Problem 11-2 (ACP) Furlough Company began operations at the beginning of current year with 10,000 units of merchandise with unit cost of P80. Purchases for the current year follow: Unit cost Units Lot No. 2,000 8,000 6,000 9,500 14,500 100 110 120 100 90 The physical inventory revealed 15,000 units on hand at year-end. Required: Compute inventory cost at year-end and cost of goods sold for the year following each method listed below. 1. FIFO periodic 2. Weighted average periodic 3. Specific identification (assuning the inventory comes frob Lot 3, 6,000 units, and Lot 4, 9,000 units). 12345

Problem 11-2 (ACP) Furlough Company began operations at the beginning of current year with 10,000 units of merchandise with unit cost of P80. Purchases for the current year follow: Unit cost Units Lot No. 2,000 8,000 6,000 9,500 14,500 100 110 120 100 90 The physical inventory revealed 15,000 units on hand at year-end. Required: Compute inventory cost at year-end and cost of goods sold for the year following each method listed below. 1. FIFO periodic 2. Weighted average periodic 3. Specific identification (assuning the inventory comes frob Lot 3, 6,000 units, and Lot 4, 9,000 units). 12345

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Inventories

Section: Chapter Questions

Problem 6.2BE: Perpetual inventory using FIFO Beginning inventory, purchases, and sales for Item Zeta9 are as...

Related questions

Topic Video

Question

Transcribed Image Text:3. Specific identification (assuming the inventory comes from

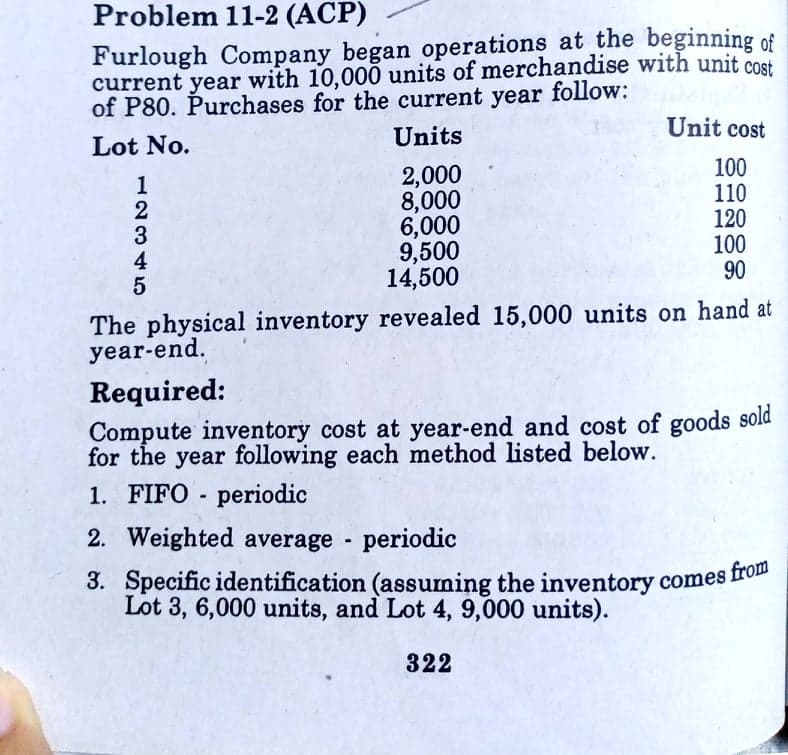

Problem 11-2 (ACP)

Furlough Company began operations at the beginning of

current year with 10,000 units of merchandise with unit cost

of P80. Purchases for the current year follow:

Unit cost

Units

Lot No.

2,000

8,000

6,000

9,500

14,500

100

110

120

100

90

The physical inventory revealed 15,000 units on hand at

year-end.

Required:

Compute inventory cost at year-end and cost of goods sold

for the year following each method listed below.

1. FIFO - periodic

2. Weighted average periodic

3. Specific identification (assuming the inventory comes ro

Lot 3, 6,000 units, and Lot 4, 9,000 units).

322

12345

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning