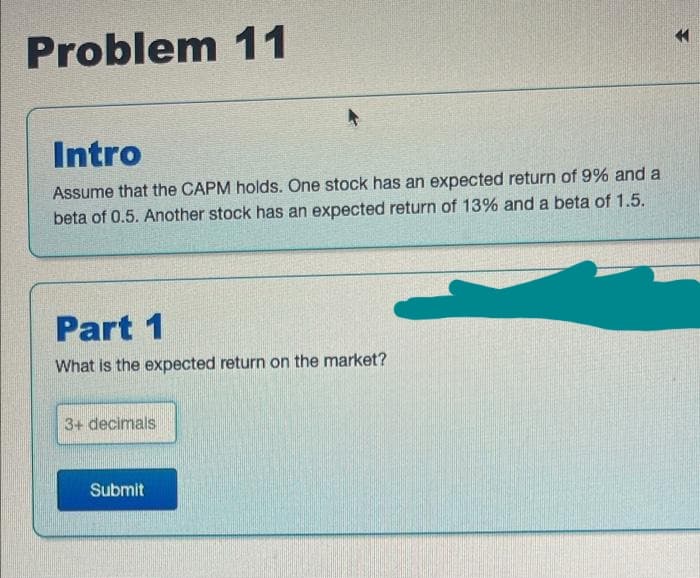

Problem 11 Intro Assume that the CAPM holds. One stock has an expected return of 9% and beta of 0.5. Another stock has an expected return of 13% and a beta of 1.5. Part 1 What is the expected return on the market?

Q: A European put option with an exercise price of $100 and 3 months till maturity is trading at $4 whe...

A: The exercise price of stock is $100. Maturity period is 3months Value of put option is $4 Spot pric...

Q: make and buy. The make altermative has an initial equipment cost of $175,000, a life of 5 years, a S...

A: Number of Cameras needed must satisfy the all cost that are necessary to make including processing a...

Q: FMT Co has current assets that consist of cash: $20,000, receivables: $70,000 and inventory: $90,000...

A: Ratio article analyzes line-item data from the company's financial records to elicit information abo...

Q: Ms. Magan Dah and her sister, Ms. Supla Dah got into the cakes and pastries business almost by accid...

A: As per the guidelines in case of multipart questions we are required to solve the first 3 subparts ...

Q: During 2021, Tom Sanchez purchased 200 shares of common stock issued by Tri State Manufacturing for ...

A: Profit is referred as the financial benefit, which used to realize at the time of the generation of ...

Q: ome recent financial statements for Smolira Golf, Inc., follow. SMOLIRA GOLF, INC. Balance Sheets as...

A: Profit margin = Net Profit/ Net Sales Return of Assets = Net profit/ Average total assets Return...

Q: Burkhardt Corp. pays a constant $14.90 dividend on its stock. The company will maintain this dividen...

A: Constant dividend are of $14.90 Time period is 6 years Required return is 10% To find: Current Shar...

Q: On June 1, 2018, Vaughn Company and Bramble Company merged to form Sunland Inc. A total of 808,000 s...

A: The number of shares to be used for calculating basic earnings per share, diluted earnings per share...

Q: Transaction costs In late December you decide to sell a losing position that you hold in Twitter so ...

A: Bid/ask spread Bid/ask spread is referred to as that amount which is the difference between the high...

Q: Melissa wants to retire with $45,000 per month.she needs $4,500,000 in principal at the time she ret...

A: Simple interest is computed by multiplying the daily interest rate by the principal and later by nu...

Q: Khulna Development Authority (KDA) owns 50 hectares of valuable land has decided to lease the land t...

A: We will find the present value of all the amounts with respective time periods using interest rate o...

Q: If a broker quotes a price of 111.25 for a bond on September 1O, what amount will a client pay per $...

A: Given the Face Value of Bond = $1000 Coupon Rate = 7% Number of days between 15 May and September 10...

Q: You are to pay a bill in Meralco every month for 5 years. The accumulated amount of the payment you ...

A: Future Value with compounding other than annual With frequency of compounding in a year (m), annual...

Q: What is the difference (financial instruments traded) between Money Market, Bond Market, Equity Mark...

A: Financial markets encompass any marketplace where securities are traded, such as the stock market, b...

Q: You want to sell four call option contracts on AA Industries stock at a strike price of $32.50 a sha...

A: Option premium is the amount that the call option writer gets when he sell the call option.

Q: QUESTION 7 Select from the following a factor that does not relate to the reduction of agency costs....

A: Agency cost refers to a payment made to the agent who is acting on behalf principal. this cost is tr...

Q: In the year 2020, the stock market fell because of COVID-19. You started investing from the year 200...

A: Future value (FV) with compounding other than annual With number of compounding in a year (m), total...

Q: You currently have $900 (Present Value) in an account that has an interest rate of 4.5% per year com...

A: Future value is the accumulated amount of a deposit along with the interest earned on it. The amount...

Q: Bond J has a coupon rate of 5.8 percent. Bond K has a coupon rate of 15.8 percent. Both bonds have e...

A: Given, Bond J and Bond K with par value of $1,000. Coupon of Bond J is 5.8% and Bond K is 15.8%. Ter...

Q: A perpetuity with a present value of $80,000 today yields cash flows of $2,500 per quarter. The firs...

A: For an unlimited amount of time, the stream of cash flows continues is known as perpetuity. A perpet...

Q: Sonnie's payments will be deferred for 3.25 years. How much should Bonnie be willim roperty if inter...

A: The present value the future payments will be without interest the payment for principal payment and...

Q: In order to accumulate $500,000 after 25 years, calculate the amounts that must be invested at the e...

A:

Q: An investor takes a long position on an FRA that is based on 90-day LIBOR and has 6 months till expi...

A: A forward rate agreement is referred to those agreements that are made over-the-counter to determine...

Q: Consider an investor who purchases a Treasury inflation-indexed note with an original principal amou...

A: Treasury inflation-index note guarantees return more than the inflation index and consumer price ind...

Q: Poulter Corporation will pay a dividend of $4.10 per share next year. The company pledges to increas...

A: Formula for calculation of current stock value :- Price = D1/(r - g)

Q: The stock price of Alps Co. is $53.50. Investors require a return of 13 percent on similar stocks. I...

A: Stock price is $53.50 Required retturn is 13% Dividend next year is 3.40% To Find: Growth rate

Q: The following is the excerpt of financial information of SVT Corporation on December 31, 2022: Accou...

A: The question is related to Ratio Analysis. The return on Assets is calculated with the help of follo...

Q: What parameter is this question asking for? What deposit made at the end of each month will accumula...

A: Annuity is the equal periodic cash flows over specific time time period. When the payment is due at ...

Q: or something to satisfy the medium-of-exchange function of money, it must be readily exchangeable ...

A: Medium of exchange means that money should be used as an intermediary between a buyer and seller. Su...

Q: What is the difference (How will the investment earn?) between Money Market, Bond Market, Equity Mar...

A: Financial markets refer broadly to any marketplace where the trading of securities occurs, including...

Q: How do you set up a two-stage dividend growth model on excel?

A: Companies with an uncertain initial growth rate can be valued using the two-stage model. In the seco...

Q: Topic: Cost of Funds Solve the following cases using the Gordon Growth Model of determining the cos...

A: 1. Given, Return on Equity = 15% Payout rate = 30% Current dividend on ordinary share = p8 Dividend...

Q: lolanda purchased a Treasury bond with a coupon rate of 2.62% and face value of $100. The maturity d...

A: Here, Purchase Date is 7/Feb/2018 Maturity Date is 15th/ April/2019 Time Period between two dates is...

Q: 6) What is the present value of the following payment series when the interest rate is 3%: YR1 = $20...

A: We have to find the Present Value for the given payment series for the period of six years. Where th...

Q: You pay $9.51 for lunch from Chipotle most days during the work week. 1. How much do you pay for th...

A: Price of Lunch = $9.51

Q: 5. Suppose you only have one neighbor and that she enjoys loud music such that her benefit from loud...

A: Given in the question, TB= 30dB- 0.12dB2 ( benefit from loudness) where dB is the unit used to measu...

Q: CDE Co. has the following assets: Cash = P64,800, Accounts Receivable = P684,800, Inventory = P161,7...

A: Assets are the revenue-generating property of the business. Current assets are the assets that can b...

Q: ABC stock price after 30 days = $80 ABC stock price after 45 days = $95 ABC stock price after 60 day...

A: Put option gives right to sell the stock on the date of expiration but no obligation to sell the sto...

Q: Which of the following are true statements on the principal-agent problem between corporate managers...

A: the principal-agent problem occurs when there is conflicts of interest between the principal and age...

Q: -Fifty thousand pesos is deposited annually at an interest rate of 6% per annum compounded continuou...

A: Compound interest or compounding implies you not just get the interest on the fundamental principal ...

Q: 1. Describe the importance of a credit score for financial planning.

A: Since multiple questions are asked , we will answer 1st question for you as per prescribed guideline...

Q: Consider ALZ corp stock. ALZ corp stock does not pay a dividend. The risk-free rate is 7%. The mark...

A: Sharpe ratio measures the return earned in excess the of the risk free rate on a portfolio to the po...

Q: Some recent financial statements for Smolira Golf, Inc., follow. SMOLIRA GOLF, INC. Balance Sheets a...

A: We need to use the following formulas for ratio Total debt ratio =Total liabilities/total assets Deb...

Q: One year from today, investors anticipate that Amazing Inc. stock will pay a dividend of $3.25 per s...

A: The stock price which is the maximum price to be paid for share consists of dividends and terminal v...

Q: At an interest rate of 10% per year, the perpetual equivalent annual cost of $70,000 now, $100,000 a...

A: Perpetual equivalent annual cost in simple words is an annual cost of one period considering the who...

Q: The probability of losing investment in a foreign country is known as: O confiscation O political ri...

A: Investment made in foreign countries outside jurisdiction of domestic country is subject to risk.

Q: What is the coupon rate for the bond? Assume semi-annual payments. Answer as a percent! Bond Coupon ...

A:

Q: Sources and Uses of Cash. create the statemen of cash flows from the entries: Net income ...

A: Statement of cashflows shows the flow of cash in the business. It consists of operating activities, ...

Q: Synovec Corporation is expected to pay the following dividends over the next four years: $6.00, $17....

A: The required return on stock is 9%. Growth rate in dividends is 5%.

Q: I am trying to figure out dollar dividens per share of a company. I am using yahoo finnace. Divide...

A: A dividend is a distribution of profits by a company. The company pays dividends to its shareholders...

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Ch. 11. Using CAPM, A stock has an expected return on 10.7 percent, the risk-free rate is 4.1 percent, and the market risk premium is 6 percent. What must the beta of this stock be? Round to two places past the decimal point as "X.XX"8.9 Stock R has a beta of 2.3, Stock S has a beta of 0.9, the required return on an average stock is 8%, and the risk-free rate of return is 6%. By how much does the required return on the riskier stock exceed the required return on the less risky stock? Round your answer to two decimal places.Problem 8-09 Stock A has a risk premium of 6.2 percent. If Treasury bills yield 2.2 percent and the expected return on the market is 9.2 percent, what is the stock’s beta coefficient? Round your answer to two decimal places.

- 11.12 Using CAPM A stock has a beta of 1.15, the expected return on the market is 11.1 percent, and the risk-free rate is 3.8 percent. What must the expected return on this stock be?12.1 Factor Models A researcher has determined that a two-factor model is appropriate to determine the return on a stock. The factors are the percentage change in GNP and an interest rate. GNP is expected to grow by 3.5 percent and the interest rate is expected to be 2.9 percent. A stock has a beta of 1.3 on the percentage change in GNP and a beta of −.47 on the interest rate. If the expected rate of return on the stock is 10.2 percent, what is the revised expected return on the stock if GNP actually grows by 3.2 percent and the interest rate is 2.7 percent?