Problem 11-7 (IAA) Slack Company provided the following inventory information relating to television sets for the current year: Units Unit cost January 1 Inventory on hand April 1 5 Purchase October 1 Purchase 200 300 500 7,500 9,000 10,000 The entity sold 700 TV sets during the year. A physical count on December 31 indicated that 300 TV sets are on hand.

Problem 11-7 (IAA) Slack Company provided the following inventory information relating to television sets for the current year: Units Unit cost January 1 Inventory on hand April 1 5 Purchase October 1 Purchase 200 300 500 7,500 9,000 10,000 The entity sold 700 TV sets during the year. A physical count on December 31 indicated that 300 TV sets are on hand.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter6: Receivables And Inventories

Section: Chapter Questions

Problem 6.4.2P: Inventory by three cost flow methods Details regarding the inventory of appliances on January 1,...

Related questions

Question

What's the best answer for problem 11-7 and 11-9

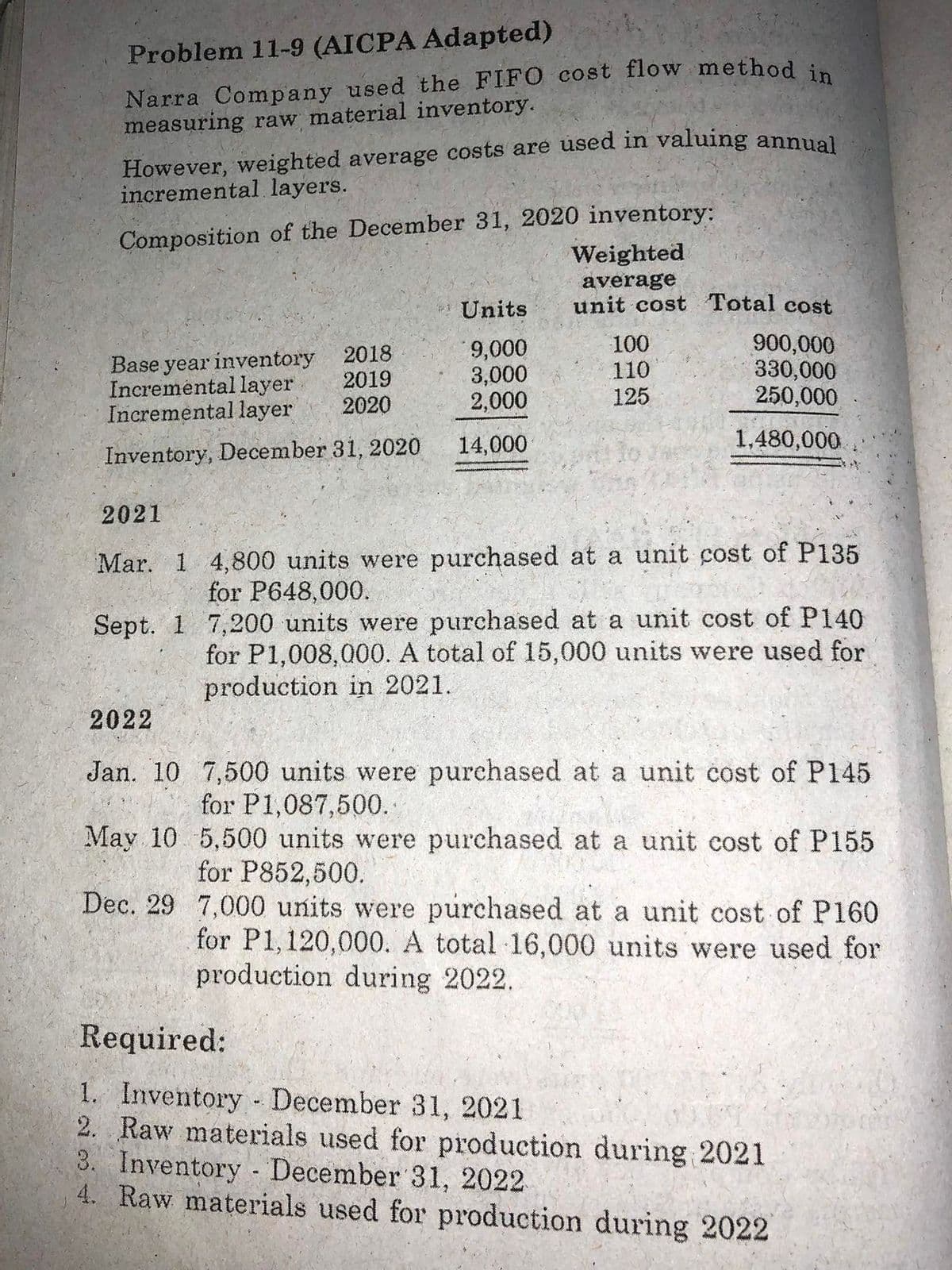

Transcribed Image Text:Problem 11-9 (AICPA Adapted)

Narra Company used the FIFO cost flow method i

measuring raw material inventory.

However, weighted average costs are used in valuing annual

incremental layers.

Composition of the December 31, 2020 inventory:

Weighted

average

unit cost Total cost

Units

Base year inventory

Incremental layer

Incremental layer

2018

2019

9,000

3,000

2,000

100

110

900,000

330,000

250,000

2020

125

14,000

1,480,000

Inventory, December 31, 2020

2021

Mar. 1 4,800 units were purchased at a unit cost of P135

for P648,000.

Sept. 1 7,200 units were purchased at a unit cost of P140

for P1,008,000. A total of 15,000 units were used for

production in 2021.

2022

Jan. 10 7,500 units were purchased at a unit cost of P145

for P1,087,500.

May 10 5,500 units were purchased at a unit cost of P155

for P852,500.

Dec. 29 7,000 units were purchased at a unit cost of P160

for P1,120,000. A total 16,000 units were used for

production during 2022.

Required:

1. Inventory December 31, 2021

2. Raw materials used for production during 2021

3. Inventory - December 31, 2022

4. Raw materials used for production during 2022

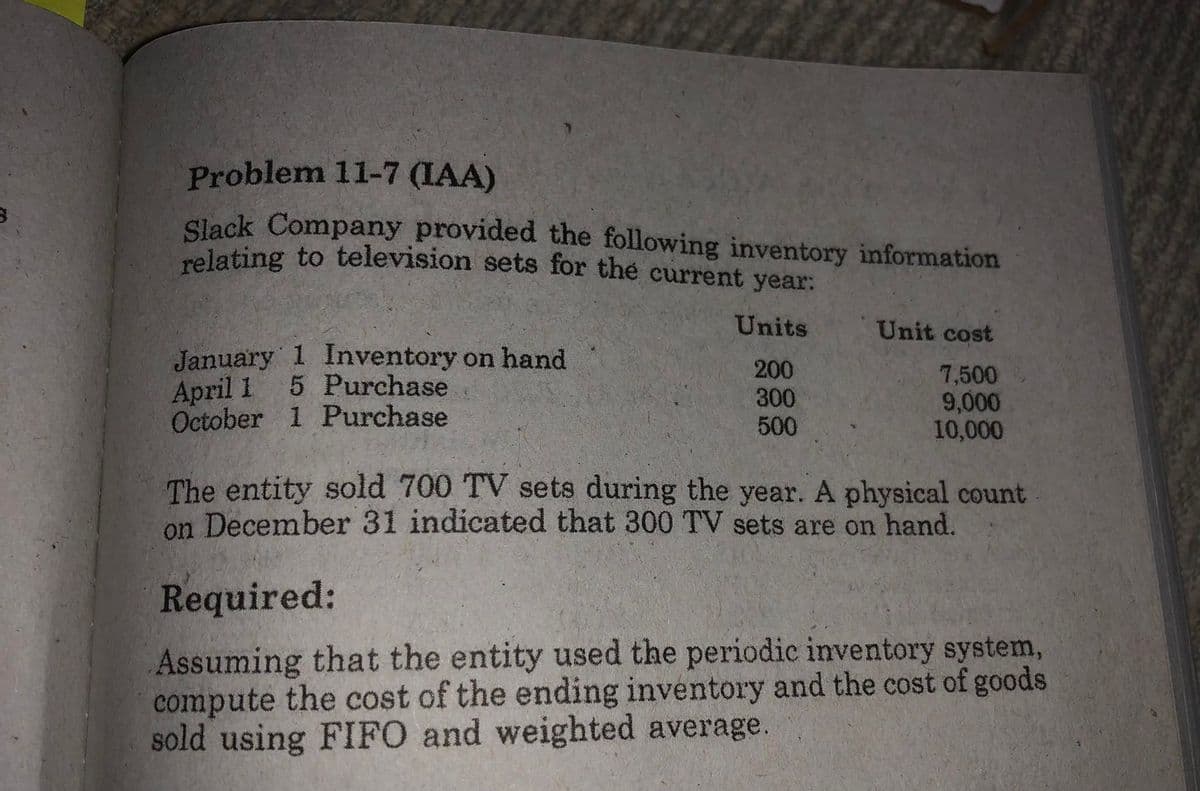

Transcribed Image Text:Problem 11-7 (IAA)

Slack Company provided the following inventory information

relating to television sets for the current year:

Units

Unit cost

January 1 Inventory on hand

April 1

October 1 Purchase

200

300

500

7,500

9,000

10,000

5 Purchase

The entity sold 700 TV sets during the year. A physical count

on December 31 indicated that 300 TV sets are on hand.

Required:

Assuming that the entity used the periodic inventory system,

compute the cost of the ending inventory and the cost of goods

sold using FIFO and weighted average.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College