will affect the book value per share computation? Explain briefly.

Transcribed Image Text:Problem 1

The balance sheet of Kangaroo Company as of December 31 is presented below:

Assets

Cash

Marketable Securities

2019

2020

Accounts Receivable (net)

Inventory

Property, Plant and Equipment

Accumulated Depreciation

Total Assets

P 45,000

60,000

60,000

70,000

300,000

(45,000)

P490,000

P 60,000

85,000

80,000

100,000

300,000

(80,000)

P545,000

Liabilities and Shareholder's Equity

Accounts Payable

Short-term Notes Payable

Bonds Payable

Ordinary Shares

Retained Earnings

Total Liabilities and Shareholder's Equity

35,000

50,000

85,000

200,000

120,000

P490,000

45,000

50,000

75,000

225,000

150,000

P545,000

Ordinary shares have par value of P5.00 per share. In April 1, 2020, the Kangaroo

Company issued additional shares as part of its funding plan.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning