Use the data in the tables below to answer the following questions: Average rates of return on Treasury bills, government bonds, and common stocks, 1900-2020. Average Annual Rate of Return (8) Average Premium (Extra return versus Treasury bills) (%) Portfolio Treasury bills Treasury bonds Common stocks Standard deviation of returns, 1900-2020. Portfolio Treasury bills Long-term government bonds Common stocks 3.7 5.4 11.5 Standard Deviation (%) a. Average rate of return b. Average risk premium c. Standard deviation of returns 2.8 8.9 19.5 a. What was the average rate of return on large U.S. common stocks from 1900 to 2020? b. What was the average risk premium on large stocks? c. What was the standard deviation of returns on common stocks? 1.7 7.8 Note: Enter your answer as a percent rounded to 1 decimal place. % % %

Use the data in the tables below to answer the following questions: Average rates of return on Treasury bills, government bonds, and common stocks, 1900-2020. Average Annual Rate of Return (8) Average Premium (Extra return versus Treasury bills) (%) Portfolio Treasury bills Treasury bonds Common stocks Standard deviation of returns, 1900-2020. Portfolio Treasury bills Long-term government bonds Common stocks 3.7 5.4 11.5 Standard Deviation (%) a. Average rate of return b. Average risk premium c. Standard deviation of returns 2.8 8.9 19.5 a. What was the average rate of return on large U.S. common stocks from 1900 to 2020? b. What was the average risk premium on large stocks? c. What was the standard deviation of returns on common stocks? 1.7 7.8 Note: Enter your answer as a percent rounded to 1 decimal place. % % %

Fundamentals of Financial Management (MindTap Course List)

14th Edition

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter8: Risk And Rates Of Return

Section: Chapter Questions

Problem 22SP

Related questions

Question

Finance

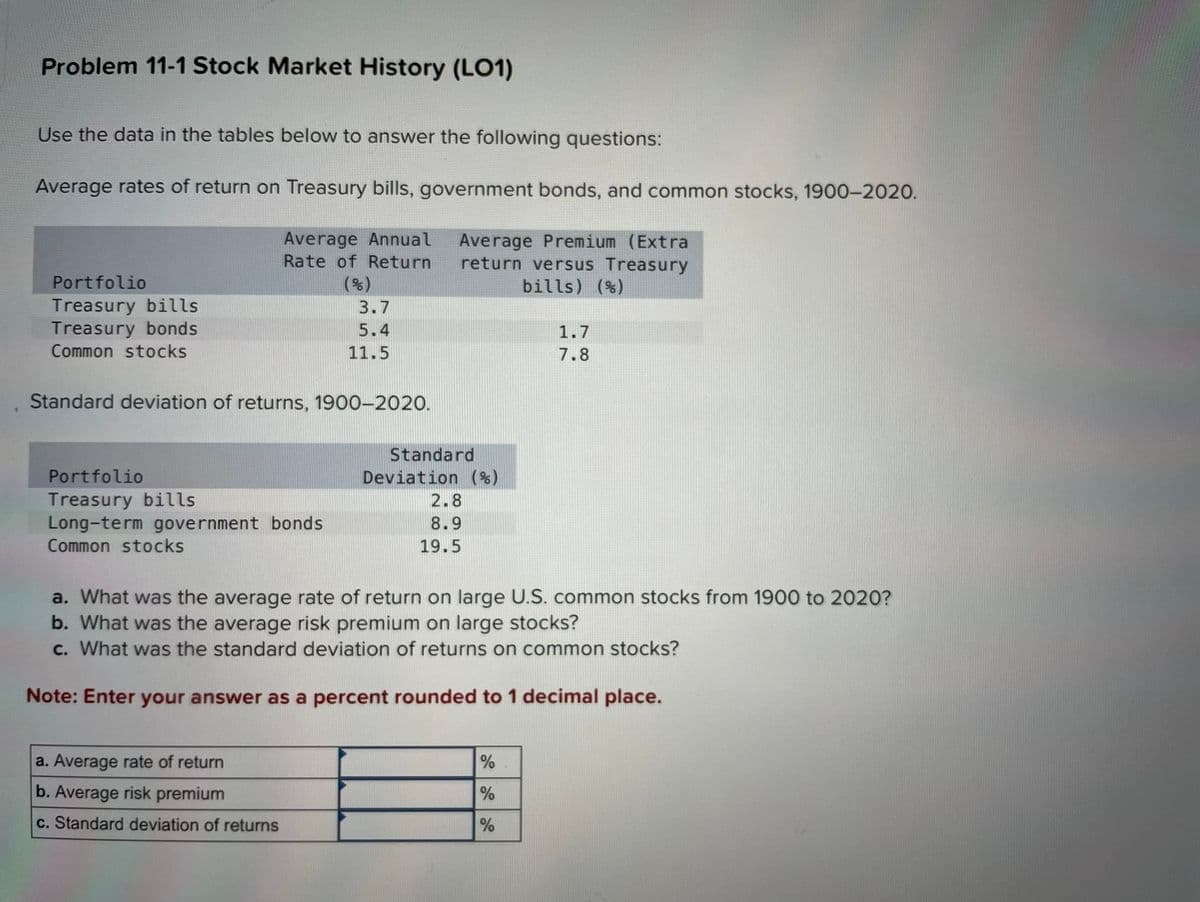

Transcribed Image Text:Problem 11-1 Stock Market History (L01)

Use the data in the tables below to answer the following questions:

Average rates of return on Treasury bills, government bonds, and common stocks, 1900-2020.

Average Annual

Rate of Return

Average Premium (Extra

return versus Treasury

bills) (%)

Portfolio

Treasury bills

Treasury bonds

Common stocks

Standard deviation of returns, 1900-2020.

Portfolio

Treasury bills

Long-term government bonds

Common stocks

3.7

5.4

11.5

Standard

Deviation (%)

a. Average rate of return

b. Average risk premium

c. Standard deviation of returns

2.8

8.9

19.5

a. What was the average rate of return on large U.S. common stocks from 1900 to 2020?

b. What was the average risk premium on large stocks?

c. What was the standard deviation of returns on common stocks?

1.7

7.8

Note: Enter your answer as a percent rounded to 1 decimal place.

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning