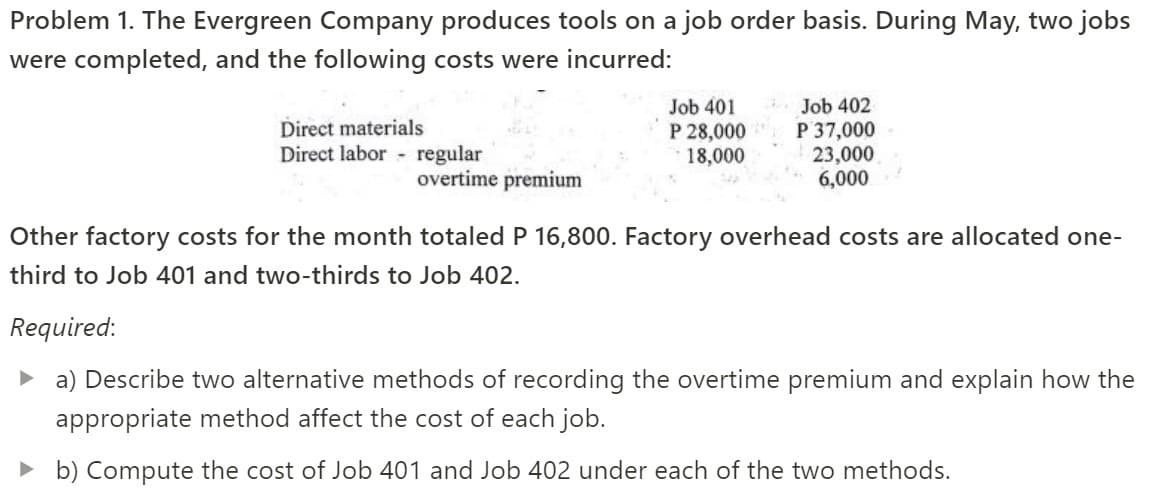

Problem 1. The Evergreen Company produces tools on a job order basis. During May, two jobs were completed, and the following costs were incurred: Job 402 Direct materials Job 401 P 28,000 18,000 P 37,000 Direct labor regular 23,000 overtime premium 6,000 Other factory costs for the month totaled P 16,800. Factory overhead costs are allocated one- third to Job 401 and two-thirds to Job 402. Required: ► a) Describe two alternative methods of recording the overtime premium and explain how the appropriate method affect the cost of each job. ► b) Compute the cost of Job 401 and Job 402 under each of the two methods.

Problem 1. The Evergreen Company produces tools on a job order basis. During May, two jobs were completed, and the following costs were incurred: Job 402 Direct materials Job 401 P 28,000 18,000 P 37,000 Direct labor regular 23,000 overtime premium 6,000 Other factory costs for the month totaled P 16,800. Factory overhead costs are allocated one- third to Job 401 and two-thirds to Job 402. Required: ► a) Describe two alternative methods of recording the overtime premium and explain how the appropriate method affect the cost of each job. ► b) Compute the cost of Job 401 and Job 402 under each of the two methods.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter2: Job Order Costing

Section: Chapter Questions

Problem 3CMA: Lucy Sportswear manufactures a specialty line of T-shirts using a job order cost system. During...

Related questions

Question

Explain in detail

Transcribed Image Text:Problem 1. The Evergreen Company produces tools on a job order basis. During May, two jobs

were completed, and the following costs were incurred:

Job 402

Direct materials

Direct labor

Job 401

P 28,000

18,000

P 37,000

23,000

regular

overtime premium

6,000

Other factory costs for the month totaled P 16,800. Factory overhead costs are allocated one-

third to Job 401 and two-thirds to Job 402.

Required:

a) Describe two alternative methods of recording the overtime premium and explain how the

appropriate method affect the cost of each job.

▸ b) Compute the cost of Job 401 and Job 402 under each of the two methods.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning